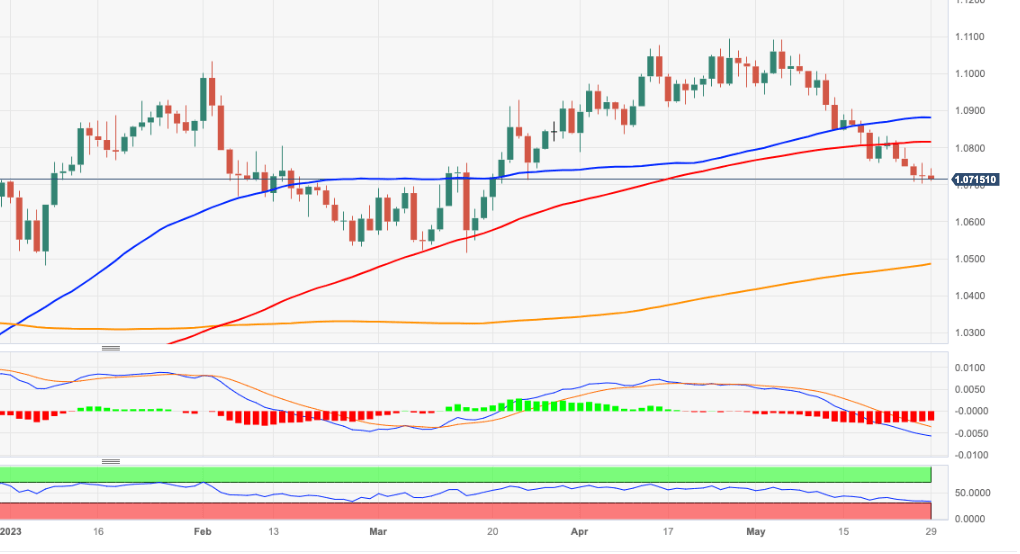

EUR/USD Price Analysis: Extra pullbacks not ruled out

- EUR/USD remains under pressure and close to 1.0700.

- The breach of 1.0700 could pave the way for a sustained drop.

EUR/USD keeps the bearish note well in place and keeps the trade near the key 1.0700 zone on Monday.

The ongoing bearish development could force the pair to break below the 1.0700 region and thus expose a deeper pullback to, initially, the March low of 1.0516 (March 15) in the near term.

Looking at the longer run, the constructive view remains unchanged while above the 200-day SMA, today at 1.0485.

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.