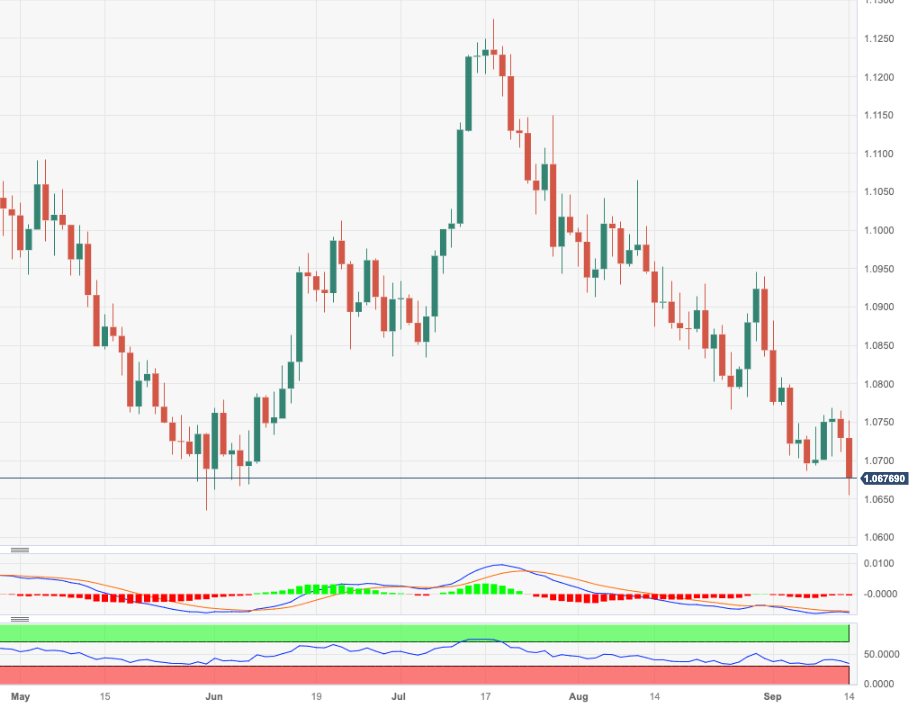

EUR/USD Price Analysis: Extra losses could revisit 1.0635

- EUR/USD intensify its decline to fresh four-month lows.

- Bears now re-shift their attention to the 1.0630 zone.

EUR/USD sinks to levels last traded four months ago in the mid-1.0600s on Thursday.

The underlying bearish sentiment remains unchanged and leaves the door open to extra pullbacks in the short-term horizon. Against that backdrop, a sustained breach of the 1.0700 yardstick could encourage sellers to embark on a probable visit to the May low of 1.0635 (May 31).

In the meantime, further losses remain in the pipeline while below the key 200-day SMA, today at 1.0827.

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.