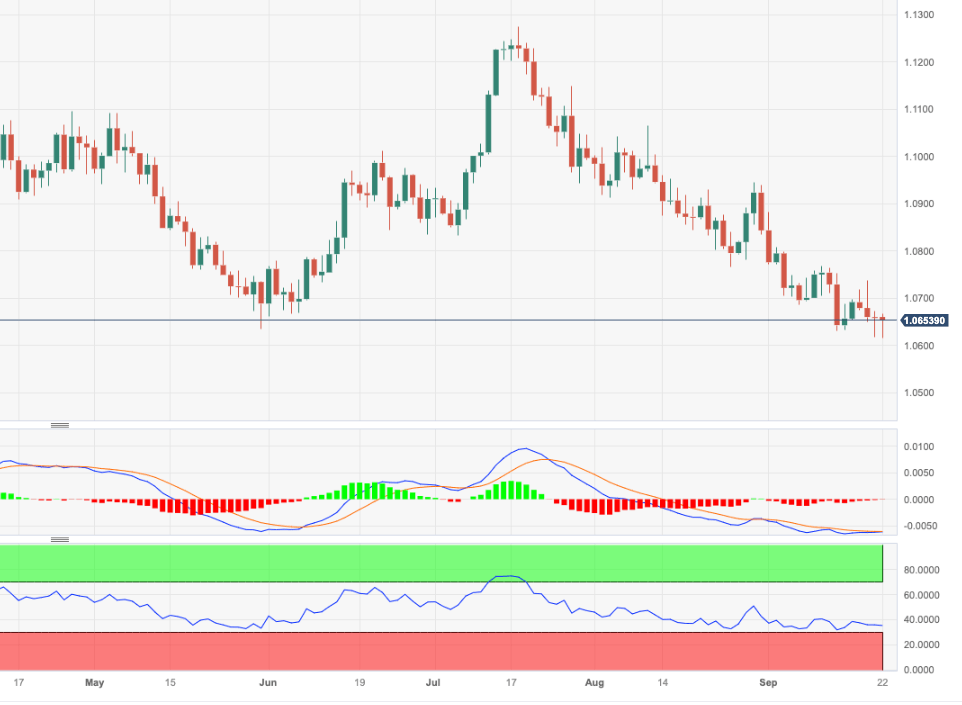

EUR/USD Price Analysis: Extra losses appear on the table

- EUR/USD clinches new six-month lows near 1.0610.

- Further decline opens the door to a drop to the 1.0515 zone.

EUR/USD keeps the negative price action well in place and retreats to fresh multi-month lows around 1.0615 on Friday.

If the pair breaches this level in the short-term horizon, it could then open the door to a potential retracement to the March low of 1.0516 (Mar 8), which is the last defence ahead of an assault on the 2023 low at 1.0481 (January 6).

While below the key 200-day SMA at 1.0828, the pair is likely to face extra weakness.

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.