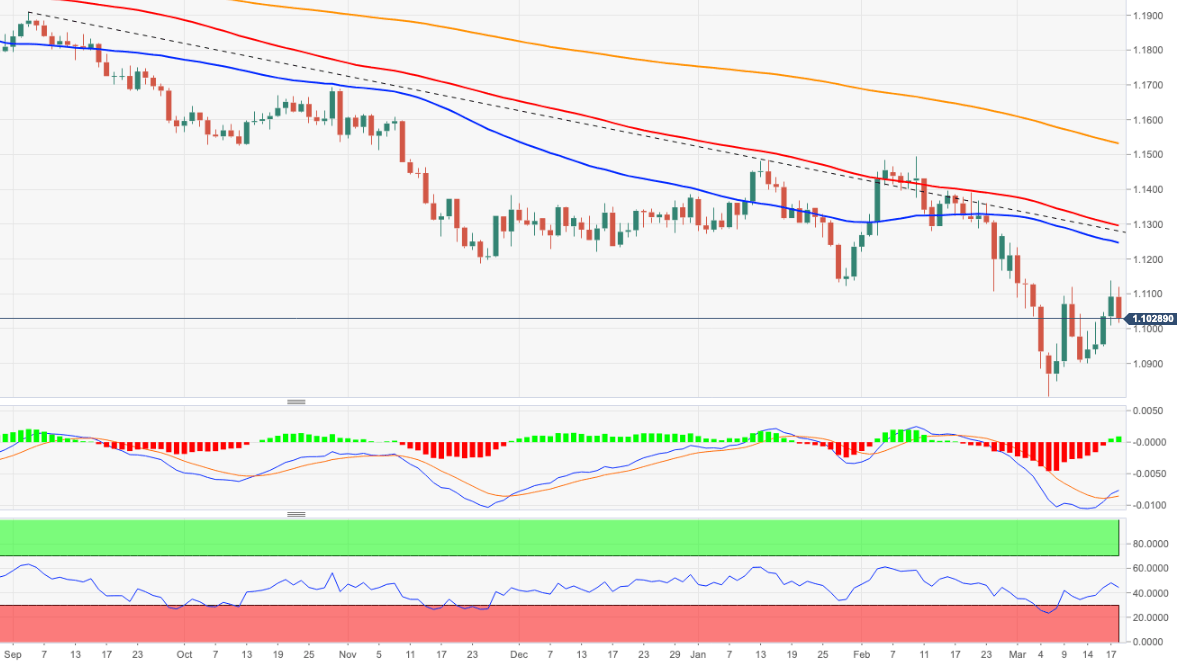

EUR/USD Price Analysis: Extra losses align below 1.1000

- EUR/USD comes under pressure and retests the low-1.1000s.

- There is an initial support at the 10-day SMA at 1.0975.

EUR/USD faces some selling pressure and retreats from recent peaks past 1.1100 the figure on Friday.

In case sellers push harder, a breakdown of the 1.1000 mark carries the potential to spark a deeper pullback to, initially, the 10-day SMA at 1.0975 prior to the weekly low at 1.0900 (March 14).

The medium-term negative outlook for EUR/USD is expected to remain unchanged while below the key 200-day SMA, today at 1.1530.

Also read: Gold Price Forecast: Why is XAUUSD under pressure?

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.