EUR/USD Price Analysis: Extra gains likely above 1.1887

- EUR/USD adds to the recovery well above the 1.18 mark.

- Next target comes in at the Fibo level at 1.1887.

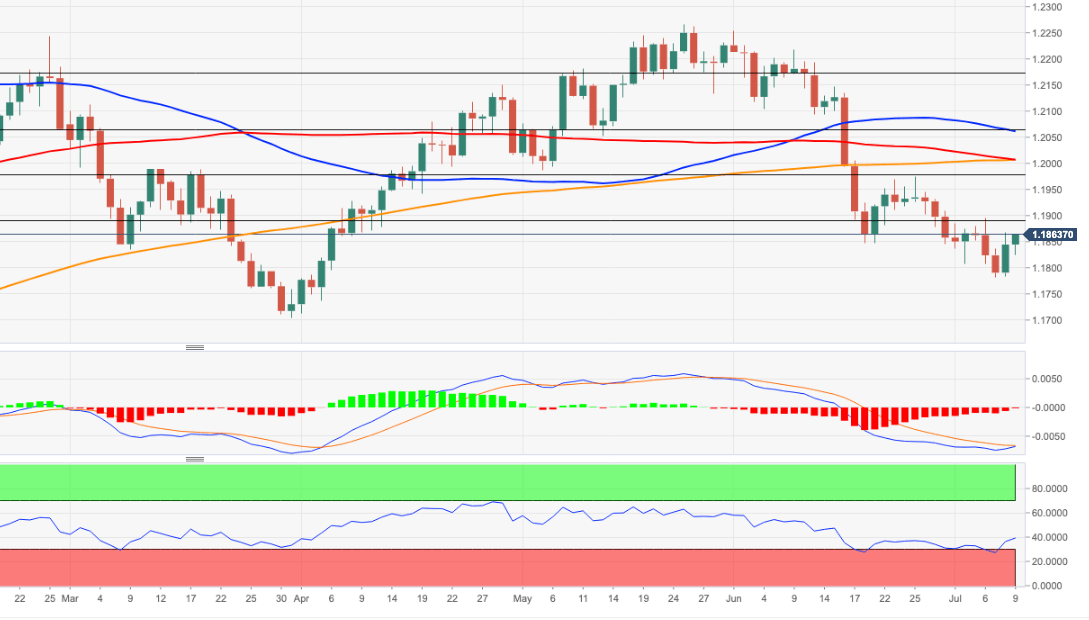

EUR/USD manages to extend the rebound from recent lows in the 1.1780 zone. This area is coincident with the key 2020-2021 support line (off November 2020 lows).

In case the buying pressure gathers extra steam, then the next hurdle emerges at the Fibo level at 1.1887. Above this area, the downside pressure could alleviate somewhat and allow for a probable move to the more relevant 1.1970 area.

Further out, the near-term outlook for EUR/USD is seen on the negative side while below the key 200-day SMA, today at 1.2000.

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.