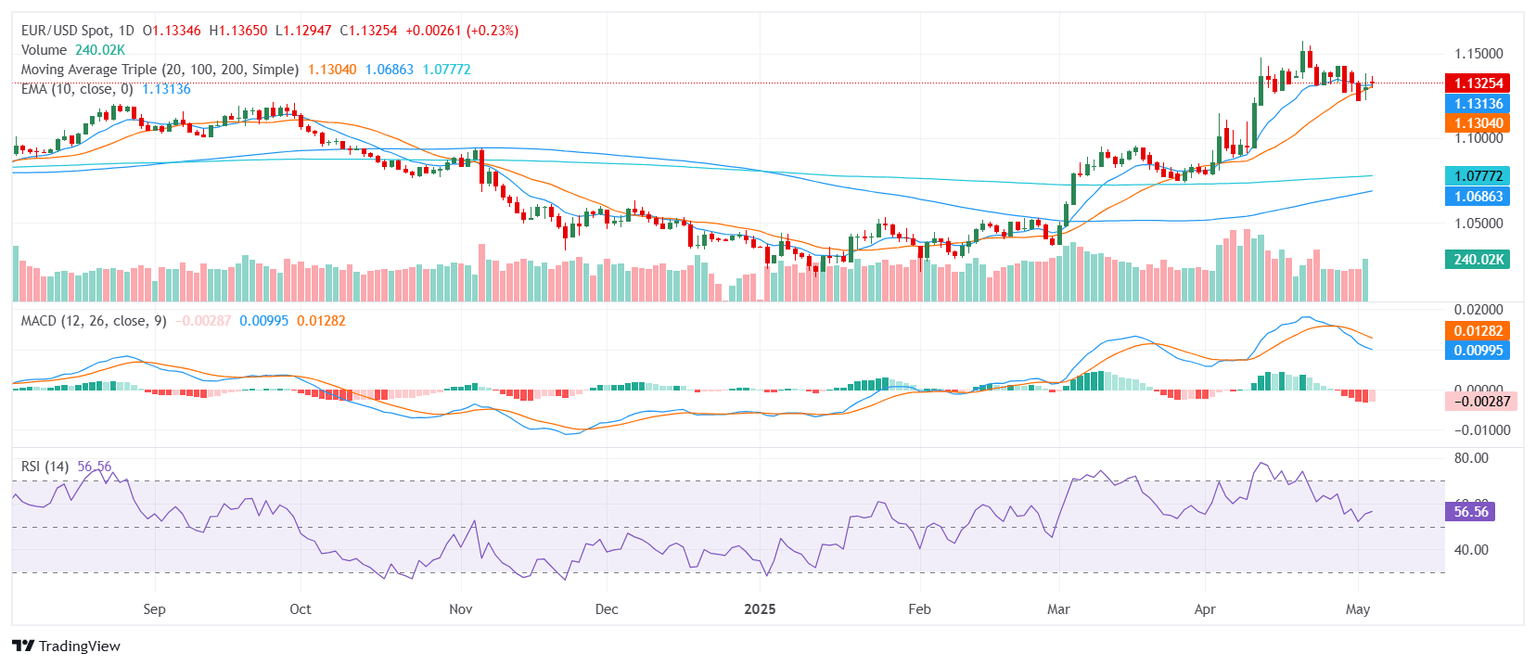

EUR/USD Price Analysis: Euro holds firm near 1.1300 as bullish trend persists

- EUR/USD trades near the 1.1300 zone after climbing modestly post-European session.

- Bullish structure remains supported despite mixed momentum signals.

- Upward-sloping trend indicators reinforce strength, with support levels holding below.

The EUR/USD pair edged higher on Monday, trading around the 1.1300 zone following the European session. Price action stayed confined within the mid-range of the day’s movement, reflecting a steady grind higher rather than an impulsive breakout. While some momentum indicators suggest consolidation, the broader trend remains clearly bullish, backed by firm alignment across key moving averages.

Technically, EUR/USD continues to flash a bullish overall signal. The Relative Strength Index is neutral near 58, showing moderate momentum without overbought conditions. The Moving Average Convergence Divergence flashes a sell signal, which tempers immediate bullish expectations, while the Ultimate Oscillator and Awesome Oscillator also remain in neutral territory. These readings highlight a possible pause in short-term momentum, though they don’t reverse the broader trend.

The core bullish bias is driven by moving averages. The 20-day, 100-day, and 200-day Simple Moving Averages lie below the current price and point upward, providing a firm technical base. Supporting this outlook further are the 30-day Exponential and Simple Moving Averages, which continue to rise and align with the short-to-medium term uptrend.

Support levels are found at 1.1314, 1.1287, and 1.1279. Resistance lies at 1.1331 and 1.1353. A sustained move above resistance could expose further bullish extension, while a drop below the nearest support would likely lead to a brief retest of recent lows.

Daily Chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.