EUR/USD Price Analysis: Euro defends big support

- EUR/USD reverses higher from support at 1.1757 to 1.1770.

- A close below 1.1757 would confirm a channel breakdown or major bearish reversal pattern.

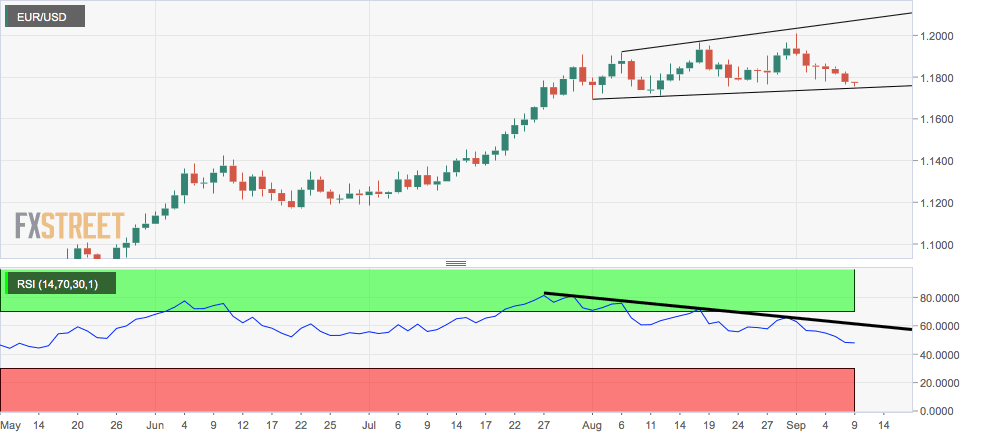

EUR/USD has bounced up from the lower end of a daily chart expanding sideways channel.

The pair is currently trading largely unchanged on the day near 1.1770, having defended the channel support at 1.1757 a few minutes before press time.

If confirmed with a daily close under 1.1757, a channel breakdown would mean the rally from lows under 1.08 seen in May has ended, and the bears have regained control.

That possibility cannot be ruled out as long as the 14-day relative strength index's downtrend line is intact.

Key support levels to watch out for this week are the lower end of the channel at 1.1757 and the 50-day simple moving average located at 1.1677. Meanwhile, the 50-hour SMA at 1.1809 and the psychological level of 1.19 are crucial hurdles.

Daily chart

Trend: Bearish

Technical levels

Author

Omkar Godbole

FXStreet Contributor

Omkar Godbole, editor and analyst, joined FXStreet after four years as a research analyst at several Indian brokerage companies.