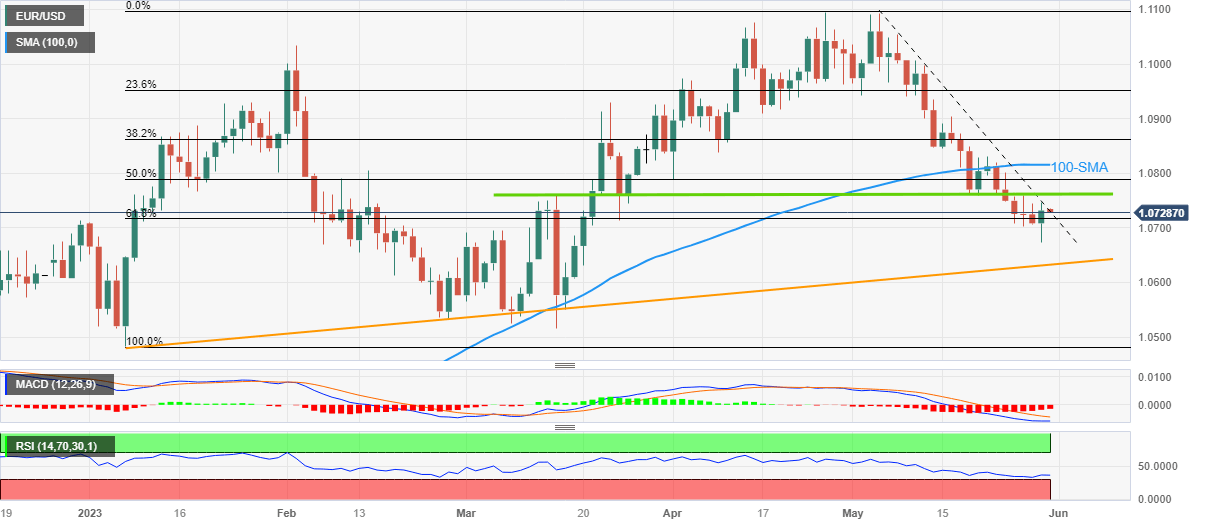

EUR/USD Price Analysis: Euro buyers flirt with resistance-turned-support near 1.0730

- EUR/USD struggles to extend corrective bounce off multi-day low.

- Bearish MACD signals, market’s cautious mood prod Euro buyers.

- RSI conditions, clear break of previous key resistances keep buyers directed towards 100-DMA.

- Sellers need validation from five-month-old ascending support line to retake control.

EUR/USD remains sidelined around 1.0730-35 as bulls seek more clues to extend the previous day’s recovery from a 10-week low amid Wednesday’s sluggish Asian session. In doing so, the Euro pair portrays the market’s anxiety as the key European/US data and events stand ready to prod the market’s momentum.

Also read: EUR/USD rebound pauses around 1.0750, German inflation, US employment clues eyed

That said, the Euro pair’s successful trading above a downward-sloping trend line from early May, around 1.0725, as well as the 61.8% Fibonacci retracement of its January-May upside, near 1.0715, joins the nearly oversold RSI (14) line to keep the buyers hopeful of further upside.

However, the bearish MACD signals and a horizontal area comprising multiple levels marked since mid-March, close to 1.0760, appear a tough nut to crack for the EUR/USD bulls.

Even if the Euro buyers manage to cross the 1.0760 hurdle, the 100-DMA level surrounding 1.0815 can act as the last defense of the bears.

Meanwhile, the EUR/USD pair’s downside remains elusive unless it drops back below the aforementioned 61.8% Fibonacci retracement level, also known as the golden ratio, around 1.0715. It should be noted that the resistance-turned-support line near 1.0725 limits the immediate downside of the quote.

In a case where the EUR/USD drops below 1.0715, the 1.0700 round figure and an upward-sloping support line from March 15 will be in the spotlight.

EUR/USD: Daily chart

Trend: Further recovery expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.