EUR/USD Price Analysis: Bulls tighten grip as pair surges to multi-month highs

- EUR/USD extended its rally after the European session, trading near fresh multi-month highs above key moving averages.

- The pair has surged more than 3.70% in the week, shifting the outlook decisively in favor of buyers.

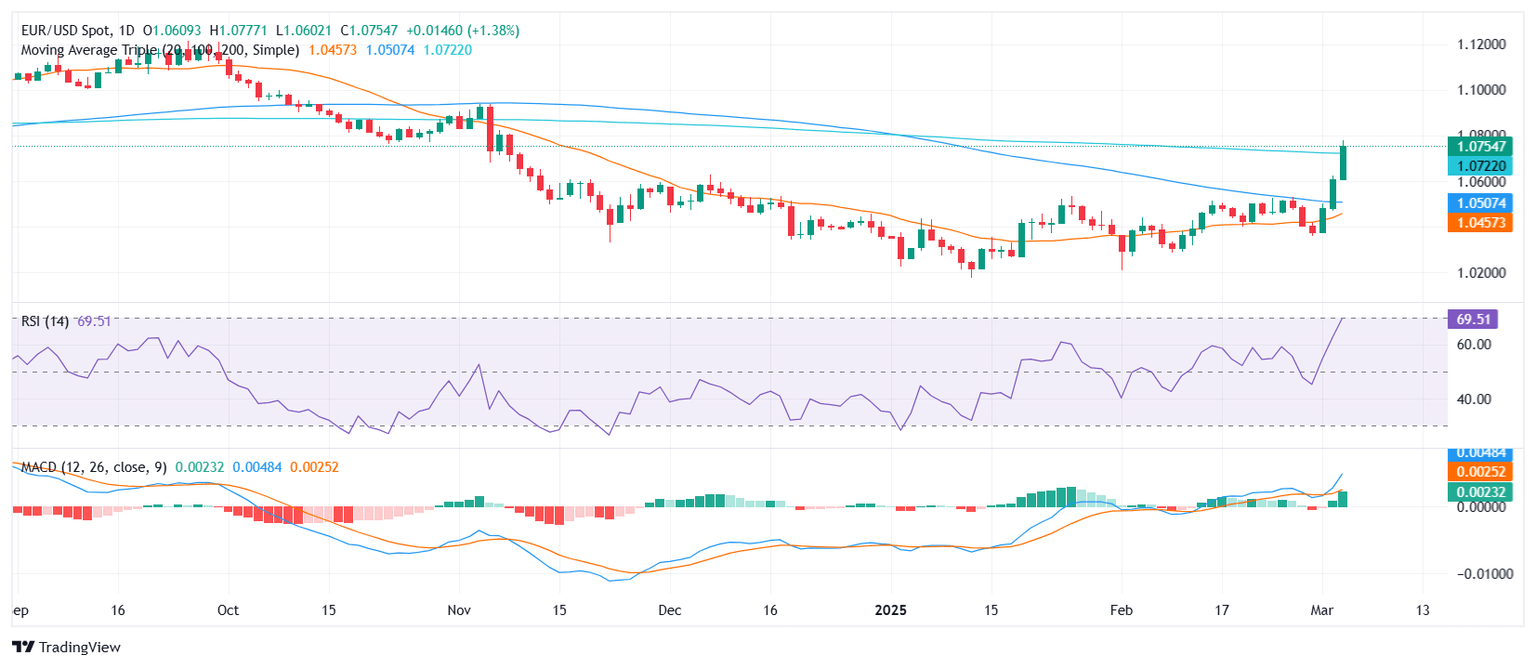

EUR/USD gained significant ground on Wednesday, pushing further into bullish territory after an already strong performance in recent sessions. The pair saw renewed demand during the European session, soaring to its highest level since November. With price action now firmly above the 20, 100, and 200-day Simple Moving Averages (SMAs), buyers appear to be in control, reinforcing an upward bias.

Technical indicators reflect this bullish momentum. The Relative Strength Index (RSI) is rising sharply and hovers near overbought territory, suggesting strong buying pressure. Meanwhile, the Moving Average Convergence Divergence (MACD) has printed a fresh green bar, further confirming the shift in sentiment. Given the magnitude of recent gains, a period of consolidation or mild pullback cannot be ruled out in the short term.

Looking at key levels, immediate resistance is seen near 1.0730, a zone that could determine whether the bullish run extends further. On the downside, initial support lies around 1.0505, with stronger buying interest expected near the 100-day SMA. A move below these levels could indicate a pause in bullish momentum, though the broader outlook remains positive as long as price action holds above key trend-defining SMAs.

EUR/USD daily chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.