EUR/USD Price Analysis: Bulls struggle as pair retreats from 100-day SMA

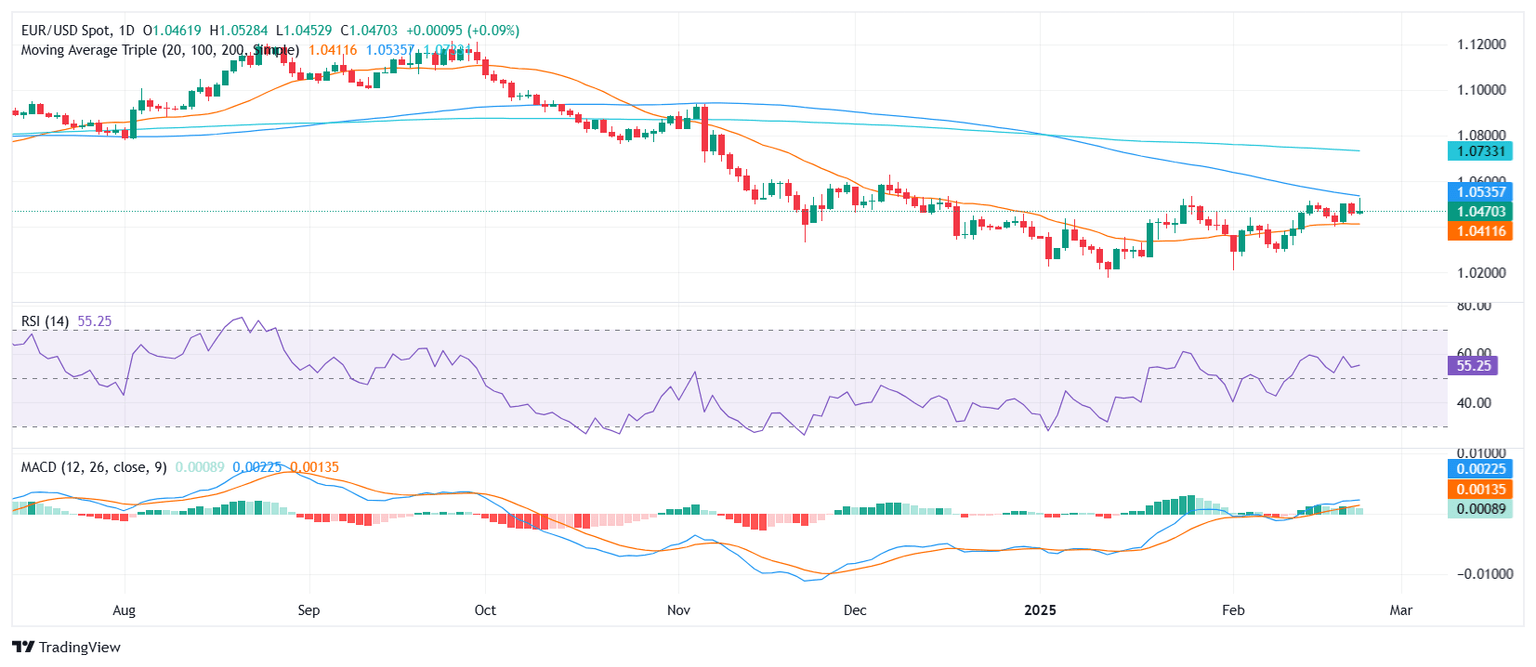

- EUR/USD posts mild gains but faces rejection near the 100-day SMA.

- RSI remains in positive territory but shows signs of fading bullish momentum.

The EUR/USD pair started the week on a cautiously positive note, climbing toward recent highs before encountering strong resistance near the 100-day Simple Moving Average (SMA). After briefly reaching the 1.0530 area, the pair lost momentum and pulled back toward the 1.0470 zone. This retreat suggests that bullish efforts are beginning to stall, with sellers gradually regaining control.

Technical signals highlight this shift in sentiment. The Relative Strength Index (RSI) remains in positive territory but is flattening, indicating that bullish momentum may be running out of steam. The Moving Average Convergence Divergence (MACD) histogram shows flat green bars, reinforcing the notion of weakening upward pressure. Without a decisive break above the 100-day SMA, bulls could struggle to maintain control.

In the short term, the key focus will be on whether the pair can defend support around the 1.0450 zone. A break below this level could invite further losses, pushing the pair toward the 20-day SMA. On the upside, a clear breach of the 100-day SMA would be required to revive bullish momentum and open the door for a sustained recovery. For now, the technical indicators suggest that time may be running out for the bulls to regain traction.

EUR/USD daily chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.