EUR/USD Price Analysis: Bulls run into key resistance but ride dynamic support

- EUR/USD is moving up to key resistance.

- If EUR/USD holds above 1.0800, then the bias will be longer-term bullish.

EUR/USD is stalling on the bid near a five-day high around 1.0850 as euro zone government bond yields rose on Tuesday.

The US Dollar fell against a basket of currencies for a second straight day on Tuesday with the DXY, which measures the currency against six rivals, falling to a low of 102.41, not far now from the seven-week low of 101.91 hit last Thursday. This gives rise to a bullish outlook as illustrated on the following charts:

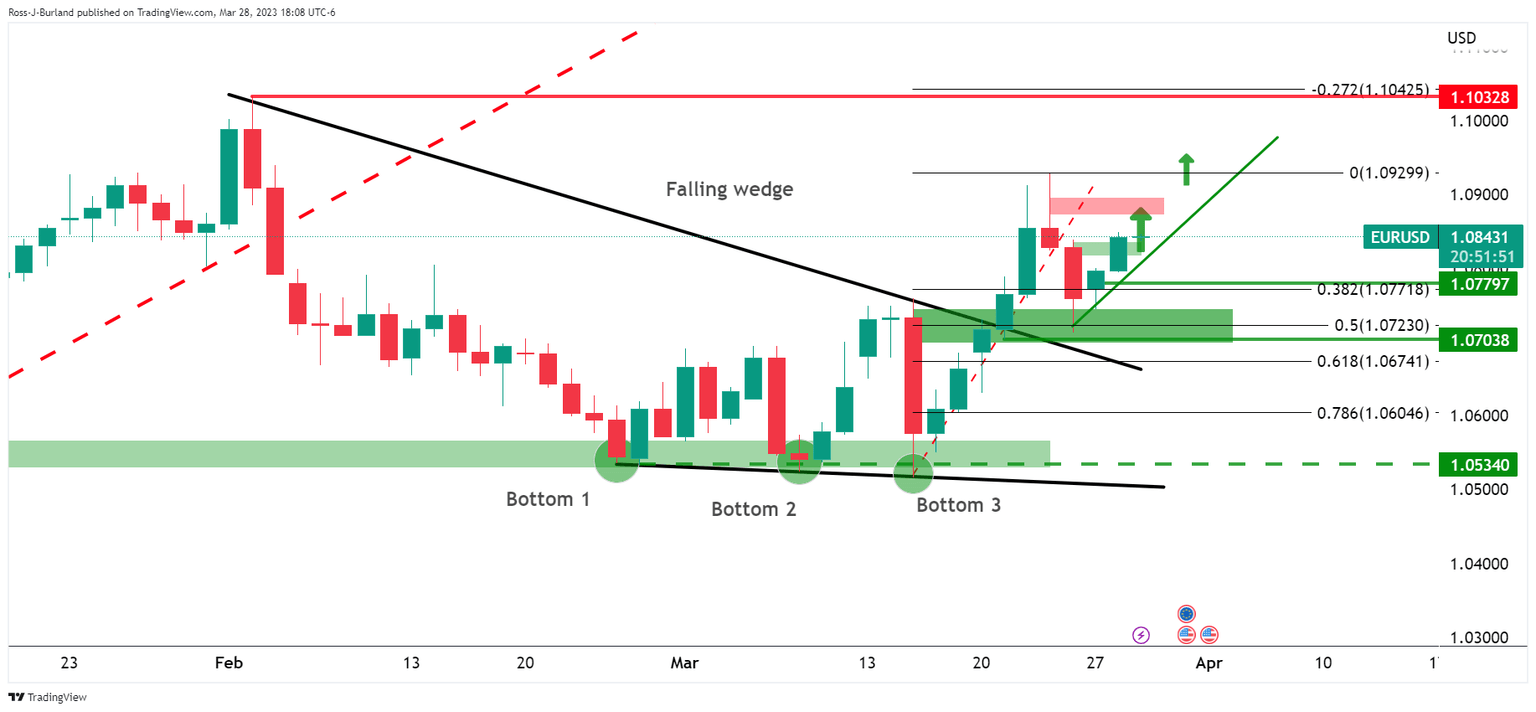

EUR/USD daily chart

The daily chart shows the price on the front side of the bullish microtrend breaking out of the bearish wedge.

EUR/USD H1 chart

From a lower time frame, the price is moving up to the resistance and a break of dynamic support could be the catalyst for a significant correction. However, holding above 1.0800, the bias is longer-term bullish.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.