EUR/USD Price Analysis: Bulls flex muscles on the way to 1.0610 hurdle

- EUR/USD treads water after three-day uptrend, dribbles around two-week high.

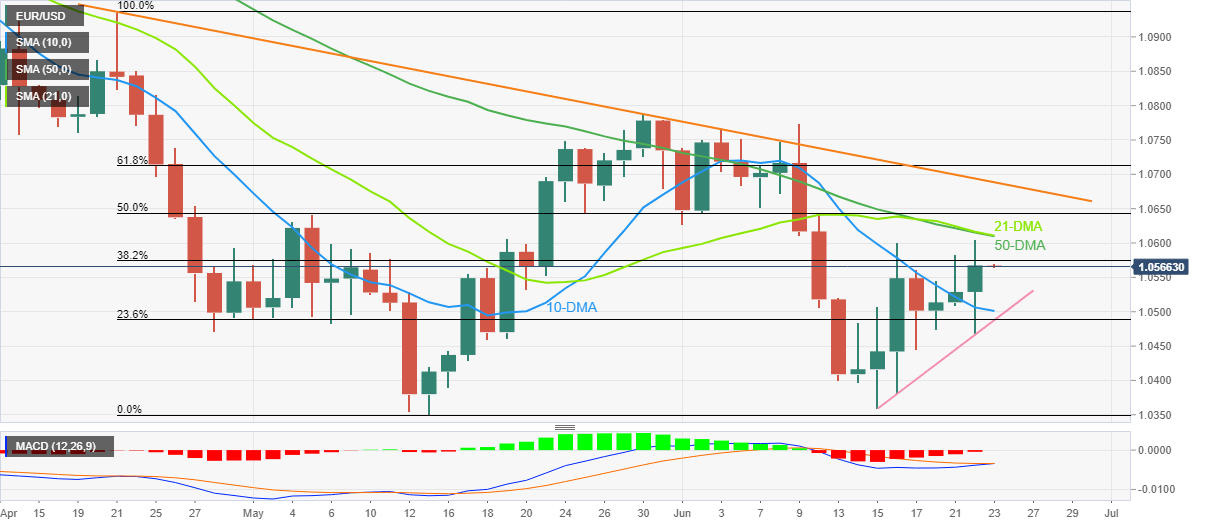

- Clear break of 10-DMA, impending bull cross on MACD favor buyers.

- Convergence of 21-DMA, 50-DMA appears a tough nut to crack for the bulls.

- One-week-old ascending trend line adds to the downside filters.

EUR/USD bulls take a breather around 1.0570, following a three-day uptrend, as traders await the preliminary PMIs for June month from Eurozone and the US during early Thursday.

Even so, the major currency pair defends the previous day’s breakout of the 10-DMA, the first since early June, which in turn keeps buyers hopeful. Additionally suggesting the quote’s further upside is the looming bull cross of the MACD.

With this, the EUR/USD buyers are all set to challenge the 1.0610 hurdle comprising the 50-DMA and the 21-DMA.

It should be noted, however, that the pair’s ability to cross the 1.0610 key resistance will propel it towards a two-month-old downward sloping resistance line, at 1.0690 by the press time.

On the contrary, pullback moves remain elusive until the EUR/USD prices remain beyond the 10-DMA level of 1.0500.

Following that, a one-week-long support line, close to 1.0485 at the latest, will act as an additional downside filter before directing the pair towards the recently flashed multi-month low of 1.0349.

EUR/USD: Daily chart

Trend: Further upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.