EUR/USD Price Analysis: Bulls extend gains above key resistance levels

- EUR/USD climbed higher after the European session, trading near the 1.0520 zone as bullish momentum strengthened.

- The pair pushed further above the 100-day SMA, adding nearly 1.40% at the start of the week with indicators improving.

- Resistance emerges near 1.0560, while support is seen at 1.0480; a failure to hold above key levels may invite selling pressure.

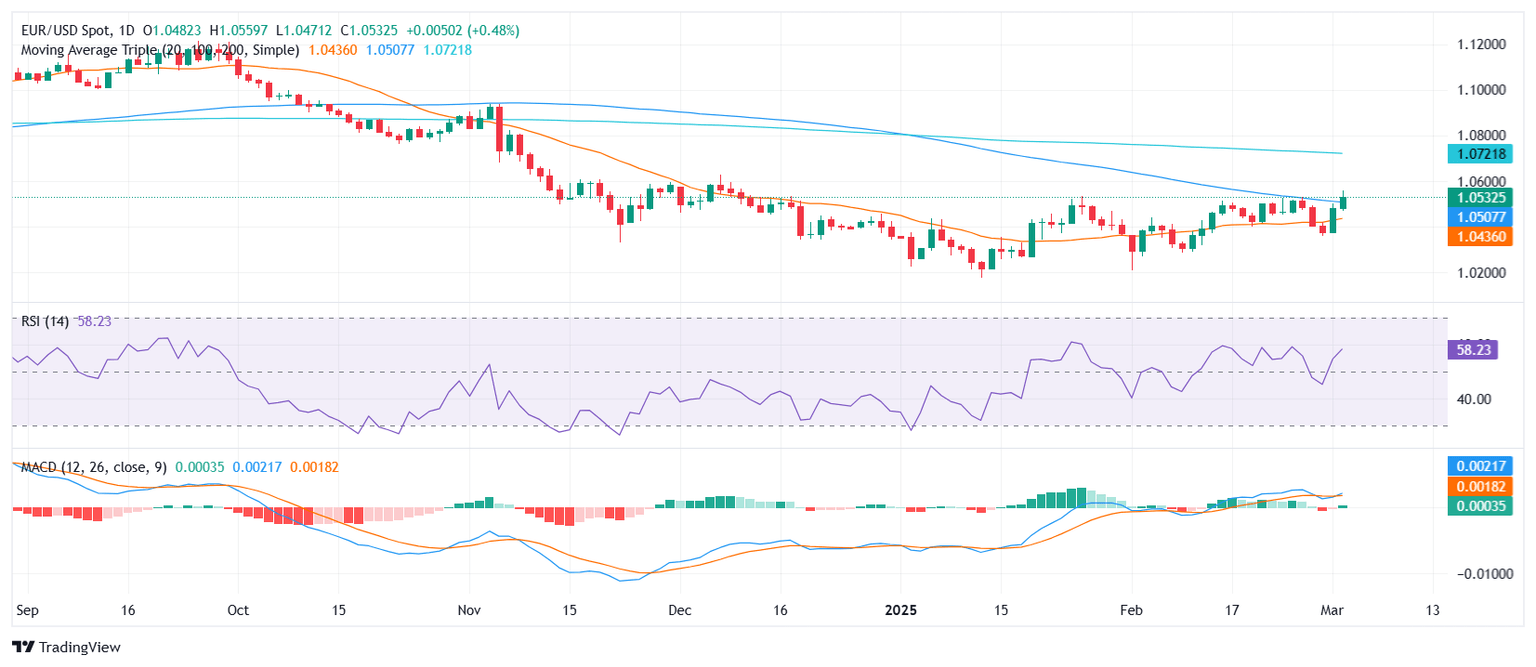

EUR/USD extended its advance on Tuesday, holding steady above a key resistance area after gaining traction earlier in the session. The pair saw a notable push following the European session, building on its strong start to the week and continuing the bullish momentum. A fresh green bar on the Moving Average Convergence Divergence (MACD) and a mild rise in the Relative Strength Index (RSI), now in positive territory, indicate improving conditions for buyers.

Bulls managed to bring the pair above the 100-day Simple Moving Average (SMA), solidifying gains of nearly 1.40% since the beginning of the week. The RSI remains in positive territory, suggesting that buying interest is still intact, though not yet at overbought levels. Meanwhile, the MACD printing fresh green bars further supports the case for continued upside, though further confirmation is needed.

Looking at technical levels, immediate resistance stands around the 1.0560 area, where sellers could step in to cap further gains. If buyers manage to clear this level, a move toward the 1.0600 psychological handle could be in play. On the downside, the first relevant support lies at 1.0480, with a drop below this threshold possibly triggering a pullback toward the 20-day SMA near 1.0450.

EUR/USD daily chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.