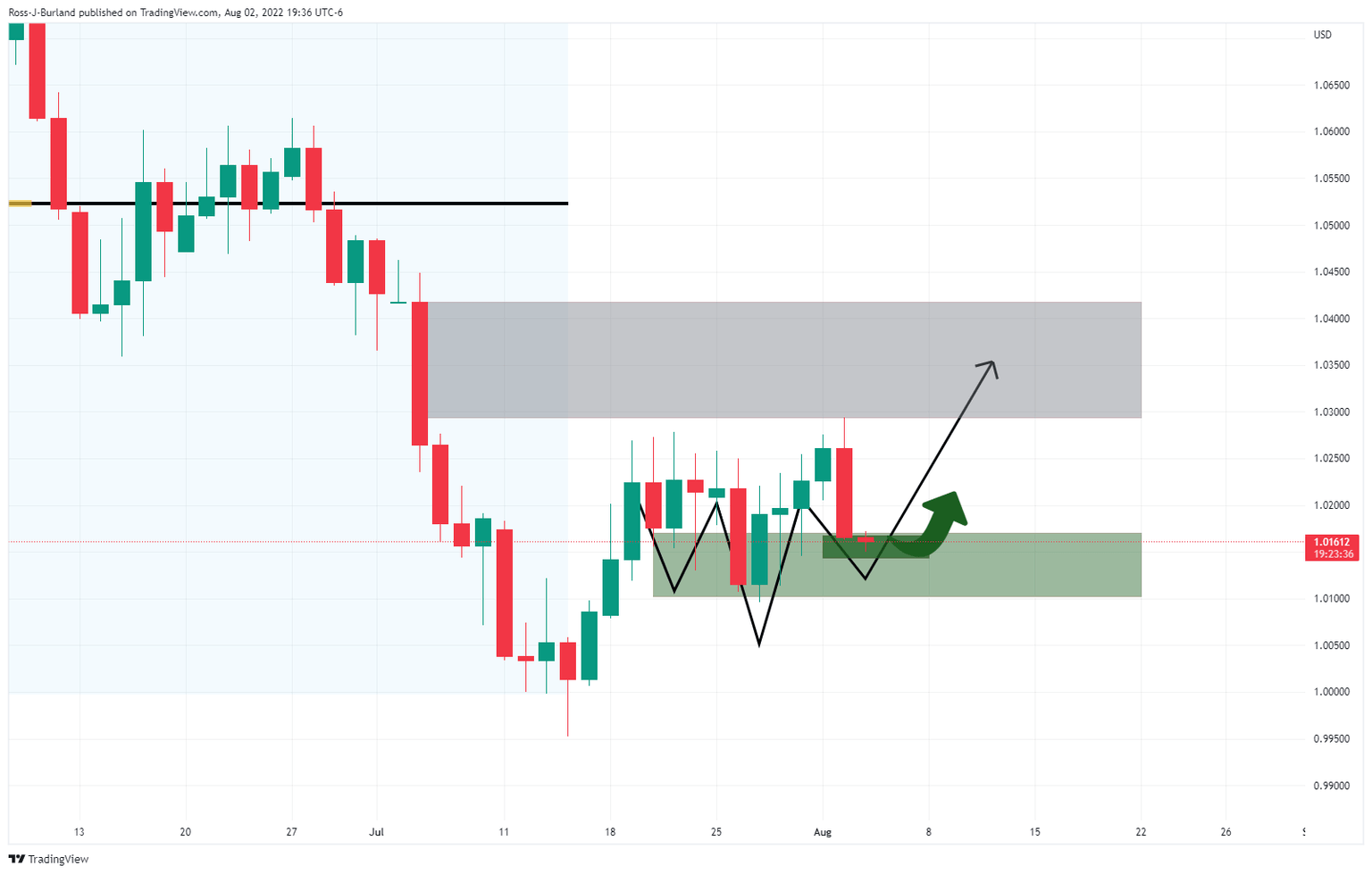

EUR/USD Price Analysis: Bulls charge and draw an inverse H&S on daily chart

- EUR/USD has burst to life leaving an inverse H&S on the daily chart.

- The hourly 38.2% Fibonacci, 50% mean reversion and 61.8% ratio could be an area of support in the coming sessions.

As per the prior analysis, EUR/USD Price Analysis: Bulls eye a break of 1.0171 structure, the bulls have taken control and rallied all the way to 1.0253.

The prior analysis said the bullish correction could eventually result in an upside continuation leaving behind the outcome of an inverted head and shoulders.

EUR/USD daily chart, prior analysis

EUR/USD live market

The price has moved higher as anticipated and there are prospects of a move into the greyed area in the forthcoming days. The bulls will need to overcome the resistance, however between 1.0250 and 1.0300. At this juncture, a pull back on the houly time frame is probable:

The 38.2% Fibonacci, 50% mean reversion and 61.8% ratio could be an area of support in the coming sessions and in the countdown to the Nonfarm Payrolls event to end the week.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.