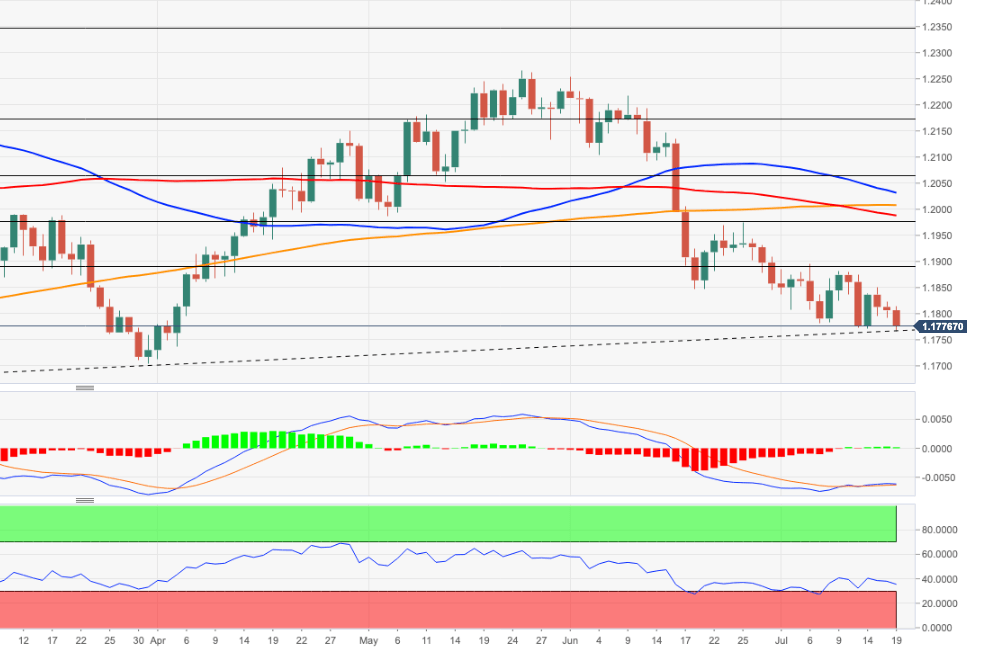

EUR/USD Price Analysis: Below 1.1762 emerges 1.1704

- EUR/USD records new 3-month lows around 1.1765.

- Extra downside could see the 1.17 neighbourhood retested.

EUR/USD’s downtrend gathers steam below the 1.1800 mark on Monday.

While the upside remains capped by the 1.1880/90 band, further pullbacks remain in the pipeline.

Against this, the breach of the 2020-2021 support line (around 1.1770) would be an important bearish event and carries the potential to accelerate losses to, initially, the Fibo level near 1.1760 ahead of the 2021 low in the 1.1700 neighbourhood (March 31).

Further out, the near-term outlook for EUR/USD is seen on the negative side while below the key 200-day SMA, today at 1.2002.

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.