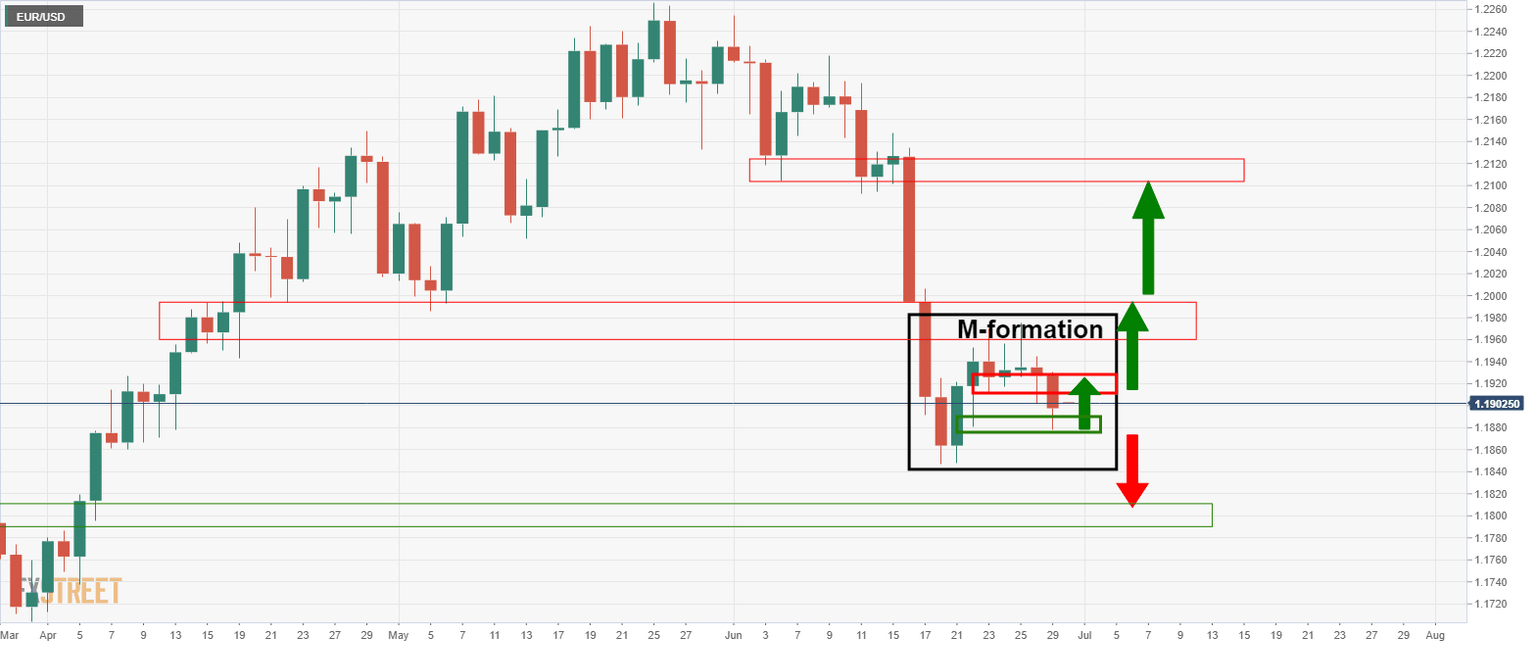

EUR/USD Price Analysis: Bears need to consider the daily M-formation

- M-formation on the daily chart hinders the bearish prospects.

- EUR/USD has stalled at prior lows and has corrected sharply.

As per the prior analysis, EUR/USD Price Analysis: Bears on the next leg towards 1.1805/12, the bears are in control and are seeking a daily downside extension.

However, chart patterns and price action should be monitored and, unfortunately, a bullish formation has emerged on the daily chart that needs to be accounted for in the trade plan.

An M-formation has a high completion rate. There is the probability of a correction back to test the prior lows. The neckline of the formation is a risk to the short playbook.

Prior analysis

''As per the prior analysis, EUR/USD bears seeking break of 4-hour support, the euro has indeed melted to the downside following a breach of the 4-hour support.''

Bears have been monitoring for a shorting opportunity from within the build-up of lower highs within the daily correction that had been losing momentum in prior sessions.

From a lower time frame, such as the 4-hour chart, bears were monitoring for bearish structure on a break of the support as follows:

Prior 4-hour analysis

''First, the 4-hour support of 1.1920 needs to give first, breaking the 4-hour dynamic supporting line.''

Prior 4-hour analysis, critical support broken

''On the break of the 4-hour support, the zone will now be expected to act as resistance and so far it has.

Corrections are stalling below and thus forming a new bearish structure and confirmed resistance between 1.1912/23.

There is now a high probability that the price will continue to melt and make for a daily downside extension towards 1.1805/12 as follows:''

Live market analysis, M-formation

The risk now is that with the price supported at prior lows and correcting, that the bulls take over and move in on the 24th June lows of 1.1917. The old 4-hour support will therefore come under pressure at that point.

A stop-loss moved to breakeven (old 4-hour support near 1.1917) will prevent potential losses accruing should the price continue higher and beyond there.

This will allow for potential gains should the market continue to melt instead and without completing the M-formation nor pressure the 4-hour resistance and the proposed stop loss.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.