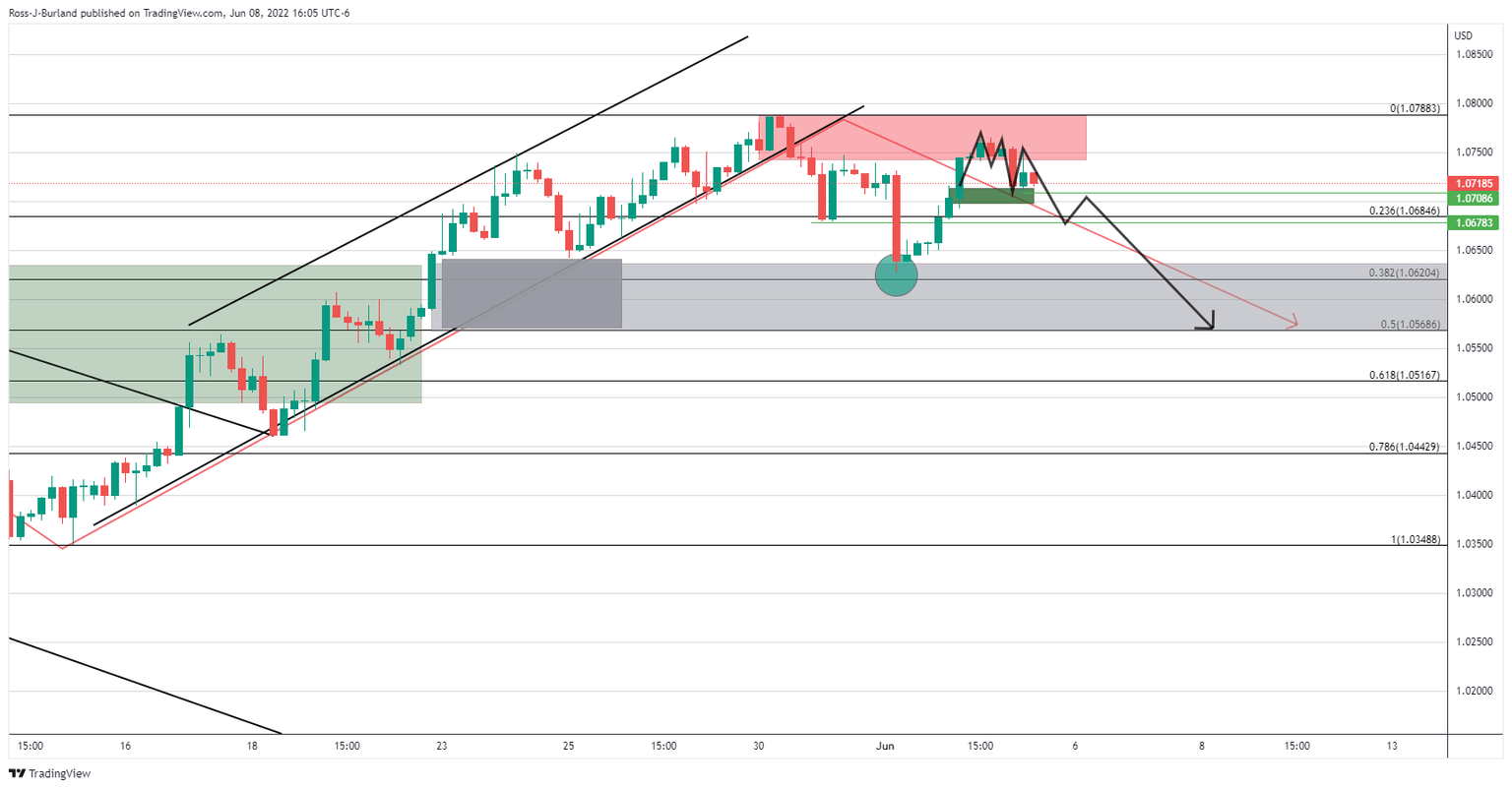

EUR/USD Price Analysis: Bears are stalling bullish advances at key resistance, 50% mean reversion eyed

- EUR/USD bears are lurking below a critical resistance.

- A break of 4-hour support could open the risk of a significant correction.

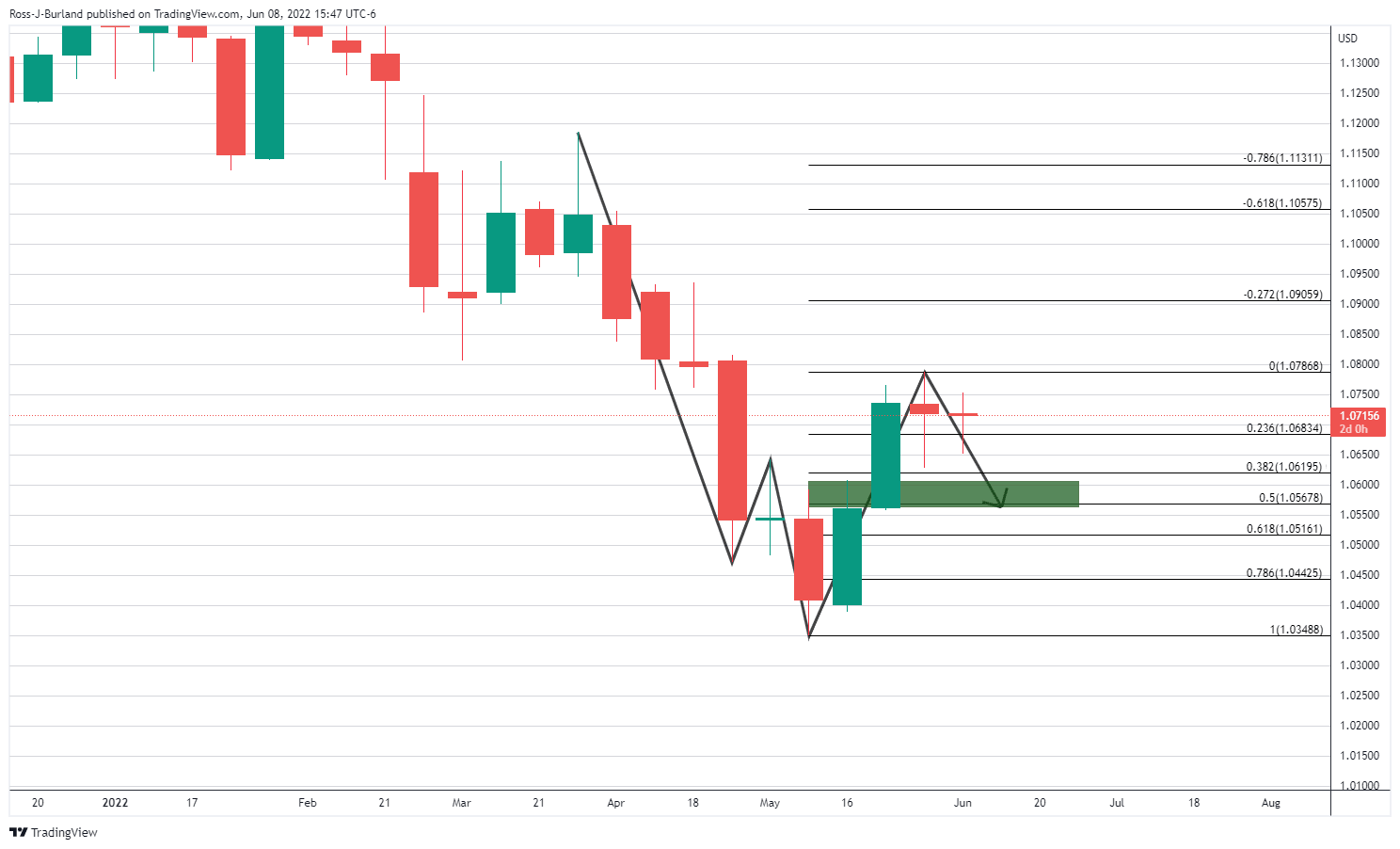

EUR/USD is displaying a bearish bias on the weekly chart which can be analysed on a lower time frame for prospects of a deeper correction in the days ahead. The following illustrates the market structure on a multi-timeframe basis:

EUR/USD weekly chart

This is a powerful reversion pattern and a move in to test the old support, or the nose of the W-formation, is a high probability.

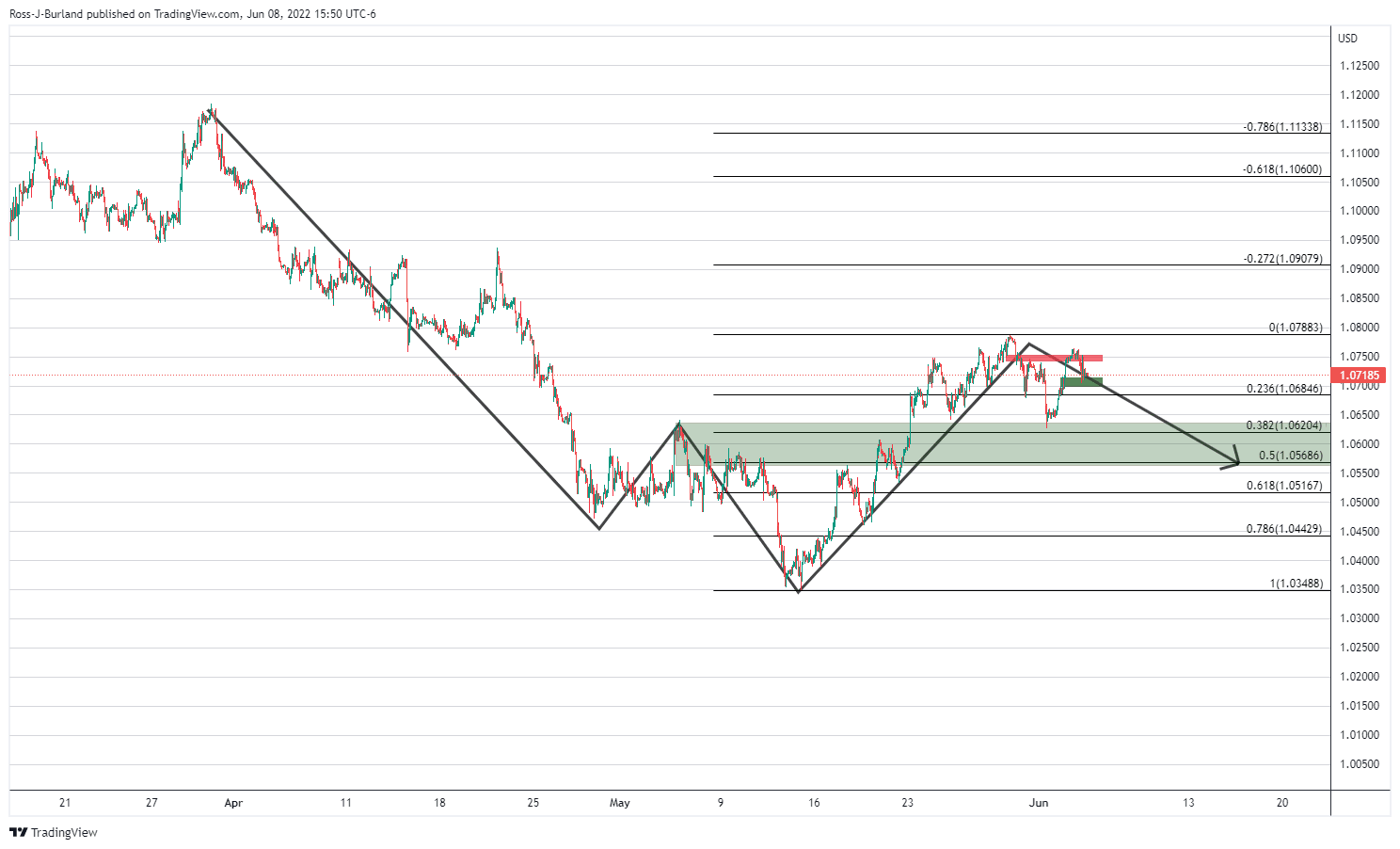

EUR/USD lower time frames, H1 & H4

On the lower time frames is where the current market structure and the potential distribution schematic that can be analysed for a bearish trade set-up

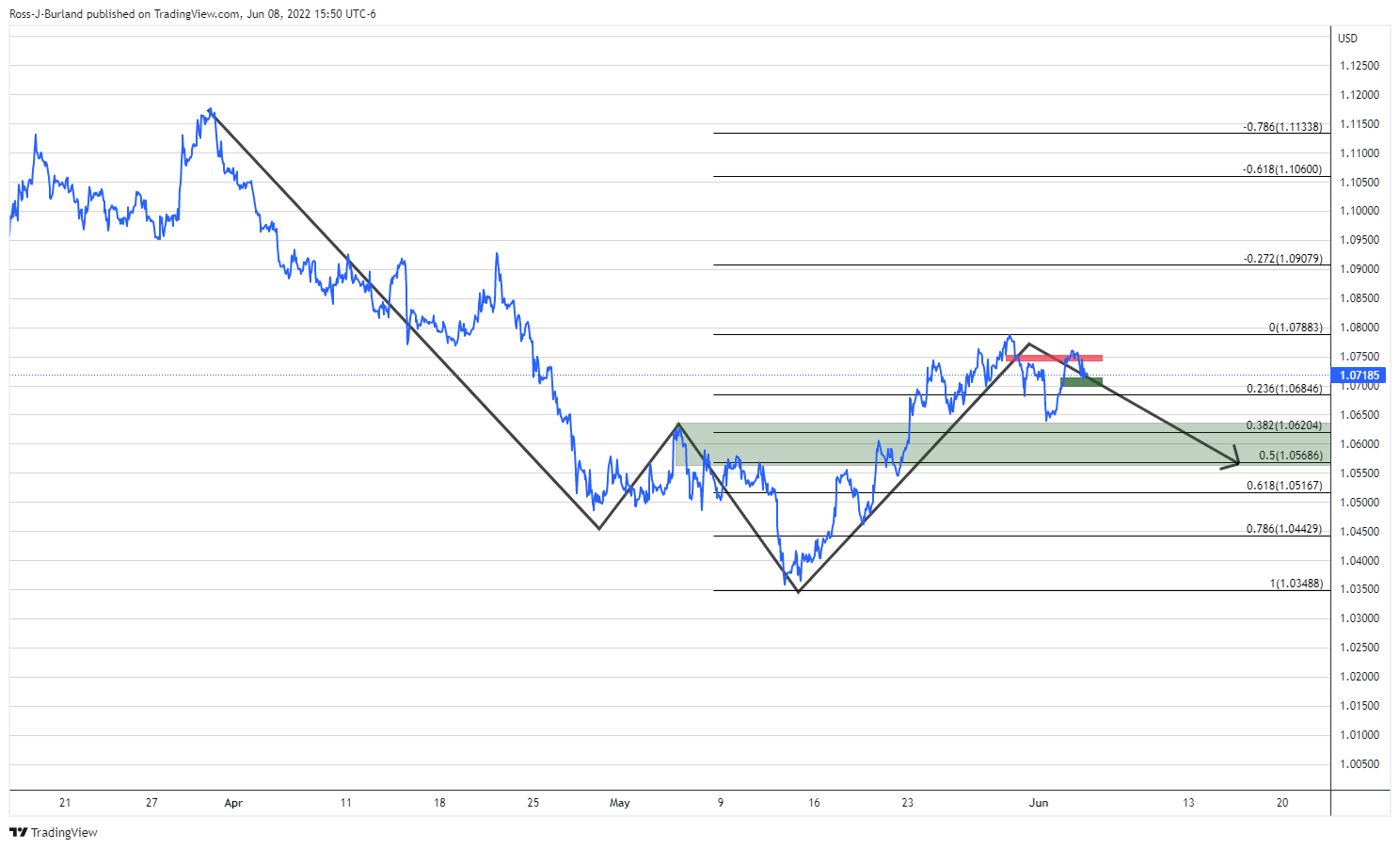

A line chart shows the weekly W pattern more clearly:

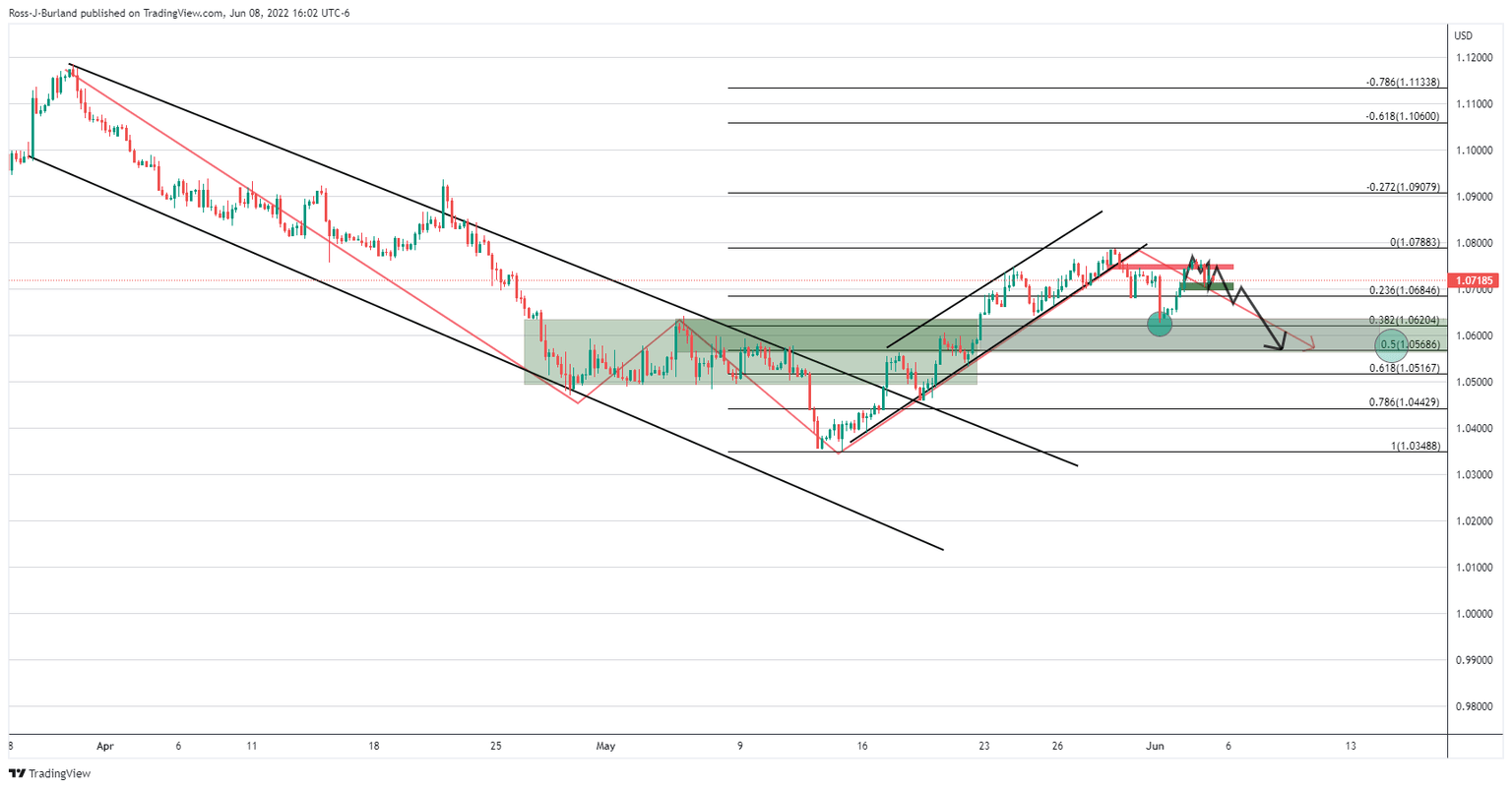

H4 charts

Where there is less noise on the four-hour chart, zooming in on the near-term price action and structure, we can see an M-formation has developed. There are prospects of either some sideways consolidation between resistance and support before a breakout to the downside if we do not get that beforehand.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.