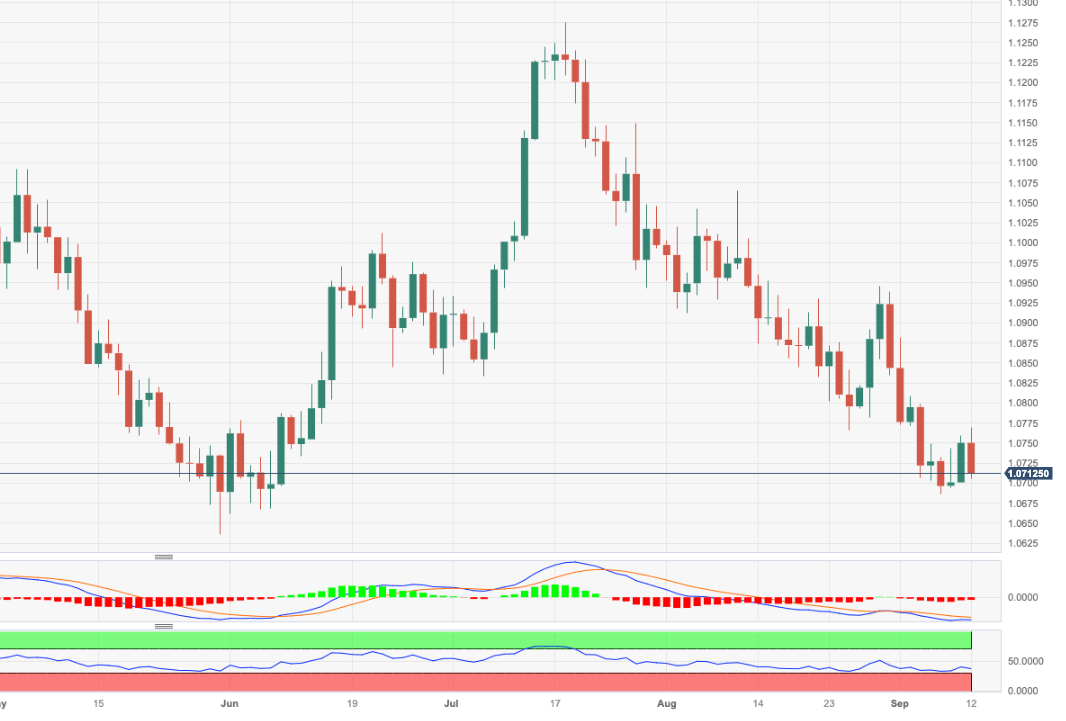

EUR/USD Price Analysis: Another visit to 1.0685 remains on the table

- EUR/USD comes under heavy pressure after climbing to 1.0770.

- The loss of 1.0700 should put 1.0685 back on the radar.

EUR/USD fully fades the auspicious start of the new trading week and confronts the 1.0700 zone following an early bull run to the 1.0770 region, or four-day highs.

The underlying bearish sentiment remains unchanged and leaves the door open to extra pullbacks in the short-term horizon. Against that backdrop, the breach of the 1.0700 region could encourage sellers to embark on a probable visit to the September low of 1.0685 (September 7) ahead of the May low of 1.0635 (May 31).

In the meantime, further losses remain in the pipeline while below the key 200-day SMA, today at 1.0824.

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.