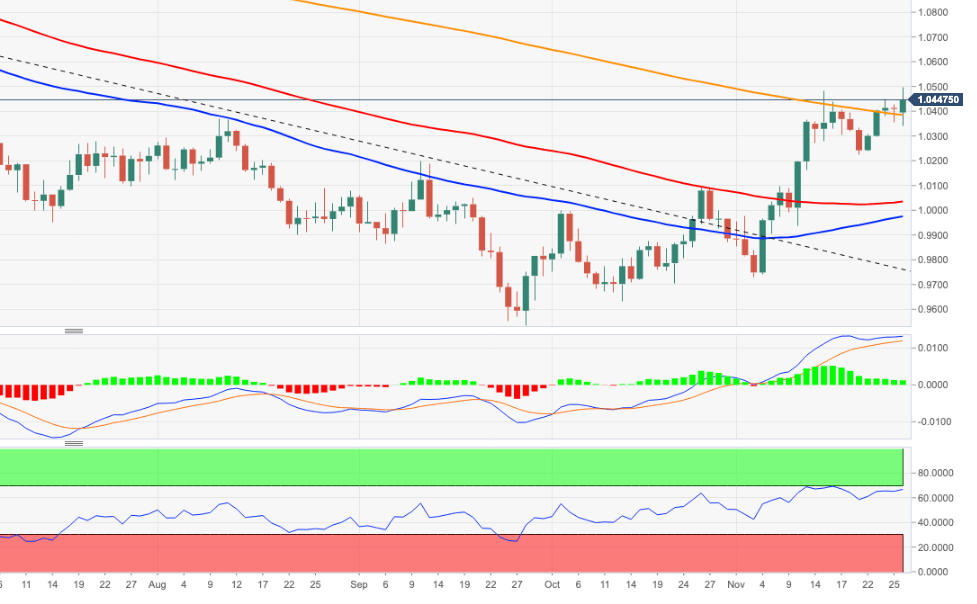

EUR/USD Price Analysis: Above 1.0500 comes 1.0614

- EUR/USD climbs to multi-month highs near 1.0500.

- Extra gains look likely beyond the 1.0500 hurdle.

EUR/USD picks up extra upside traction and pokes with the key barrier at 1.0500 the figure on Monday.

Once 1.0500 is cleared, the pair is expected to refocus on the weekly peak at 1.0614 (June 27) ahead of the June top at 1.0773 (June 9) and the May high at 1.0786 (May 30).

Above the 200-day Simple Moving Average (SMA) (1.0382), the pair’s outlook should remain constructive.

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.