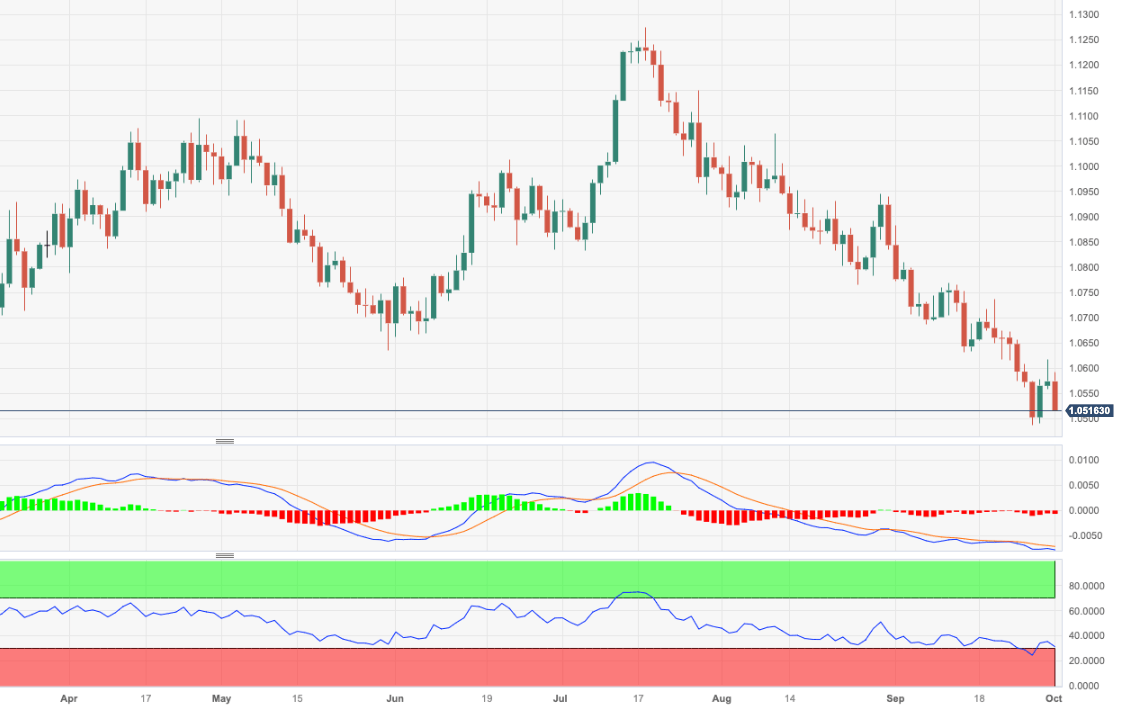

EUR/USD Price Analysis: A visit to the YTD low looms closer

- EUR/USD resumes the downside and retargets the 1.0500 zone.

- The September low at 1.0490 comes next for EUR-bears.

EUR/USD leaves behind a two-day recovery and shifts its attention to the downside and the 1.0500 neighbourhood on Monday.

If bears remain in control, another visit to the September low of 1.0488 (September 27) should start emerging on the horizon just ahead of the 2023 low of 1.0481 (January 6).

Meanwhile, further losses remain on the table as long as the pair navigates the area below the key 200-day SMA, today at 1.0826.

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.