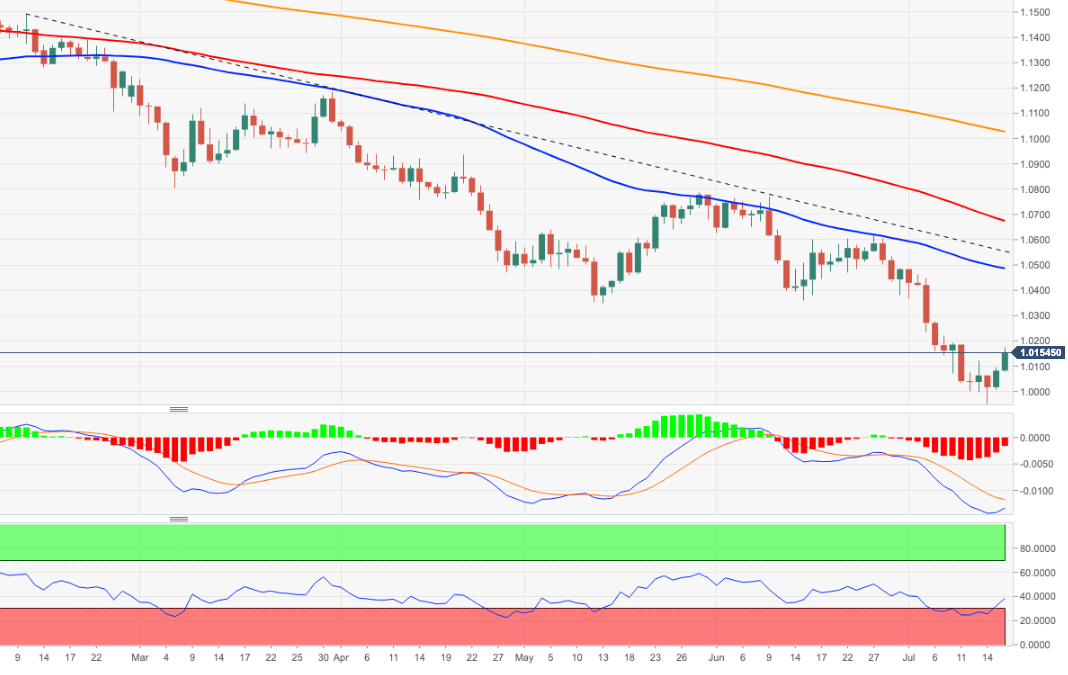

EUR/USD Price Analysis: A test of 1.0200 now emerges on the horizon

- EUR/USD rebounds sharply from recent oversold levels.

- Extra gains are seen revisiting the 1.0200 neighbourhood soon.

EUR/USD advances further and adds to Friday’s bounce, retesting the 1.0170/75 band at the beginning of the week.

Further gains could revisit the 1.0200 zone sooner rather than later, although the pair’s bearish stance remains in place. Against that, the resumption of the downtrend should meet initial contention at the key parity level ahead of the 2022 low at 0.9952 (July 14).

As long as the pair navigates below the 5-month support line around 1.0540 further losses remain in store.

In the longer run, the pair’s bearish view is expected to prevail as long as it trades below the 200-day SMA at 1.1026.

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.