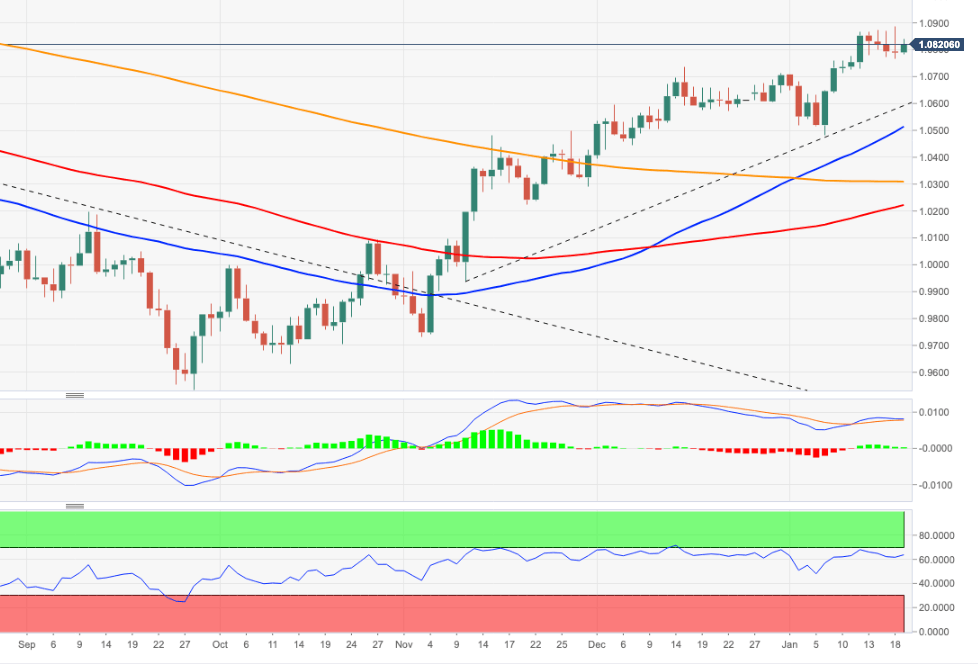

EUR/USD Price Analysis: A move to the 1.0900 zone remains likely

- EUR/USD reclaims the 1.0800 area and above after dropping to 1.0770.

- Immediately to the upside now emerges the 2022 peak at 1.0887.

EUR/USD adds to Wednesday’s uptick and manages to retake the area above the key 1.0800 barrier on Thursday.

It seems the pair is moving within a range bound theme ahead of the potential resumption of the uptrend. Against that, the immediate resistance level comes at the so far YTD high at 1.0887 (January 18). Once cleared, it could lead up to a probable visit to the round level at 1.0900 in the relatively short-term horizon.

Furthermore, while above the short-term support line near 1.0610, extra gains should remain in store.

In the longer run, the constructive view remains unchanged while above the 200-day SMA at 1.0307.

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.