EUR/USD Price Analysis: A drop to the parity level emerges on the horizon

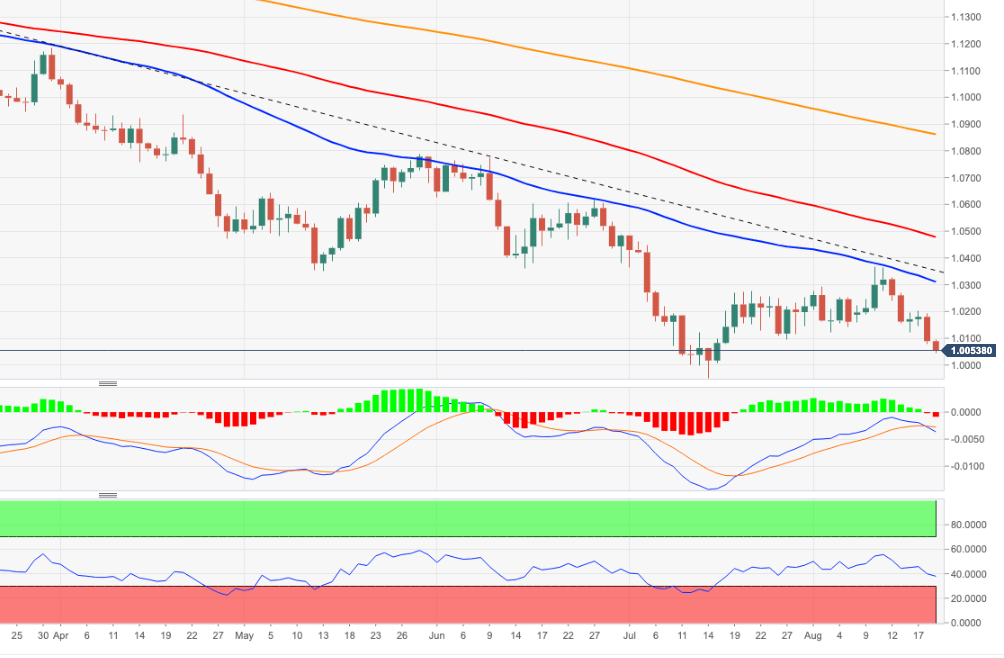

- EUR/USD extends the decline to the 1.0050/45 band.

- Next on the downside appears a potential test of the parity zone.

EUR/USD adds to the recent weakness and extends the breach of the 1.0100 level at the end of the week.

Further losses appear on the cards as well as a probable visit to the parity level in the short-term horizon. The loss of this key support zone could expose a deeper retracement to the YTD low at 0.9952 (July 14).

In the longer run, the pair’s bearish view is expected to prevail as long as it trades below the 200-day SMA at 1.0859.

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.