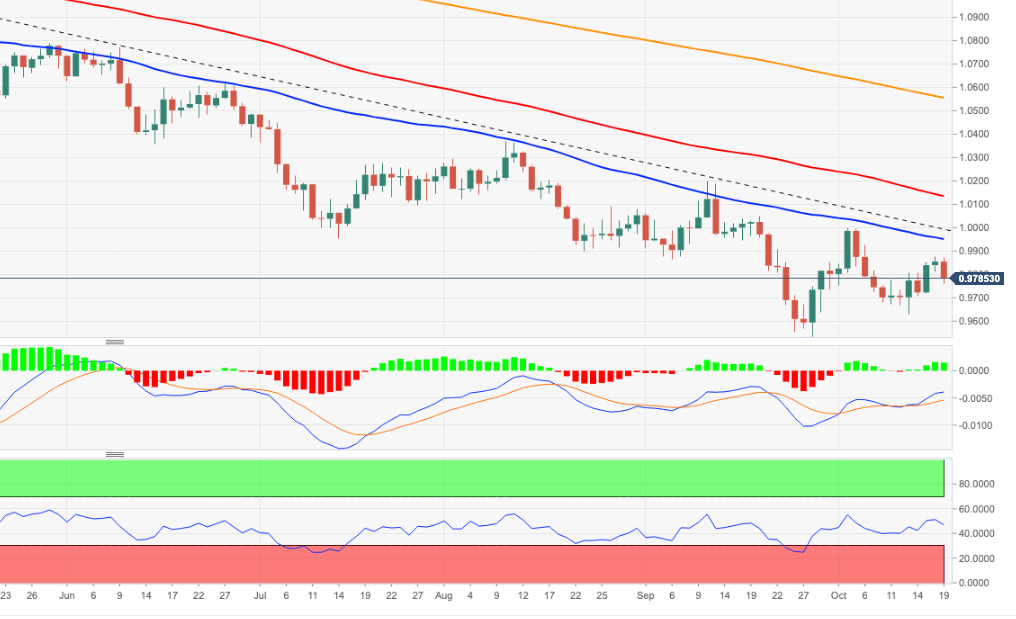

EUR/USD Price Analysis: A deeper correction could revisit 0.9631

- EUR/USD fades the recent advance and breaks below 0.9800.

- The October low near 0.9630 comes next on the downside.

EUR/USD reverses the uptick to the 0.9870/80 band and comes under pressure below the 0.9800 support on Wednesday.

The inability of the pair to surpass the area of weekly highs near 0.9880 in the very near term could lure extra selling pressure in and pave the way for a probable test of the October low at 0.9631 (October 13).

In the longer run, the pair’s bearish view should remain unaltered while below the 200-day SMA at 1.0553.

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.