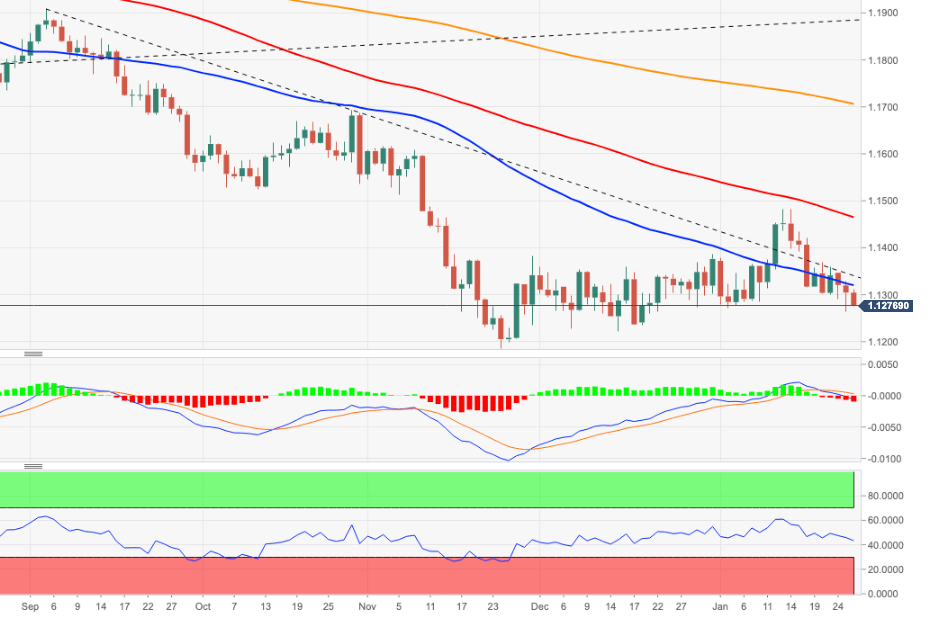

EUR/USD Price Analysis: A breach of 2022 lows exposes 1.1220

- EUR/USD extends the bearish note for the third straight session.

- Below YTD lows emerges the December 2021 low near 1.1220.

EUR/USD remains well under pressure and trades at shouting distance from recent 2022 lows near 1.1260.

The bias appears tilted to a deeper pullback in the very near term. That said, the next support of note is now seen at the December 2021 low at 1.1221 (December 15) ahead of the 2021 low at 1.1186 (November 24).

The longer term negative outlook for EUR/USD is seen unchanged while below the key 200-day SMA at 1.1704.

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.