EUR/USD meanders near Thursday's close at 1.0875 ahead of next week’s ECB rate decision

- The EUR/USD to finish the week with losses of 1.56%.

- Geopolitics, FOMC minutes, and Fed speaking kept the euro pressured.

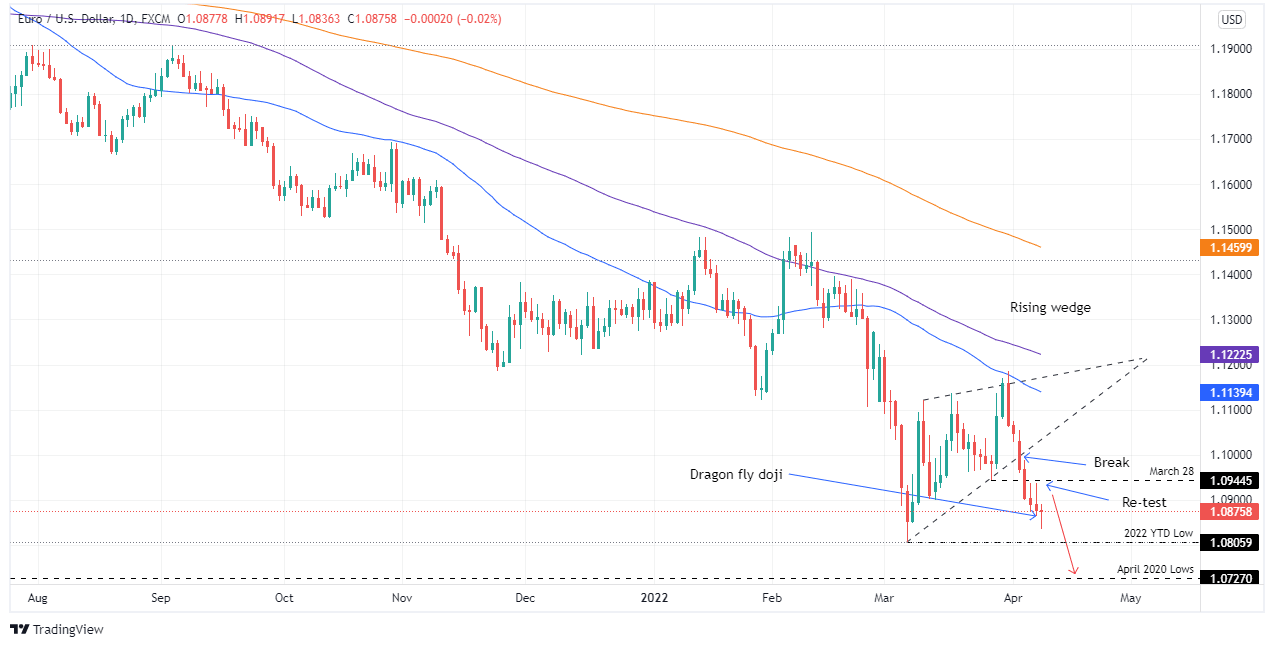

- EUR/USD Price Forecast: The pair is downward biased, but a dragon-fly doji suggests that the pair might consolidate in the near term.

The EUR/USD remains pressured and aims to finish the week on the wrong foot amidst a mixed market sentiment. The EUR/USD is trading at 1.0876 as traders prepare for the weekend.

Geopolitics and hawkish Fed keep sentiment mixed

Investors’ mood was mixed during the North American session. US equities fluctuated while market players’ focus turned to geopolitics and Fed speakers. However, in the next week, the attention will be on March’s Consumer Price Index, which could shed some light on Fed expectations of inflation.

Next week, the European Central Bank (ECB) will have its rate decision. Late in the mid-North American session, Bloomberg sources reported that the ECB is crafting a crisis tool if bond yields jump, but it is still in the design stage. Aside from central banking chatter, the EU announced a subsequent tranche of sanctions on Russian oligarchs and President Putin’s family members.

On Friday, US Treasury yields finished the session with gains along the yield curve, reflecting the aggressive stance of the Fed. The US 10-year benchmark note rose five basis points, sat at 2.701%, and underpinned the greenback, as shown by the US Dollar Index, up 0.09%, currently at 99.834.

The Federal Reserve March meeting minutes showed that most policymakers were looking for a 50-bps increase if not for the Ukraine conflict; instead, the Fed hiked 25 bps. At the same meeting, the US central bank laid the ground to reduce its $9 trillion balance sheet by $95 billion a month, $60 on US Treasuries, and $35 billion on mortgage-backed securities (MBS).

As the Friday North American session is about to finish, money market futures have priced in a 88% chance of a 0.50% rate hike to the Federal Funds Rate (FFR) in the May 4 meeting.

EUR/USD Price Forecast: Technical outlook

The EUR/USD bias remains downwards and further cemented it when on April 4, the EUR/USD broke the upslope trendline of a rising wedge, which opened the door towards 1.0700, but first would need to overcome some hurdles on its way down. Nevertheless, Friday’s price action is forming a candlestick named a “dragon-fly doji,” which means that bears jumped off the boat as bulls lifted the pair from weekly lows to the 1.0875 region.

That said, the EUR/USD first support would be 1.0848. A breach of the latter would expose the 2022 YTD low at 1.0806, followed by April 2020 swing lows around 1.0727, and then the abovementioned 1.0700 mark.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.