EUR/USD loses upside momentum above 1.0760 as US NFP comes into picture, hawkish ECB bets remain solid

- EUR/USD is displaying a lackluster performance above 1.0760 as the focus has shifted to US NFP data.

- Federal Reserve policymakers are divided about June’s interest rate policy stance post US Manufacturing PMI and ADP Employment data.

- European Central Bank President Christine Lagarde is expected to raise interest rates despite sheer softening of Eurozone inflation.

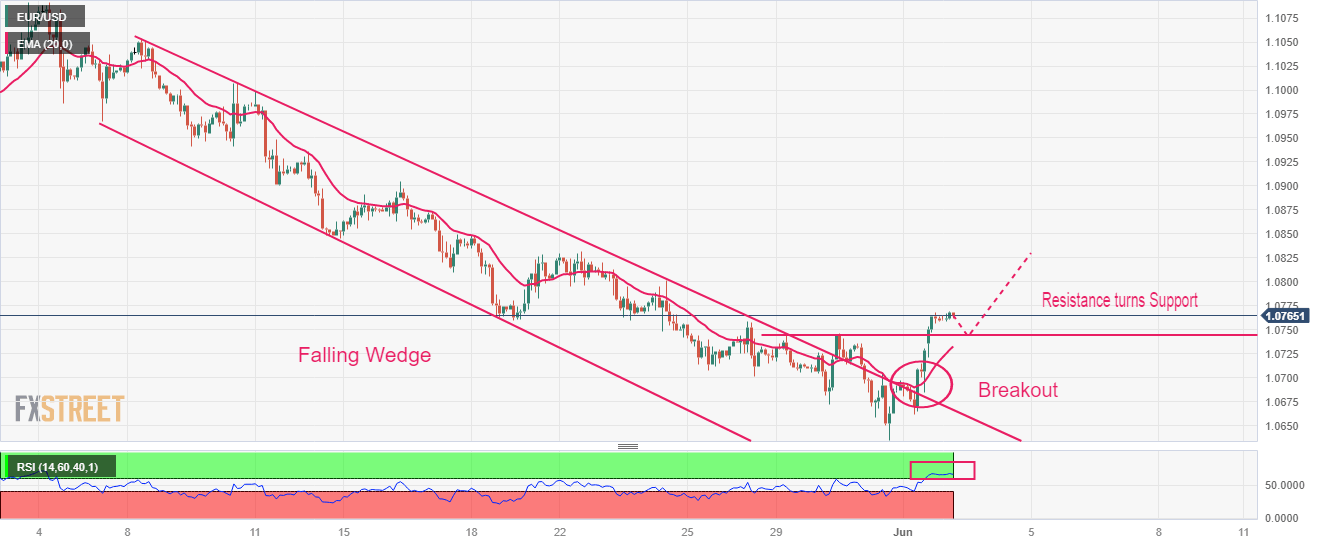

- EUR/USD has delivered a breakout of the Falling Wedge chart pattern, which indicates a bullish reversal after a prolonged downside.

EUR/USD is consistently demonstrating a back-and-forth action above the critical support of 1.0760 in the early European session. The major currency pair is showing signs of a loss in the upside momentum amid a failure in extending its rally further. After a vertical sell-off, the US Dollar Index (DXY) has attempted to defend its downside post-refreshing weekly low at 103.44.

S&P500 futures are holding gains added in Asia amid an upbeat market mood. US equities carry-forwarded risk appetite theme showed on Thursday amid the clearance of the US debt-ceiling bill by Congress and easing odds of a further interest rate hike by the Federal Reserve (Fed) in its June meeting.

The US Dollar Index remained under pressure after a few Federal Reserve (Fed) policymakers favored a pause in the year-long policy-tightening spell. Philadelphia Federal Reserve Bank President Patrick Harker stated on Thursday that he believes it is time for the central bank to 'hit the stop button' for at least one meeting, reiterating his comments from Wednesday about a potential pause at the next meeting. Harker argued that such a move would be prudent at this time.

A recovery in the US Treasury yields has provided some support to the US Dollar. The 10-year US Treasury yields have rebounded above 3.62%.

Investors are bracing for a volatile action in global financial markets amid the release of the United States Nonfarm Payrolls (NFP) data (May), which will provide more clarity about interest rate policy to be dictated by the Federal Reserve.

US contracting factory activity vs. tight labor market conditions

Diverged United States economic indicators have created chaos among Federal Reserve policymakers. On Thursday, the US ISM agency reported the seventh straight contraction in Manufacturing PMI for May. A 50.0 threshold figure that separates expansion from contraction showed declining US domestic factory activities. The economic data landed at 46.9 from the downwardly revised figure of 47.0. Also, the New Orders Index that indicates forward demand dropped significantly to 42.6 vs. the estimates of 44.9. It seems that higher interest rates by the Federal Reserve and tight credit conditions have forced firms to operate with lower capacity. Also, individuals are struggling to avail credit for core goods.

On the contrary, US Automatic Data Processing (ADP) agency showed the Employment Change (May) at 278K jobs, significantly higher than the estimates of 170K. This has created a tug-of-war among Federal Reserve policymakers as tight labor market conditions advocate for more interest rate hikes while consistently contracting factory activities favor a pause this month.

Strong consensus for US NFP

After the release of upbeat US ADP Employment Change, the street is confident that US official Employment data would also remain extremely solid. Analysts at Wells Fargo expect NFP to increase by 200K. They believe it is important to keep a close eye on wage growth and the labor force participation numbers. The labor force has grown at a healthy pace over the past year, and a further deceleration in wages alongside expanding supply would be an encouraging sign in the Federal Reserve's fight to get inflation back to 2%.

Softening Eurozone Inflation fails to trim hawkish ECB bets

A compiled version of 20-Eurpoean nations showed that inflationary pressures for May have softened more than what the street was anticipating. Eurozone followed the trail of Germany, France, and Spain and reported lower-than-anticipated Harmonized Index of Consumer Prices (HICP) figures as individuals are surrendering luxuries due to higher cost of living. Monthly headline HICP remained flat vs. former expansion of 0.6% while annual HICP decelerated heavily to 6.1% from the estimates of 6.3% and the former release of 7.0%.

Investors started expecting that the European Central Bank (ECB) will consider the current deceleration in inflationary pressures and German’s recession and might consider a pause for June. However, European Central Bank President Christine Lagarde is expected to raise interest rates by 25 basis points (bps) as core inflation is still persistent as announced on Thursday.

EUR/USD technical outlook

EUR/USD has delivered a breakout of the Falling Wedge chart pattern, which indicates a bullish reversal after a prolonged downside. The shared currency pair has shifted above the horizontal resistance plotted from May 29 high at 1.0744, which has turned into a support for the Euro bulls.

Upward-sloping 20-period Exponential Moving Average (EMA) at 1.0734 indicates that the short-term trend is bullish.

An oscillation in the bullish range by the Relative Strength Index (RSI) (14) indicates that the upside momentum is still active.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.