EUR/USD looks bid, regains 1.1700 and beyond

- EUR/USD regains the smile above 1.17000 on Thursday.

- The dollar retreats from monthly tops above 93.50.

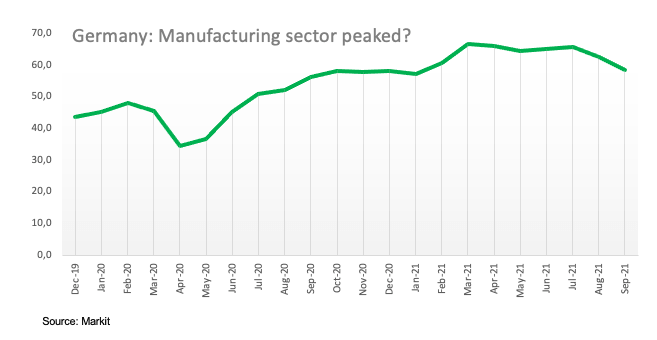

- Flash PMIs in the core euro area receded further in September.

The single currency finally smiles and now lifts EUR/USD back above the 1.1700 mark on Thursday.

EUR/USD focused on dollar, data

EUR/USD attempts a mild rebound after recording new tops for the month of September earlier on Thursday near 1.1680.

The improvement in the risk complex helps the pair to regain some composure and reverse, albeit partially, the intense leg lower in place since the beginning of the month. In fact, EUR/USD shed nearly 2% since monthly highs past the 1.1900 mark (September 3) to lows recorded during early trade in the 1.1685/80 band.

The pair opened the session on a positive note and quickly surpassed the 1.1700 barrier on Thursday on the back of some profit taking mood hitting the buck as market participants continue to digest Wednesday’s FOMC gathering.

In the euro docket, preliminary readings for Manufacturing/Services PMIs in the core Euroland for the month of September came in below estimates and added to the view of some deceleration in the region.

Data across the pond includes the usual weekly Claims, the Chicago Fed Index, flash PMIs and the CB Leading Index.

What to look for around EUR

EUR/USD dropped and rebounded from lows near 1.1680 in the wake of the FOMC event. The firm sentiment surrounding the dollar is expected to persist for the time being and particularly now that the Committee sees higher rates in 2022 and the QE tapering process is expected to kick in “soon”. The lower-than-expected PMIs in the bloc further suggest that the economic recovery could be stalling, emerging at the same time as another potential source of weakness for the single currency.

Key events in the euro area this week: Flash September PMIs (Thursday) – German IFO (Friday) – German elections (Sunday).

Eminent issues on the back boiler: Asymmetric economic recovery in the region. Sustainability of the pick-up in inflation figures. Progress of the Delta variant of the coronavirus and pace of the vaccination campaign. Probable political effervescence around the EU Recovery Fund. German elections in September could bring some political jitters to the scenario. Investors’ shift to European equities in the wake of the pandemic could lend extra oxygen to the single currency. ECB tapering speculations.

EUR/USD levels to watch

So far, spot is gaining 0.30% at 1.1722 and faces the next up barrier at 1.1790 (55-day SMA) seconded by 1.1845 (weekly high Sep.14) and finally 1.1909 (monthly high Sep.3). On the other hand, a break below 1.1683 (monthly low Sep.23) would target 1.1663 (2021 low Aug.20) en route to 1.1602 (monthly low Nov.4 2020).

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.