EUR/USD jumps above 1.1690 as trade tensions weigh on USD ahead of ECB’s meeting

- EUR/USD rises as the ECB is expected to hold rates steady.

- August 1 US tariff deadline triggers Greenback outflows, boosting EUR/USD.

- Fed drama resurfaces with Powell under political fire.

- Investors eye EU PMIs, US housing and durable goods data later this week.

The EUR/USD surged on Monday, rising by over 0.50%, as the US dollar edged lower, undermined by a decline in US Treasury yields and trade uncertainty, with the August 1 deadline looming. This triggered outflows from the Greenback, as depicted by the pair trading at 1.1694 after bouncing off daily lows of 1.1614.

Market mood is jovial as investors await earnings from two megacap companies in the United States (US). Trade tensions between the European Union (EU) and the US increased as EU diplomats are exploring a broader set of countermeasures against the US, as the chances of reaching an agreement faded.

The European Central Bank (ECB) is expected to hold rates unchanged at the July 24 meeting, following a string of interest rate cuts, though eyes are on the Federal Reserve’s next week meeting.

Tensions around Fed Chair Jerome Powell persist, following Congresswoman Anna Paulina Luna's formal accusation that the Fed head committed perjury on two separate occasions, both stemming from discussions about the Fed's long-scheduled renovations to its headquarters in Washington, DC.

This week, the EU’s economic docket will feature Consumer Confidence, Flash PMIs for July, and the European Central Bank (ECB) monetary policy decision. Across the pond, the US schedule will announce US housing data, S&P Global Flash PMIs, Initial Jobless Claims, and Durable Goods Orders.

Daily digest market movers: EUR/USD to test 1.1700 ahead of ECB's decision

- Last week’s US economic data delivered a mixed picture. While consumer sentiment improved, inflation accelerated in June, with the Consumer Price Index (CPI) nearing the 3% mark. The Producer Price Index (PPI) showed some signs of easing, but a robust Retail Sales report highlighted the continued resilience of American consumers, despite the ongoing rise in prices.

- The lack of Fed speakers leaves traders adrift inon trade developments. A German spokesperson revealed that Germany’s Chancellor is not considering EU countermeasures against the US as appropriate.

- Some EU diplomats said the bloc is exploring a set of retaliatory measures against the US if the chances of achieving an agreement fail.

- US Treasury Secretary Scott Bessent said that trade discussions are moving along. Regarding the EU, he said that European diplomats had become more engaged in talks, and that they want to negotiate faster.

- Separately, Fed Governor Christopher Waller acknowledged that while the labor market remains stable overall, conditions in the private sector are less robust. Although he expressed support for a potential rate cut in July, he emphasized that he would not commit ahead of the meeting, stating he prefers to “hear all sides” before making a final decision.

- The odds of the ECB keeping rates unchanged at the July 24 meeting are 62.5%, with a modest chance of a 0.25 percentage point cut at 37.5%.

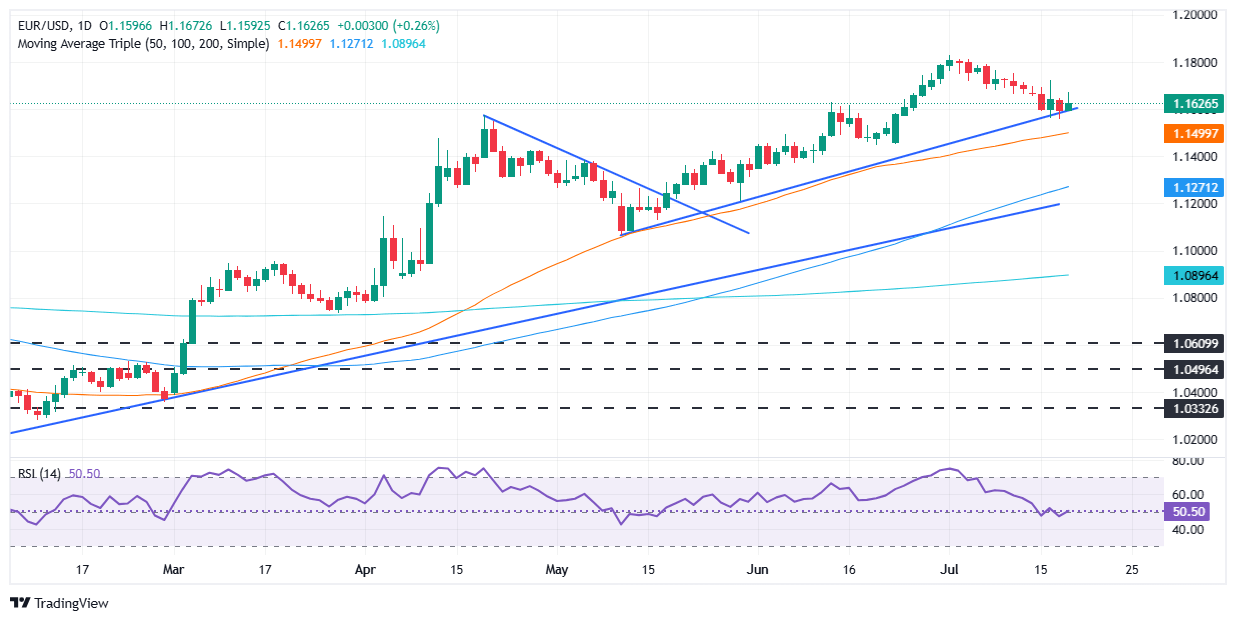

EUR/USD technical outlook: Surges towards 1.1700 on Monday

The EUR/USD remains consolidated, with traders unable to decisively clear the 1.1700 mark. As of writing, the 20-day Simple Moving Average (SMA) at 1.1698 is the first resistance level for buyers. Although they’re in charge, the Relative Strength Index (RSI) depicts that some consolidation lies ahead.

An EUR/USD daily close above 1.1700 paves the way to challenge the 1.1750 figure, 1.1800, and the YTD high of 1.1829. On the flip side, if the EUR/USD falls below 1.1650 and 1.1600, it opens the door to challenge 1.1550. The next support would be the 50-day SMA at 1.1509. Once those demand zones are surpassed, the following line of defense for bulls would be the 100-day SMA at 1.1291.

Euro FAQs

The Euro is the currency for the 19 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day. EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy. The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control. Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency. A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall. Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.