EUR/USD advances towards 1.1400 as Trump backs off EU tariffs

- EUR/USD trims gains after reaching 1.1420 on tariff relief; holiday-thinned markets keep the Dollar under pressure.

- Trump postpones 50% EU tariff threat to July 9, easing near-term trade tensions.

- ECB’s Lagarde hints Euro could rival Dollar if bloc strengthens its financial unity.

- Fed’s Kashkari flags stagflation risks from tariffs; September policy path remains uncertain.

EUR/USD begins the week on the front foot but trims some of its earlier gains after hitting a four-week high of 1.1420, sponsored by US President Donald Trump's reversal on his decision to enact tariffs on the European Union (EU) on June 1. At the time of writing, the major currency trades at 1.1390, up 0.20%.

Last week, late Friday, Trump threatened to impose 50% tariffs on EU goods on June 1, as negotiations with the bloc are not advancing as expected. This triggered a leg-up in EUR/USD, ending at a two-day high of 1.1375. Nevertheless, a call between EU Commission President Ursula von der Leyen and Trump on Sunday bought some time for both parties to reach an agreement with a deadline of July 9.

The Greenback’s decline has favored the Euro, which, according to European Central Bank (ECB) President Christine Lagarde, could become a viable alternative to the US Dollar (USD) as the world’s reserve currency. However, she stated this could happen if governments strengthened the bloc's financial and security architecture.

The US Dollar Index (DXY), which tracks the performance of the American currency against six other currencies, is down 0.10%. Still, it remains steady at 99.00 due to subdued trading conditions in observance of a US Memorial Day holiday.

Minneapolis Federal Reserve (Fed) President Neel Kashkari said uncertainty is top of mind for the Fed and US businesses. He said the September meeting is open for “anything,” adding that the US central bank is in wait-and-see mode. He added that the shock of tariffs is stagflationary.

Euro PRICE Today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.14% | -0.27% | 0.19% | 0.03% | 0.10% | -0.22% | -0.03% | |

| EUR | 0.14% | -0.12% | 0.36% | 0.17% | 0.24% | -0.08% | 0.12% | |

| GBP | 0.27% | 0.12% | 0.15% | 0.29% | 0.36% | 0.04% | 0.26% | |

| JPY | -0.19% | -0.36% | -0.15% | -0.15% | -0.09% | -0.46% | -0.21% | |

| CAD | -0.03% | -0.17% | -0.29% | 0.15% | 0.08% | -0.25% | -0.03% | |

| AUD | -0.10% | -0.24% | -0.36% | 0.09% | -0.08% | -0.36% | -0.10% | |

| NZD | 0.22% | 0.08% | -0.04% | 0.46% | 0.25% | 0.36% | 0.22% | |

| CHF | 0.03% | -0.12% | -0.26% | 0.21% | 0.03% | 0.10% | -0.22% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

EUR/USD daily market movers: Underpinned by large US fiscal deficit, strong EU data

- Recent data in the EU supports further upside on the EUR/USD pair as Germany’s economy grew faster than expected. The Gross Domestic Product (GDP) for Q1 2025 was 0.4% up from 0.2%.

- The Greenback remains on the back foot, weighed down by the approval of Trump’s tax bill in the House of Representatives, which is on its way to the Senate. If passed, the proposal would add close to $4 trillion to the US debt ceiling over a decade, according to the Congressional Budget Office (CBO).

- EUR/USD would remain driven by economic data. The EU’s economic schedule will feature Germany’s Gfk Consumer Confidence, employment and Retail Sales data in the EU. Inflation will be reported in Germany, France, Italy, Spain and the EU.

- The US economic docket will feature April Durable Goods Orders, the Federal Open Market Committee (FOMC) meeting minutes, the second estimate for Q1 2025 GDP and the release of the Core Personal Consumption Expenditures (PCE) Price Index, the Fed’s preferred inflation metric.

- The European Central Bank (ECB) is expected to lower interest rates at the upcoming meeting. On Friday, ECB’s Rehn and Stournaras backed a rate cut in June, with the latter supporting a pause after that meeting.

Source: Prime Market Terminal

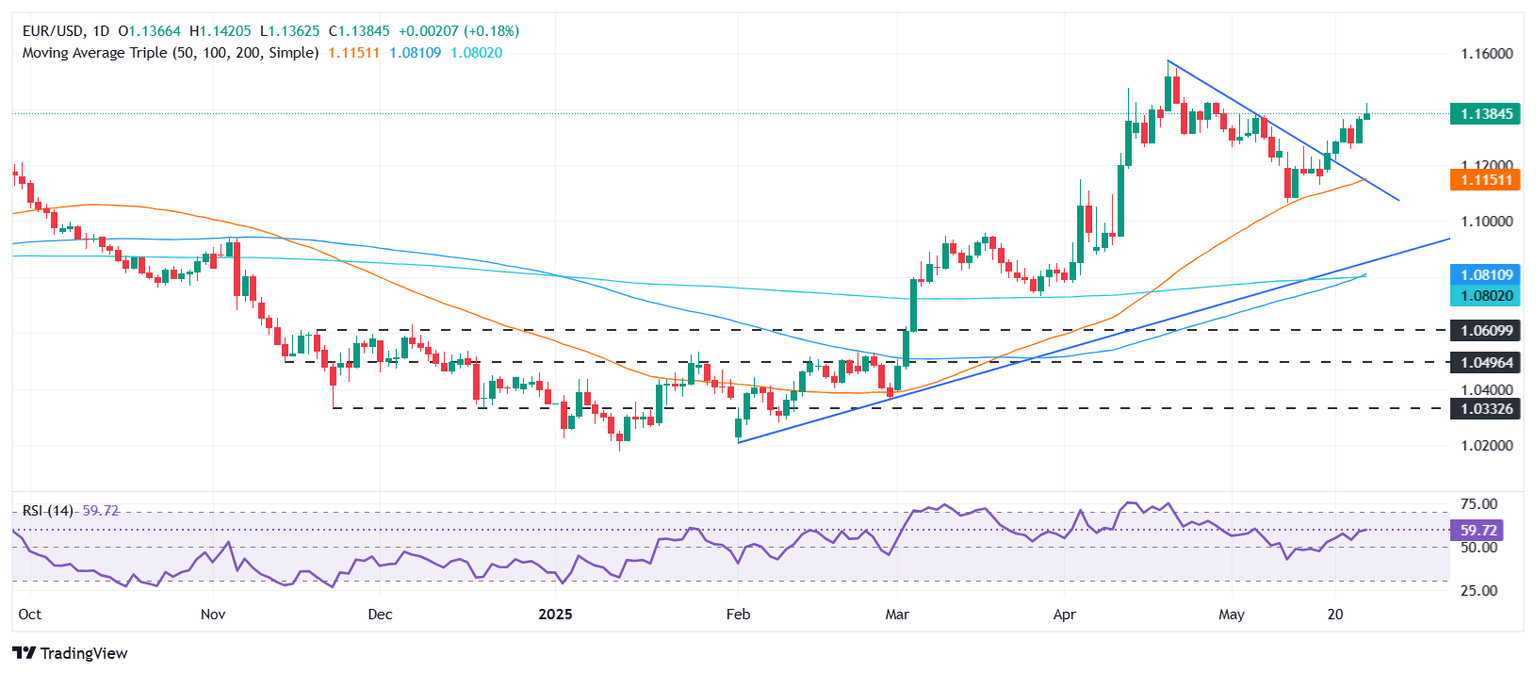

EUR/USD technical outlook: Set to challenge 1.1400 in the near term

EUR/USD remains upward biased despite forming an ‘inverted hammer,’ which indicates that sellers are outpacing buyers due to the large upper shadow in today’s price action. However, further confirmation is needed, and the pair must drop below 1.1300 for sellers if they want to test lower prices.

The next key support level would be the 20-day Simple Moving Average (SMA) at 1.1270, followed by the 1.1200 mark.

On the upside, if EUR/USD stays above 1.1375, the next resistance would be the May 26 high of 1.1418, followed by 1.1450 and 1.1500.

ECB FAQs

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy for the region. The ECB primary mandate is to maintain price stability, which means keeping inflation at around 2%. Its primary tool for achieving this is by raising or lowering interest rates. Relatively high interest rates will usually result in a stronger Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

In extreme situations, the European Central Bank can enact a policy tool called Quantitative Easing. QE is the process by which the ECB prints Euros and uses them to buy assets – usually government or corporate bonds – from banks and other financial institutions. QE usually results in a weaker Euro. QE is a last resort when simply lowering interest rates is unlikely to achieve the objective of price stability. The ECB used it during the Great Financial Crisis in 2009-11, in 2015 when inflation remained stubbornly low, as well as during the covid pandemic.

Quantitative tightening (QT) is the reverse of QE. It is undertaken after QE when an economic recovery is underway and inflation starts rising. Whilst in QE the European Central Bank (ECB) purchases government and corporate bonds from financial institutions to provide them with liquidity, in QT the ECB stops buying more bonds, and stops reinvesting the principal maturing on the bonds it already holds. It is usually positive (or bullish) for the Euro.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.