EUR/USD weakens on Fed Bowman's hawkish guidance on interest rates

- EUR/USD falls sharply from 1.0740 as Germany’s outlook appears to be dull.

- The ECB could deliver subsequent rate cuts to uplift poor demand prospects.

- The US Dollar will dance to the tunes of the US core PCE inflation data for May.

EUR/USD faces intense selling pressure near 1.0740 in Tuesday’s American session. The pullback move in the major currency pair appears to have concluded as the US Dollar (USD) rebounds after a modest correction.

The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, bounces back from 105.40 amid uncertainty about when the Federal Reserve (Fed) will start easing interest rates. The uncertainty over Fed rate cuts deepens as the preliminary United States (US) S&P Global Purchasing Managers Index (PMI) unexpectedly beats the consensus and its prior numbers in June. However, investors see the Fed reducing interest rates twice this year and will start from the September meeting.

On the interest rate outlook, Fed Governor Michelle Bowman said in an interview in Tuesday's New York session that she doesn't see any rate cut this year. Bowman added that rate cuts at this point are inappropriate, and the option of more rate hikes remains on the table if progress in the disinflation process appears to stall or reverse in the future.

This week, investors will focus on the US core Personal Consumption Expenditure price index (PCE) for May, which will be published on Friday. The core PCE price index data is the Fed’s preferred inflation measure, and it will provide fresh cues on when and how much the central bank will reduce interest rates this year.

Daily digest market movers: EUR/USD slumps amid uncertainty over Eurozone’s election outcome

- EUR/USD faces stiff resistance near 1.0740 as the outlook for the Euro is uncertain. The economic prospects of the Eurozone’s largest economy appear to be deteriorating. German IFO Institute data, which exhibits market sentiment over the economy’s current position and forward outlook, indicated a gloomy picture.

- IFO Business Climate, an early indicator of current conditions and business expectations in Germany, surprisingly declined to 88.6 in June. Investors forecasted a rise to 89.7 from May’s reading of 89.3. In the same period, the Expectations index unexpectedly dropped to 89.0 from the estimates of 91.0 and the former release of 90.3 (downwardly revised from 90.4). On the data release, IFO President Clemens Fuest said, "The German economy is having difficulty overcoming stagnation."

- Last week, the preliminary HCOB PMI data for June also pointed to slowing economic activities due to a sharper decline in new orders from domestic as well as global markets. The Manufacturing PMI contracted at a faster pace and declined to a six-month low of 45.6 from the prior reading of 47.3. The Services PMI continues to expand but at the slowest pace in three months.

- The dismal economic outlook for the Eurozone economy points to subsequent rate cuts from the European Central Bank (ECB). The ECB began unwinding its restrictive interest rate framework in its policy meeting in early June. However, officials have been refraining from committing to any specific rate-cut path as they remain concerned over upside risks to wage inflation, which could boost price pressures.

- Meanwhile, political uncertainty is deepening as France heads toward the first round of snap legislative elections, scheduled for June 30. French President Emmanuel Macron called for a snap election after his party suffered defeat in preliminary results in European parliamentary elections held on June 9 from Marine Le Pen’s far-right National Rally (RN).

Technical Analysis: EUR/USD tumbles to near 1.0700

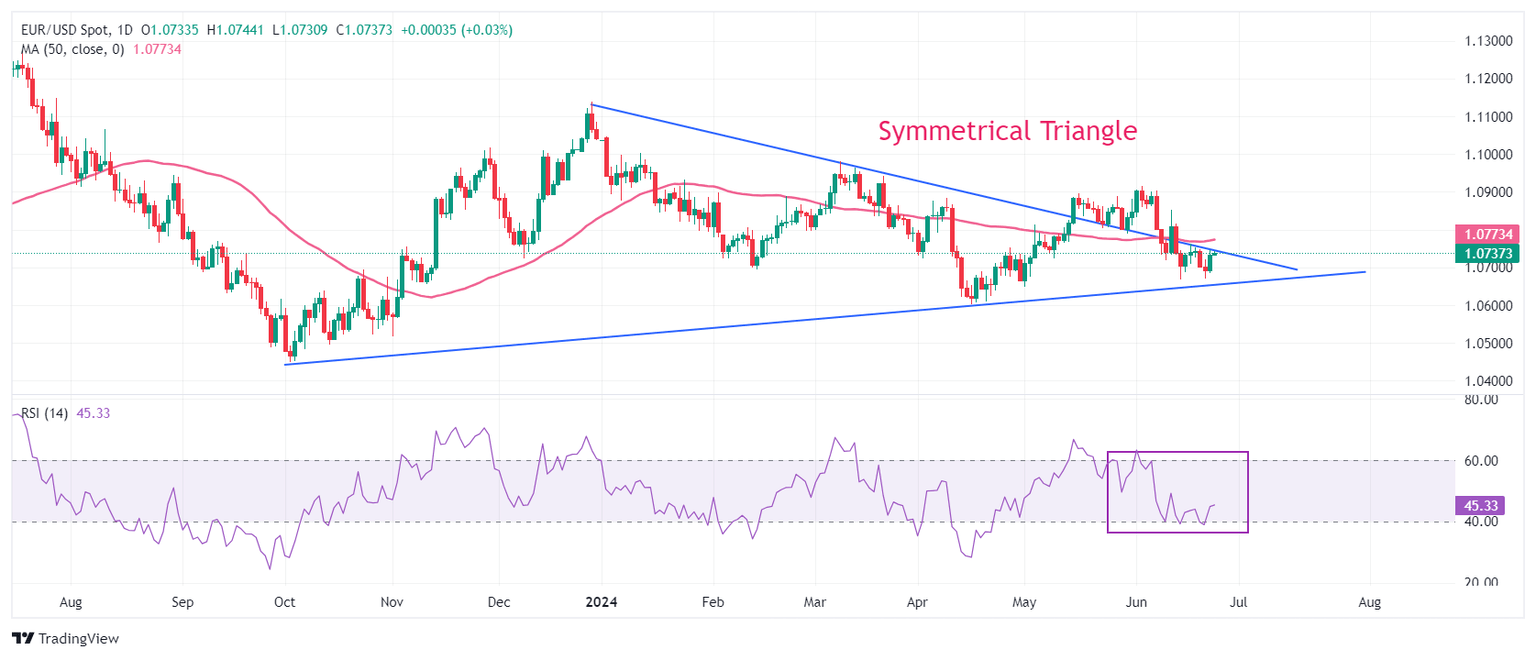

EUR/USD faces pressure near Monday’s high around 1.0740. The major currency pair continues to face selling pressure near the downward-sloping border of the Symmetrical Triangle near 1.0750, which is plotted from 28 December 2023 high around 1.1140. The pair trades below the 50-day Exponential Moving Average (EMA), which indicates that the short-term outlook is bearish.

The 14-day Relative Strength Index (RSI) hovers near 40.00. A bearish momentum would trigger if the oscillator slips below this level.

Economic Indicator

Consumer Price Index ex Food & Energy (YoY)

Inflationary or deflationary tendencies are measured by periodically summing the prices of a basket of representative goods and services and presenting the data as the Consumer Price Index (CPI). CPI data is compiled on a monthly basis and released by the US Department of Labor Statistics. The YoY reading compares the prices of goods in the reference month to the same month a year earlier. The CPI Ex Food & Energy excludes the so-called more volatile food and energy components to give a more accurate measurement of price pressures. Generally speaking, a high reading is bullish for the US Dollar (USD), while a low reading is seen as bearish.

Read more.Next release: Thu Jul 11, 2024 12:30

Frequency: Monthly

Consensus: -

Previous: 3.4%

Source: US Bureau of Labor Statistics

The US Federal Reserve has a dual mandate of maintaining price stability and maximum employment. According to such mandate, inflation should be at around 2% YoY and has become the weakest pillar of the central bank’s directive ever since the world suffered a pandemic, which extends to these days. Price pressures keep rising amid supply-chain issues and bottlenecks, with the Consumer Price Index (CPI) hanging at multi-decade highs. The Fed has already taken measures to tame inflation and is expected to maintain an aggressive stance in the foreseeable future.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.