EUR/USD flirts with daily lows near 1.2110, dollar rebounds

- EUR/USD comes under downside pressure, still above 1.2100.

- Higher US yields sustain the bounce off lows in the dollar.

- German advanced April CPI figures next in the calendar.

After hitting fresh monthly highs around 1.2150 during early trade, EUR/USD saw its gains trimmed and now tumbles to session lows in the 1.2110 region.

EUR/USD recedes from 2-month peaks

The rally in EUR/USD manages to reach fresh tops in the 1.2150 region earlier in the Asian session on Thursday, although the move run out of some steam soon afterwards and in response to the resurgence of the buying interest in the dollar.

In fact, the rebound in yields of the US 10-year benchmark to the 1.65% region lends renewed oxygen to the buck and encourages the US Dollar Index to leave behind fresh lows in the 90.40 zone.

EUR/USD edged higher in early hours in response to another confirmation that the Federal Reserve will keep the mega-accommodative stance for the time being, as per the FOMC gathering and subsequent press conference by Chief Powell on Wednesday.

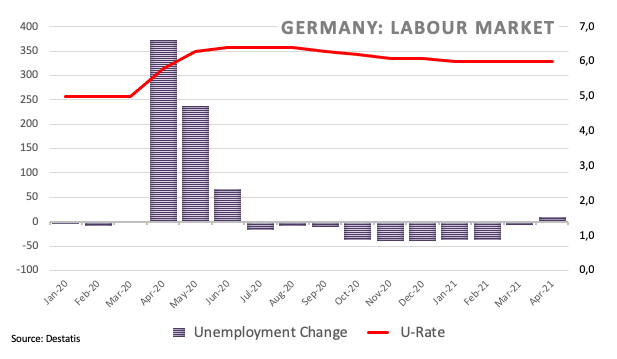

In the euro docket, the German Unemployment Change rose by 9K in April, while the jobless rate stayed unchanged at 6.0%. Later in the session comes in the final Consumer Confidence in the euro area seconded by the preliminary inflation readings in Germany for the current month. Across the pond, the release of advanced Q1 GDP figures takes centre stage followed by usual Initial Claims and Pending Home Sales.

What to look for around EUR

EUR/USD’s upside momentum reached the 1.2150 level before losing some vigour on Thursday, always against the broader backdrop of the persevering selling bias surrounding the greenback, which gained extra pace following the dovish tone from the FOMC event (Wednesday). Also propping up the better mood in the European currency appears the investors’ shift to the improved growth outlook in the Old Continent now that the vaccine campaign appears to have gained some serious pace. In addition, solid results from key fundamentals pari passu with the surging morale in the bloc also collaborate with the monthly recovery in the pair (from the vicinity of 1.1700 to the monthly highs round 1.2150 so far).

Key events in the euro area this week: German flash April CPI (Thursday) – German, EMU advanced Q1 GDP, EMU flash April CPI.

Eminent issues on the back boiler: Asymmetric economic recovery in the region. Sustainability of the pick-up in inflation figures. Progress of the vaccine rollout. Probable political effervescence around the EU Recovery Fund.

EUR/USD levels to watch

So far, spot is losing 0.09% at 1.2114 and a breach of 1.1993 (low Apr.22) would target 1.1933 (200-day SMA) en route to 1.1887 (61.8% Fibo of the November-January rally). On the other hand, the next hurdle emerges at 1.2150 (monthly high Apr.29) followed by 1.2243 (monthly high Feb.25) and finally 1.2349 (2021 high Jan.6).

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.