EUR/USD flattens out near 1.0850 as data looms

- EUR/USD cycled familiar levels on Tuesday as investors await a reason to move.

- Wednesday kicks off key date slated for the back half of the trading week.

- Fedspeak dominates headlines, tempering risk appetite.

EuR/USD stuck closely to familiar levels on a sedate Tuesday market session. Talking points from Federal Reserve (Fed) officials dominated headlines, but provided little new information for investors to digest, keeping risk appetite suppressed and stapling bids close to opening prices.

Forex Today: No progress ahead of FOMC Minutes

Read more: Fed policymakers stick to cautious script after April CPI inflation sparked rate cut hopes

The latest Meeting Minutes from the Federal Reserve (Fed) will be published on Wednesday, and investors will be looking for any signs of a structural shift in the Fed’s internal dialogue regarding rate cuts. Thursday follows up with Purchasing Managers Index (PMI) activity figures from both the EU and the US, and Friday will round out the trading week with US Durable Goods Orders.

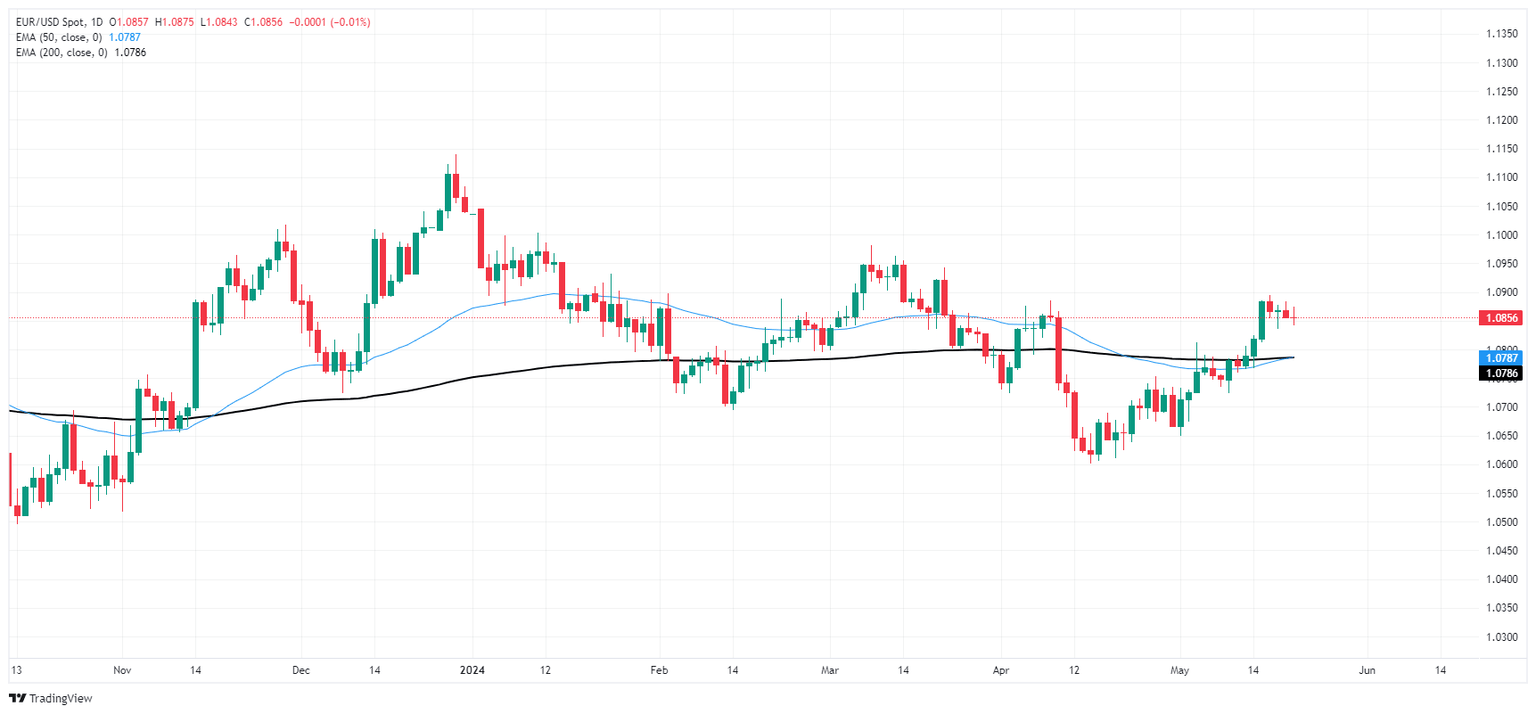

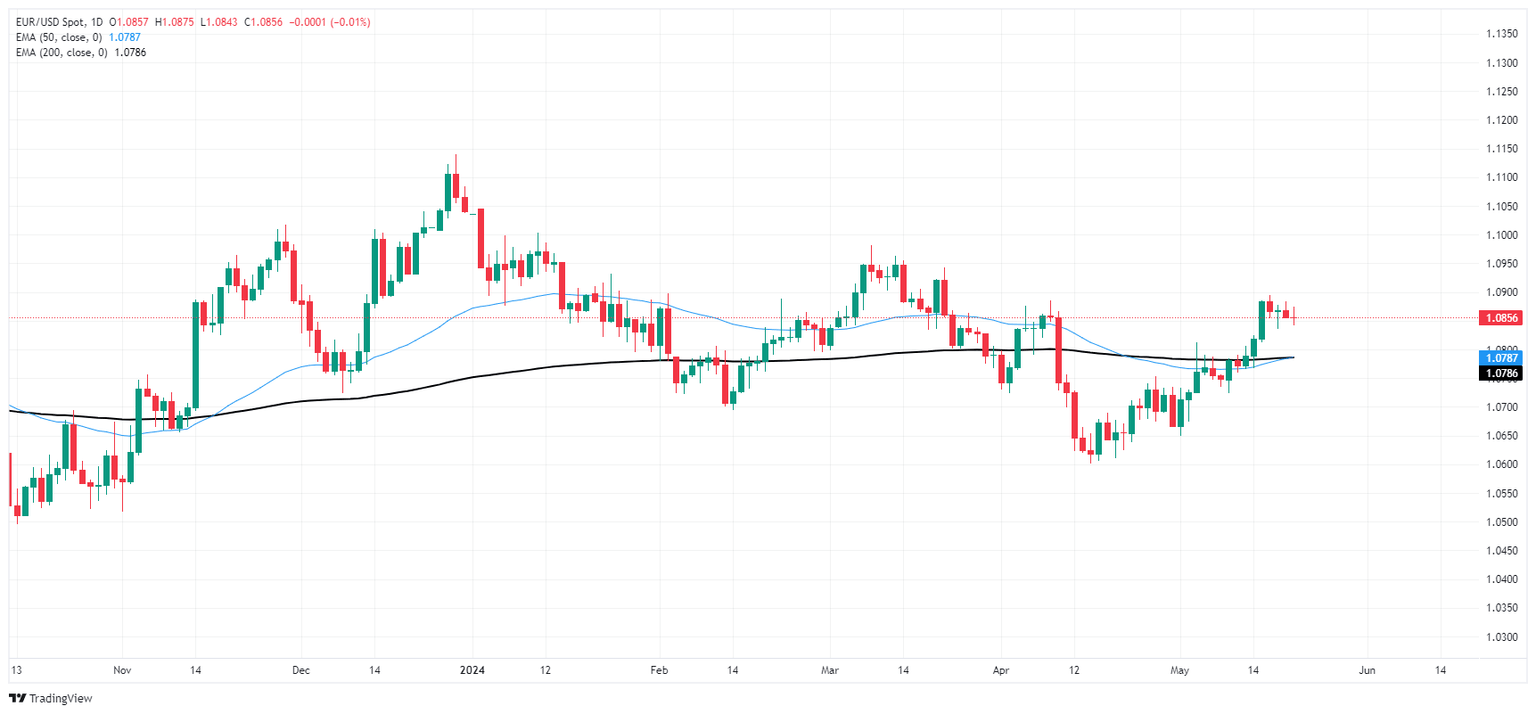

EUR/USD technical outlook

The Euro (EUR) is close to flat against the US Dollar (USD) this week, trading within a fifth of a percent from Monday’s opening bids. EUR/USD is caught on the high side of a near-term upswing, and the pair is under threat of a bearish pullback to the 200-day Exponential Moving Average (EMA) at 1.0786 after failing to break north of the 1.0900 handle.

EUR/USD daily chart

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.