EUR/USD flatlines after Friday’s surge as Fed dovish bets build, Eurozone sentiment sours

- EUR/USD unchanged after 1.52% Friday rally on dismal US jobs data.

- May–June payrolls revised down; BLS chief fired amid credibility concerns.

- Fed cut odds hit 90% for September; 59 bps of easing priced in for 2025.

- Eurozone Sentix Confidence Index dives from 4.5 to -3.7 in August.

The EUR/USD stagnates during Monday’s session, virtually unchanged, after Friday’s rally of over 1.52% following a worse-than-expected Nonfarm Payrolls report, which triggered a ramp-up of expectations for a Federal Reserve rate cut at the September meeting. The pair trades near Friday’s closing price.

The Euro failed to rally, even though some developments pressured the US Dollar. The latest employment report witnessed a revision of the May and June figures, which were sharply revised downward , triggering the firing of the US Bureau of Labor Statistics (BLS) head.

That data, along with a weak ISM Manufacturing PMI reading, triggered a reaction by investors who seem confident that the Fed might ease policy at least by 59 basis points (bps) to support the economy.

Today’s data revealed that Factory Orders in June plummeted as expected, ahead of a light calendar that will feature the announcement of the ISM Services PMI, Jobless Claims, Consumer Sentiment data, and Fed speakers.

Across the pond, the Eurozone Sentix Investor Confidence Index tumbled in August to -3.7, following July’s 4.5, according to the latest survey. The Current Situation sub-component declined in August compared to July. The survey noted that “The tariff agreement is proving to be a real mood killer.”

EU to suspend trade countermeasures on the US for six months as part of the US/EU trade agreement.

The odds for a 25 bps rate cut by the Fed at the September meeting are at 90%, according to Prime Market Terminal data.

Daily digest market movers: EUR/USD remains steady amid economic slowdown fears

- Other developments during the last week witnessed the firing of the BLS head and the resignation of Fed Governor Adriana Kugler, effective on August 8, which opens the door for President Donald Trump to nominate a “dovish” leaning Governor that could be nominated for the Fed’s top job.

- Factory Orders fell sharply by 4.8% MoM in June, matching expectations but marking a steep reversal from May’s 8.2% surge. A slump in commercial aircraft orders largely drove the decline. Broader manufacturing activity remains under pressure, as tariffs continue to elevate input costs and constrain production.

- Also, the ISM Manufacturing PMI contracted last week, resuming its downward trend for the second consecutive month. July Consumer Sentiment rose to 61.7 in July, slightly below the preliminary estimate of 61.8, according to the University of Michigan survey.

- Wall Street extended its losses amidst fears of an economic slowdown in the US. July Nonfarm Payroll figures were expected to be weaker compared to June’s, but the revision of the previous two months drove the EUR/USD higher. May and June figures were revised down by 258K.

- Alongside this, the Institute for Supply Management (ISM) revealed that manufacturing activity contracted. Meanwhile, the University of Michigan (UoM) Consumer Sentiment in June deteriorated, ending a bad day of economic reports for the US economy.

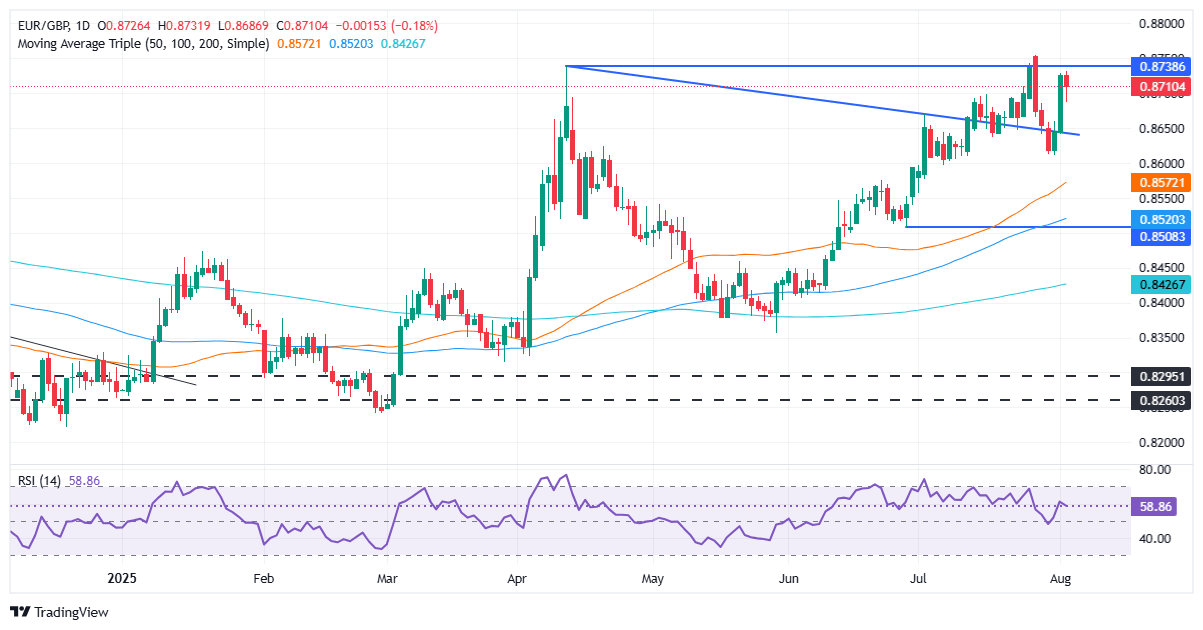

Technical outlook: EUR/USD upside clears above 1.1600, with bulls eyeing 1.1650

The EURUSD remains set to consolidate if buyers fail to clear 1.1600. Momentum remains bearish as depicted by the Relative Strength Index (RSI), but is aimed toward its neutral line, an indication that bulls are stepping in.

A breach of 1.1600 would expose the 20-day Simple Moving Average (SMA) at 1.1630, followed by 1.1650 and the 1.1700 mark. On the flipside, a drop below the 50-day SMA at 1.1576 clears the way to 1.1550, subsequently followed by the 1.1500 figure. The next area of interest would be August’s low of 1.1391.

Euro FAQs

The Euro is the currency for the 19 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day. EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy. The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control. Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency. A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall. Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.