EUR/USD firms as tariffs and Trump's tax bill dominate headlines

- EUR/USD edges higher in thin liquidity session as markets react to Trump's 'Big, Beautiful Bill'.

- The US Dollar erases gains as debt sustainability issues and renewed tariff threats weigh on the Greenback.

- EUR/USD rises as bulls remain eager to retest the psychological resistance level at 1.1800.

The Euro (EUR) is holding modest gains against the US Dollar (USD) in thin trading conditions on Friday. With US markets closed in observance of Independence Day, liquidity is limited.

Fresh headlines surrounding President Trump’s proposed tariffs and US fiscal policy are weighing on the US Dollar, with EUR/USD nearing 1.1780 at the time of writing.

The spotlight remains on the July 9 deadline for new US trade tariffs. This follows President Trump's declaration that letters outlining the requirements for each country to do business with the United States will be sent as early as Friday.

The proposed tariffs, ranging from 10% to 70%, could take effect as soon as August 1, escalating trade tensions between the US and its partners, particularly the European Union (EU).

While the EU agreed earlier this week to a 10% global tariff introduced on 'Liberation Day' in April, concerns remain over aluminium and steel tariffs, currently set at 50%, as well as auto-related imports, which face 25% duties.

The latter is particularly troubling for Germany, the EU’s largest economy, whose export-heavy manufacturing sector is vulnerable to escalating protectionism.

Markets are also assessing the implications of the new spending and tax legislation, which is currently heading to the White House for President Trump to sign into law.

While the 'Big, Beautiful Bill' makes significant cuts to green energy initiatives and Medicaid, it also raises concerns over the health of US fiscal policy. The Congressional Budget Office (CBO) estimates that the bill could increase the national deficit by $3.3 trillion over the next decade, while the debt ceiling is projected to rise by approximately $5 trillion.

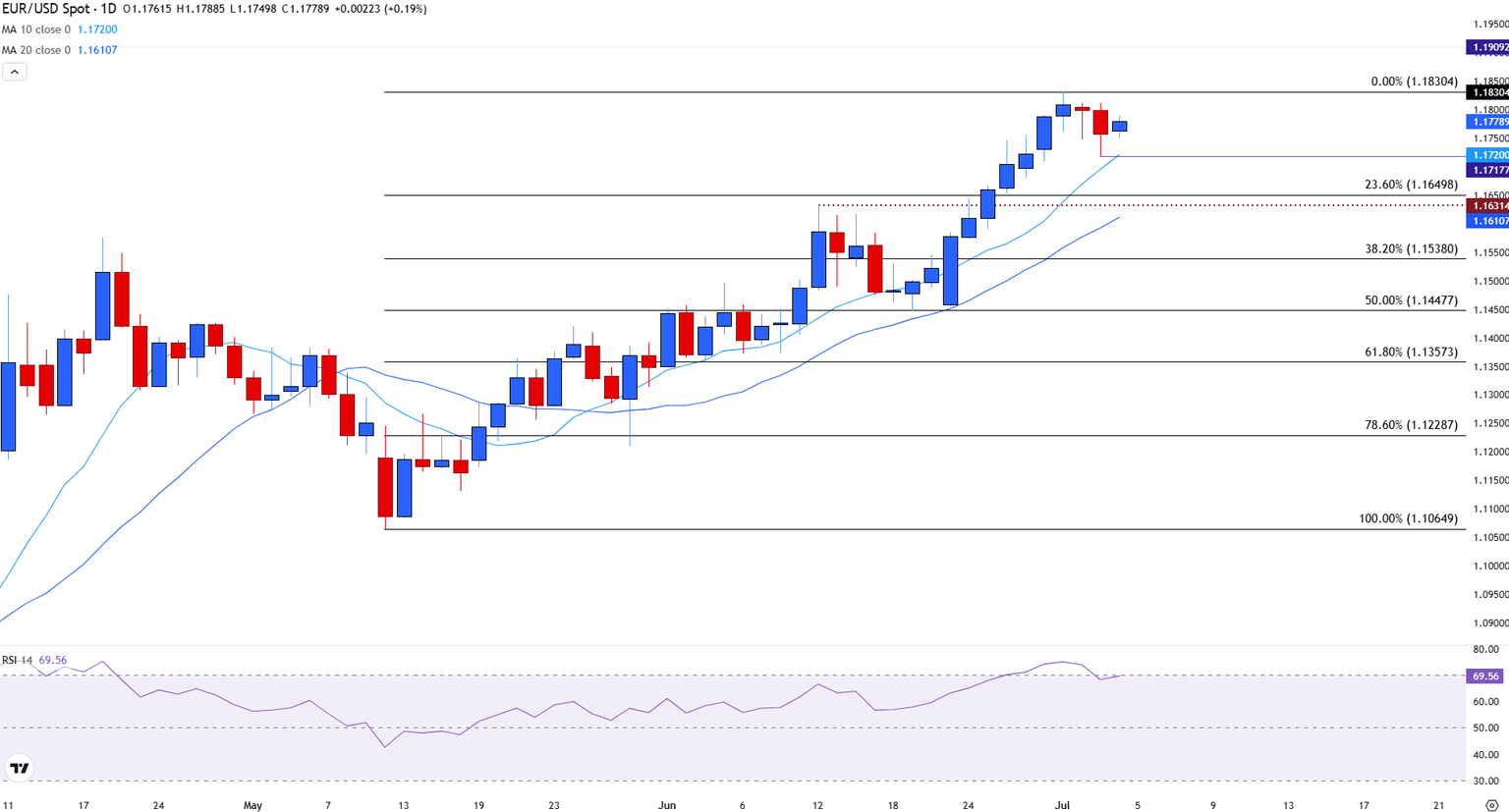

EUR/USD rises toward 1.1800 with the RSI threatening overbought territory

Technically, EUR/USD remains in a firm uptrend, although some signs of consolidation have emerged. The pair is holding above its 10-day Simple Moving Average (SMA) at 1.1720, and comfortably above the 20-day SMA at 1.1610, both of which are providing support for the pair.

Resistance remains at 1.1800, which could open the door for a push toward the recent high of 1.1830. The Relative Strength Index (RSI), just below 70 indicates overbought conditions. This suggests strong upside momentum but also a potential for short-term pullback or sideways movement if fundamentals support the US Dollar.

Tariffs FAQs

Tariffs are customs duties levied on certain merchandise imports or a category of products. Tariffs are designed to help local producers and manufacturers be more competitive in the market by providing a price advantage over similar goods that can be imported. Tariffs are widely used as tools of protectionism, along with trade barriers and import quotas.

Although tariffs and taxes both generate government revenue to fund public goods and services, they have several distinctions. Tariffs are prepaid at the port of entry, while taxes are paid at the time of purchase. Taxes are imposed on individual taxpayers and businesses, while tariffs are paid by importers.

There are two schools of thought among economists regarding the usage of tariffs. While some argue that tariffs are necessary to protect domestic industries and address trade imbalances, others see them as a harmful tool that could potentially drive prices higher over the long term and lead to a damaging trade war by encouraging tit-for-tat tariffs.

During the run-up to the presidential election in November 2024, Donald Trump made it clear that he intends to use tariffs to support the US economy and American producers. In 2024, Mexico, China and Canada accounted for 42% of total US imports. In this period, Mexico stood out as the top exporter with $466.6 billion, according to the US Census Bureau. Hence, Trump wants to focus on these three nations when imposing tariffs. He also plans to use the revenue generated through tariffs to lower personal income taxes.

Author

Tammy Da Costa, CFTe®

FXStreet

Tammy is an economist and market analyst with a deep passion for financial markets, particularly commodities and geopolitics.