EUR/USD falls as ISM Manufacturing PMI improves, boosting USD on Fed tightening speculation

- EUR/USD dips as ISM Manufacturing PMI for April shows improvement but falls short of expansionary territory.

- IMF Chief Downplays de-dollarization concerns amid banking sector vulnerabilities.

- EU Inflation Figures and HCOB Manufacturing PMI to provide insight on the European Central Bank's chances for a 50 or 25 bps rate hike.

The EUR/USD dropped below 1.1000 after the ISM announced that manufacturing activity in April improved. However, it stood in contractionary territory, while a measure of inflation in the same data increased. Therefore, speculations for further tightening by the Federal Reserve (Fed) underpinned the US Dollar (USD). At the time of writing, the EUR/USD is trading at 1.0969 after hitting a high of 1.1035.

EUR/USD losses traction and creeps lower on US data

A risk-on impulse dominates the US equity markets, courtesy of JP Morgan's acquiring the troubled First Republic Bank. However, that's not happening in the FX space, as the EUR/USD fell after the ISM Manufacturing PMI for April improved to 47.1 from 46.3 in the prior's month. While there were improvements in the Orders and Production subcomponents, they fell short of reaching expansionary territory. The Prices Index increased by 4 points to 53.2, which led to speculation that the Federal Reserve might implement tighter monetary policies in the upcoming Wednesday.

Therefore, the EUR/USD retraced, past the daily pivot point and beneath the S1 daily pivot, at 1.0970. It should be said that the greenback underpinned by higher US T-bond yields, its printing losses of 0.46%, up at 102.149.

As of writing, comments from the IMF Managing Director Kristalina Georgieva on Monday said, "De-dollarization isn't on top of my worry list." She added, "There may be more vulnerabilities exposed in the banking sector," and warned that they would see quite a lot of regulatory and disclosure thinking in the wake of the banking crisis.

An absent Eurozone's (EU) economic docket kept EUR/USD traders leaning on the American Dollar (USD) dynamics and market sentiment. On Tuesday, the EU's agenda will feature inflation figures and the HCOB Manufacturing PMI in its final reading. The US economic calendar would feature the JOLTs Job Openings report and Factory Orders ahead of Wednesday's Federal Reserve monetary policy decision.

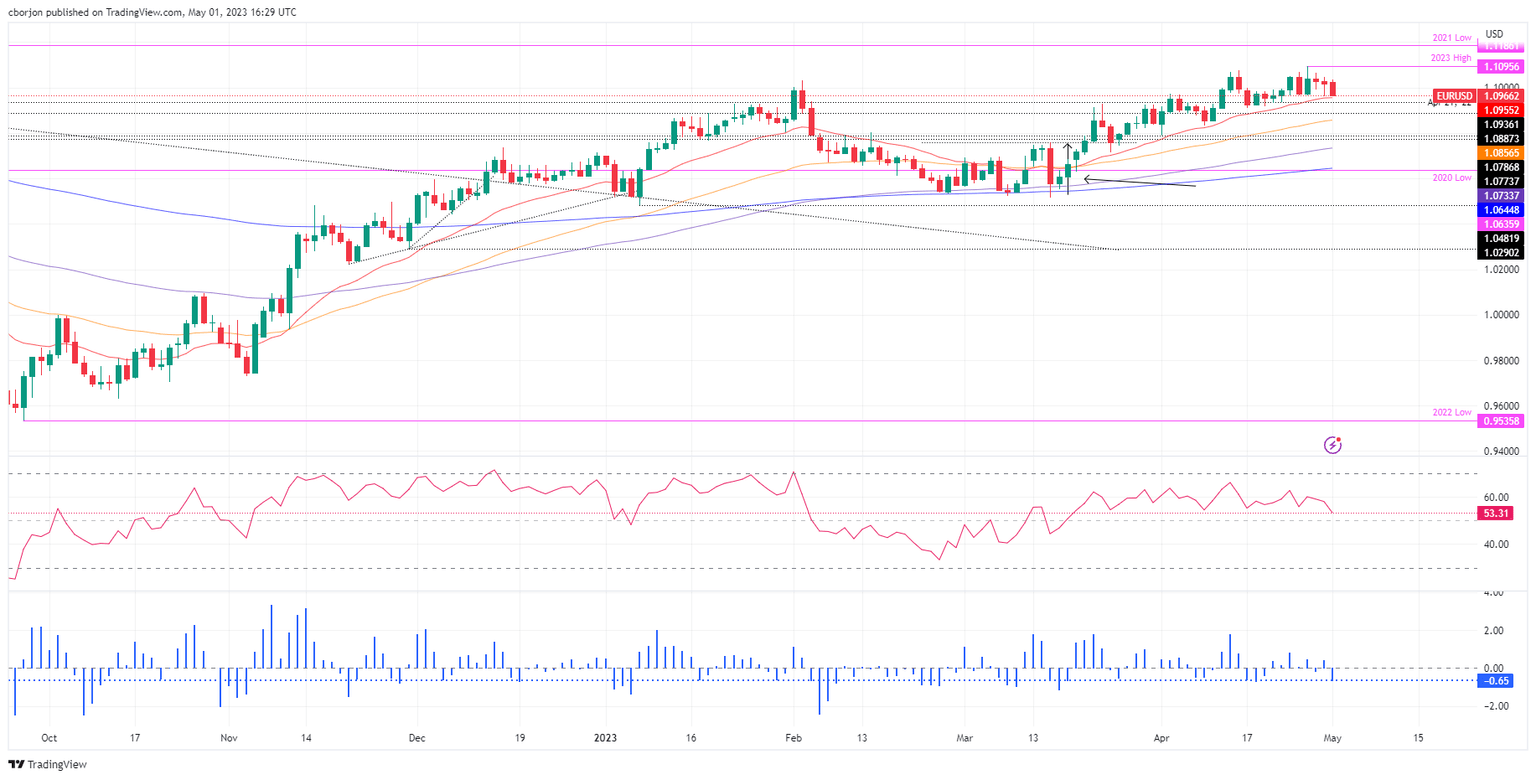

EUR/USD Technical Analysis

From a technical perspective, the EUR/USD is still upward biased but about to test the 20-day EMA at 1.0955. A fall below the latter will expose the 1.0900 figure, followed by the 50-day EMA at 1.0856. Conversely, if EUR/USD buyers reclaim 1.1000, further upside is warranted at around 1.1095.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.