EUR/USD extends selloff to 1.1550 as Dollar strengthens despite weak US data

- EUR/USD drops 0.33% after posting largest daily loss since Dec 2024 on Monday.

- US job openings miss by 200K; Consumer Confidence rises but job market concerns persist.

- Traders await Fed decision, EU inflation, jobs, and growth data to guide next move.

The EUR/USD resumed its downtrend for the second straight day as market participants digest softer-than-expected economic data from the United States (US). This and the trade agreement of the European Union (EU) and the US boosted the Dollar and weighed on the Euro, which posted a loss of more than 1.30% on Monday, the biggest since December 2024. The pair hovers around 1.1550, down 0.33% daily.

Sentiment turned slightly negative on trade news, that the US and China trade talks have not finished, though both countries agreed to extend the trade truce, which needs to be authorized by US President Trump, revealed US Treasury Secretary Scott Bessent.

On the data front, the Job Openings and Labor Turnover Survey (JOLTS) for June showed the labor market is cooling, as vacancies missed the mark by more than 200K, according to the US Bureau of Labor Statistics (BLS). Consumer Confidence for July improved, though the survey showed that people are struggling to find jobs.

Across the pond, the lack of economic data keeps the Euro underperforming, following the US-EU trade deal. Traders await the release of Retail Sales data for Germany, growth figures for Spain, Italy, Germany and the EU. Furthermore, traders await the release of HCOB Manufacturing PMIs for Spain, Italy, Germany, and the bloc, jobs data, and inflation figures in Germany and the EU.

In the meantime, traders' focus is on the Federal Reserve’s upcoming policy release, set to conclude on Wednesday. The central bank is widely expected to leave interest rates unchanged, though attention will be on possible dissenters, especially in light of recent remarks from Fed Governors Christopher Waller and Michelle Bowman in favor of a 25-bps rate cut.

Daily digest market movers: Dollar shrugs off weak jobs data, pushes Euro down

- June JOLTS report showed job openings fell to 7.437 million, down from 7.769 million in May and below the consensus of 7.5 million, according to the BLS. The drop underscores increased business caution in hiring, driven by uncertainty surrounding future tariff policies.

- The data was released ahead of the Federal Reserve’s policy decision and Friday’s Nonfarm Payrolls report, which is expected to show a moderation in hiring, with forecasts pointing to 102K new jobs—down from June’s 147K gain.

- The Conference Board reported that Consumer Confidence improved in July, with the index increasing to 97.2 from 93.0 in June, surpassing market expectations of 95.0.

- The Dollar prolonged its gains as portrayed by the US Dollar Index (DXY), which tracks the buck’s performance against six currencies, is up 0.24% at 98.89.

- This week, further US economic data is awaited. The release of the Fed’s preferred inflation gauge, the Core PCE Price Index for June, along with jobs and growth data, and the ISM Manufacturing PMI, is expected to provide insight into the current state of the economy.

- The European Central Bank (ECB) Consumer Expectations Survey for June showed that households expect inflation at 2.6%, down from 2.8% for 1-year, at 2.8% unchanged for 3-years, and 2.1% as the May print for a 5-year period.

- Regarding the ECB’s monetary policy, Deutsche Bank does not expect further cuts and hints that the next move would be a hike by the end of 2026.

- US President Trump said the US is going to impose a tariff on the rest of the world, and that's what they will have to pay, while he would love to see China open up its country. Furthermore, Trump said the world tariff would be somewhere between 15% and 20%.

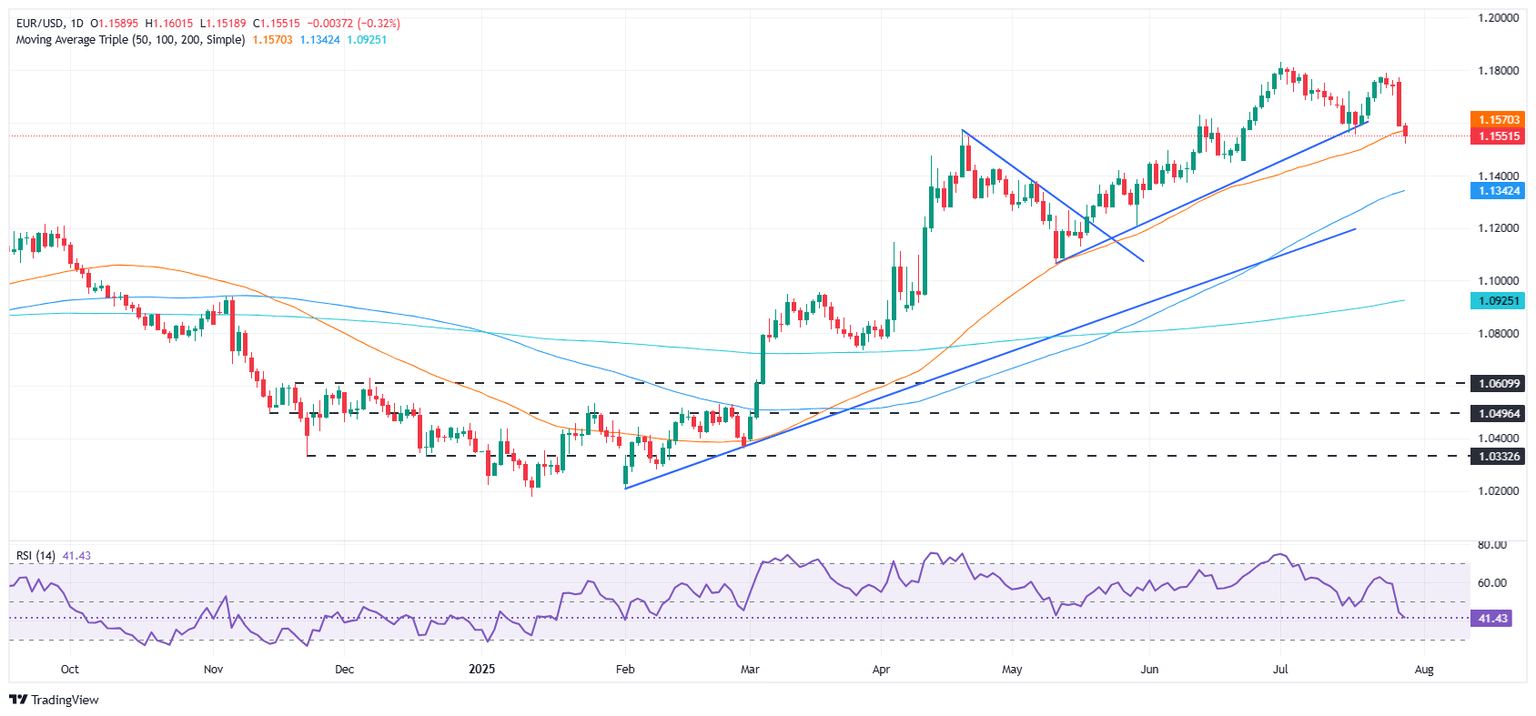

Technical outlook: EUR/USD downtrend intact, tumbles beneath 1.1600

EUR/USD dropped below the 50-day Simple Moving Average (SMA) of 1.1574, after clearing the 20-day Simple Moving Average (SMA) at 1.1678 and the 1.1600 figure, on Monday. The Relative Strength Index (RSI) turned bearish, suggesting that further downside on the pair is seen.

If EUR/USD tumbles below the 50-day SMA of 1.1550, traders would target 1.1500. If surpassed, the next stop would be 1.1400. Conversely, if the pair climbs above 1.1600, the 20-day SMA would be up for grabs at 1.1678.

Euro FAQs

The Euro is the currency for the 19 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day. EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy. The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control. Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency. A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall. Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.