EUR/USD defends channel support above 1.0600 amid renewed US Dollar selling

- EUR/USD is bouncing from near 1.0600 amid a fresh spurt of US Dollar selling.

- Investors cheer a ‘Santa rally’ while EUR/USD also cheers falling Treasury yields.

- EUR/USD defends the rising channel support at 1.0620, but for how long?

EUR/USD is attempting a rebound toward 1.0650 in Thursday’s Asian trading. The US Dollar comes under renewed selling pressure amid a risk-on market profile, as investors finally see a ‘Santa rally’ coming through. The upbeat market mood is also doing little to keep the sentiment around the US Treasury bond yields buoyed. Negative Treasury yields are also aiding the bounce in the EUR/USD pair. The benchmark 10-year US rates are down roughly 1% on the day at 3.65%, as of writing.

On the EUR side of the story, encouraging Germany’s IFO Business Climate Index climbed to 88.6 in December versus the previous reading of 86.3 and the forecast of 87.2. The institute also offered a positive outlook for the country’s employment sector for early 2023. The improving economic situation in Europe’s no.1 economy, Germany, underpins the EUR/USD recovery. The hawkish European Central Bank (ECB) policy outlook also keeps the Euro bulls hopeful.

The focus now shifts toward the US Q3 GDP revision, weekly Jobless Claims and other minority reports, especially after US consumer confidence rose to an eight-month high in December, as the inflation expectations fell to 6.7%.

EUR/USD: Technical outlook

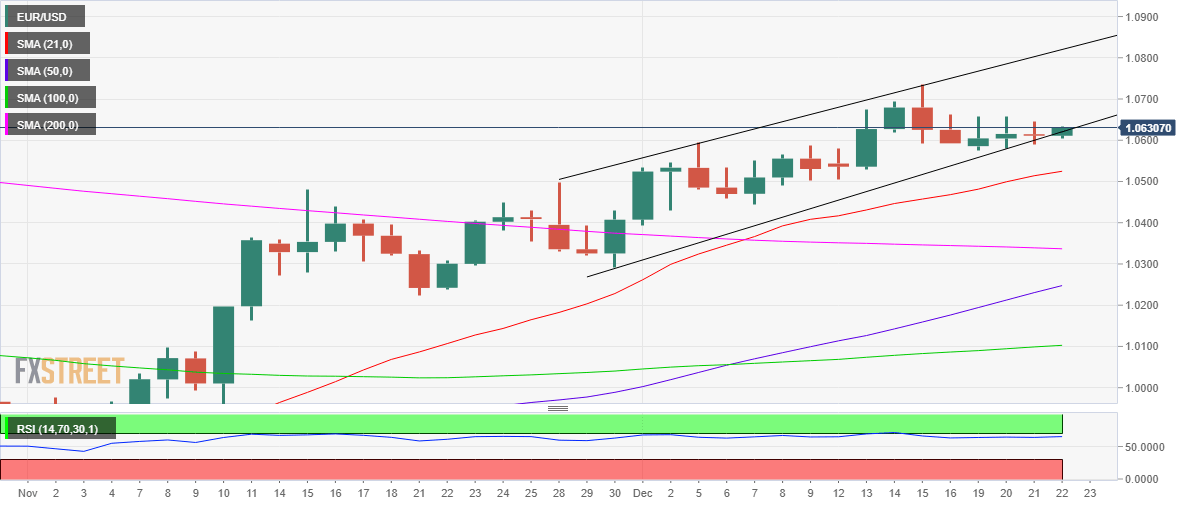

Having traversed within a rising channel formation since November 30, EUR bulls reversed from the channel resistance at 1.0736 last week.

The pair has been consolidating near the lower boundary of the channel so far this week, having bounced off that support at 1.0620 in early Asia on Thursday.

The 14-day Relative Strength Index (RSI) stays flat while above the 50.00 level, suggesting that the rebound could have legs going forward.

The next stop for bulls is seen at the weekly high at 1.0658, above which the 1.0700 threshold could come into play.

On the other side, if EUR/USD closes the day below the abovementioned rising trendline (channel) support, then it would confirm a downside break from the channel.

A fresh downswing toward the upward-sloping 21-Daily Moving Average (DMA) at 1.0524 cannot be ruled out. Although the 1.0600 round level could offer some temporary respite to the EUR/USD buyers.

EUR/USD: Daily chart

EUR/USD: Additional technical levels to watch

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.