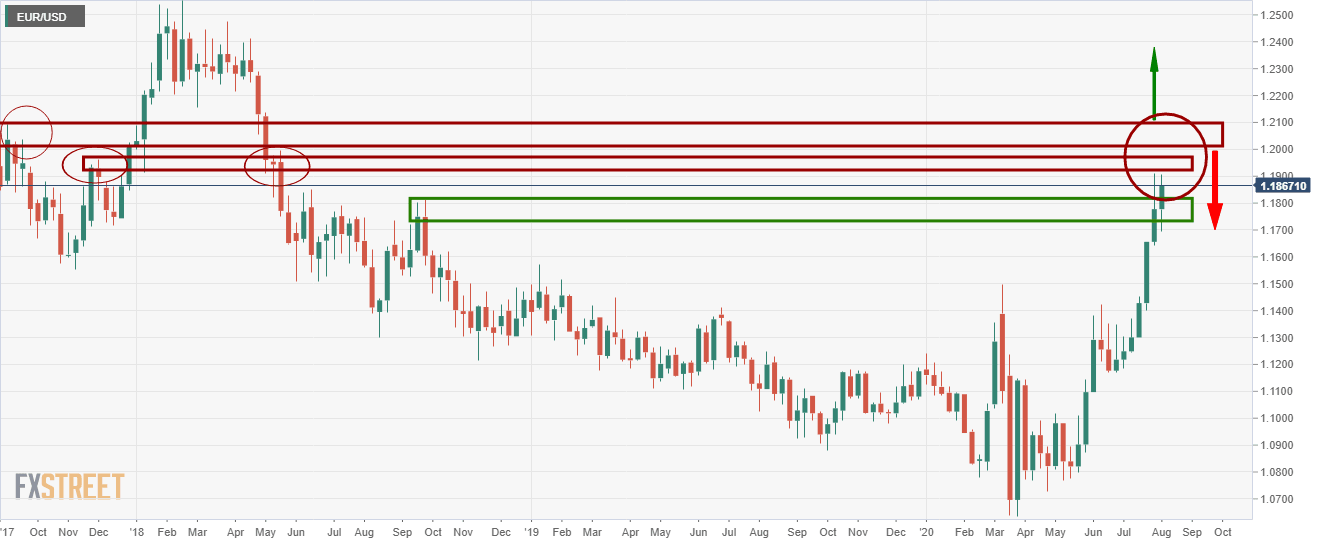

EUR/USD bulls shying away from weekly resistance, eyes on support structure

- EUR/USD bulls are backing up as the weekly resistance ahead is thwart with supply.

- A bullish case for the dollar longer-term could come into effect, but only once equities fumble the ball.

EUR/USD is trading at 1.1874 at the time of writing, pulling back from the highs of 1.1904 but still up some 0.5% as the greenback remains in strong supply.

There are a few deeply concerning issues for the US economy and dollar for which investors are alarmed for.

However, the overall picture is rather counterintuitive, for higher inflation expectations are being priced into the market, despite that US on a collision course for deflation.

We are in what are typically slower markets for the time of year, but that has not prevented Wall street to score fresh recovery highs, nor for the greenback to fall to fresh weekly lows.

Weaker USD trend remains in place

The collapse of real yields has seen gold, equities and the EUR run higher, undermining the USD as the twin deficit surges.

While some expect a V-shaped recovery from pent up demand, what if there is no stopping the virus without a vaccine?

Last week’s GDP number, we know from last weel's Gross Domestic Produce number that US economic output plunged 10.6% through the first half of the year.

The collapse in GDP was the worst downturn since the end of the Second World War.

Meanwhile, renewed shutdowns will take their toll on confidence and jobs. We have seen the Census Bureau publish the data from its new Household Pulse survey, which suggests that after 5.5 million job gains from mid-May to mid-June there were 6.75mn jobs lost between mid-June and mid-July.

Meanwhile, there are still many miles between the Democrats and Republicans on the talks for another fiscal stimulus. The Republicans' proposed $1 trillion stimulus and the Democrats' a $3.5 trillion plan.

The US$600 a week unemployment benefit-boost given to 30 million or so claimants ended last week and that is going to hurt and the second phase of the recovery will be much more challenging.

However, the US dollar will likely prevail in the long run considering that a vaccine is still elusive. The timing and efficiency are still unknown.

Any hopes of an antidote coming to the rescue in the near future are surely unfounded which could translate into heavy global equities and deflationary pressures, for which neither gold is a hedge nor the US dollar cannot thrive.

EUR/USD and DXY levels

The weekly chart above is showing from very strong supply areas that bulls are now seeking to challenge. However, the bullish case cannot be argued while bulls hold above the weekly structure that has now been broken but is subject to be retested:

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.

-637322478263417131.png&w=1536&q=95)