EUR/USD bounces off 1.18, remains pressured amid risk-off mood

- EUR/USD has been able to deflect some dollar strength and stabilize above 1.18.

- Fed Chair Powell's second day of testimony is marked by uncertainty.

- The risk-off mood and bearish technicals imply pressures are set to persist.

Down but not out – EUR/USD has bottomed out at 1.1803, evading the psychologically significant 1.18 level and moving up. Nevertheless, the world's most popular currency pair is still down on the day.

The US dollar is benefiting from a message of uncertainty coming from Federal Reserve Chair Jerome Powell. Testifying before a Senate committee, the Fed Chair said the inflation situation is unique and he also expressed uncertainty about the current low participation rates. Around three million Americans have left the workforce.

Earlier, US jobless claims missed estimates with 360K and industrial output rose by only 0.4% in June, also worse than projected. The safe-haven dollar seemed to benefit from weaker data, but that effect is fading out.

Investors are eyeing headlines related to infrastructure spending, and it is still unclear if Democrats can muster a majority to pass their proposed $3.5 trillion spending bill. Republicans have clarified they oppose it.

Concerns about the spread of the Delta covid variant persist in Europe, with the Netherlands, Spain and Portugal standing out with sharp increases in infections. These developments have somewhat weighed on the euro.

Overall, the downbeat market mood is boosting the greenback and weighing on the currency pair.

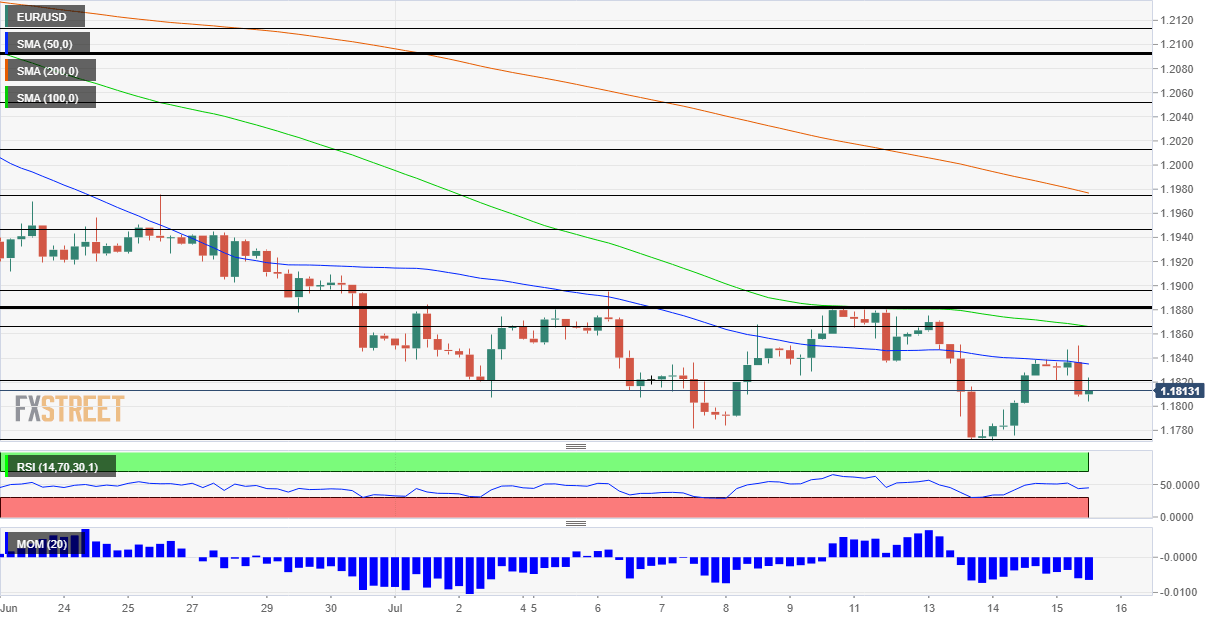

EUR/USD Technical Analysis

Euro/dollar is suffering from downside momentum on the four-hour chart and has dropped below the 50 Simple Moving Average.

Some support awaits at the daily low of 1.803 mentioned earlier. It is followed by 1.1775, which is the multi-month low. Further down, 1.1740 and 1.17 are eyed.

Looking up, some resistance is at the daily high of 1.1850, followed by 1.1865 and 1.1880, which was a stubborn cap last week.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.