EUR/USD bounces as market pressures abate

- EUR/USD gained 0.8% on Tuesday as trade wars turn hypothetical.

- President Trump’s tariff bluffs have been called by the markets after several delays.

- European economic data remains thin this week.

EUR/USD lurched higher by eight-tenths of one percent on Tuesday, regaining lost ground but failing to recapture the 1.0400 handle. Fiber has snapped a six-day losing streak, but overall bullish momentum remains thin with the Euro at the mercy of overall market flows and looming US Nonfarm Payrolls (NFP) figures.

EUR/USD’s early-week plunge toward 1.0200 sparked by impending tariffs from US President Donald Trump has firmly recovered ground after the Trump administration took any excuse it could find to avert its self-imposed threats to tax its own citizens for importing goods from other countries. Threats of a flat 10% import tax on European-produced goods are still on the cards, but last-minute pivots into concessions on nearly all of President Trump’s targeted countries, except for China, has left investors confident that the posturing is simply that and nothing more. 10% import fees on goods from China are still on the table, but President Trump also failed to follow through on his threat to arbitrarily double tariffs on any countries that retaliate.

To his credit, China’s retaliatory tariffs of 10% on US-made goods is a largely theatrical gesture; very few US-made goods make it overseas to Chinese markets, and the move is mostly symbolic. Investors are now tuning out most of President Trump’s trade rhetoric as the US administration fumbles its own setup, and future tariff threats are likely to have muted impacts as future concessions get priced in ahead of time.

The US ADP Employment Change data is set to be released on Wednesday; however, this erratic figure is not expected to generate significant movement. Additionally, the US ISM Services Purchasing Managers Index (PMI) report for January is anticipated, with projections indicating a rise from 54.1 to 54.3. The most critical US data point this week will be Friday’s Nonfarm Payrolls, which is predicted to decline from 256K to 170K.

EUR/USD price forecast

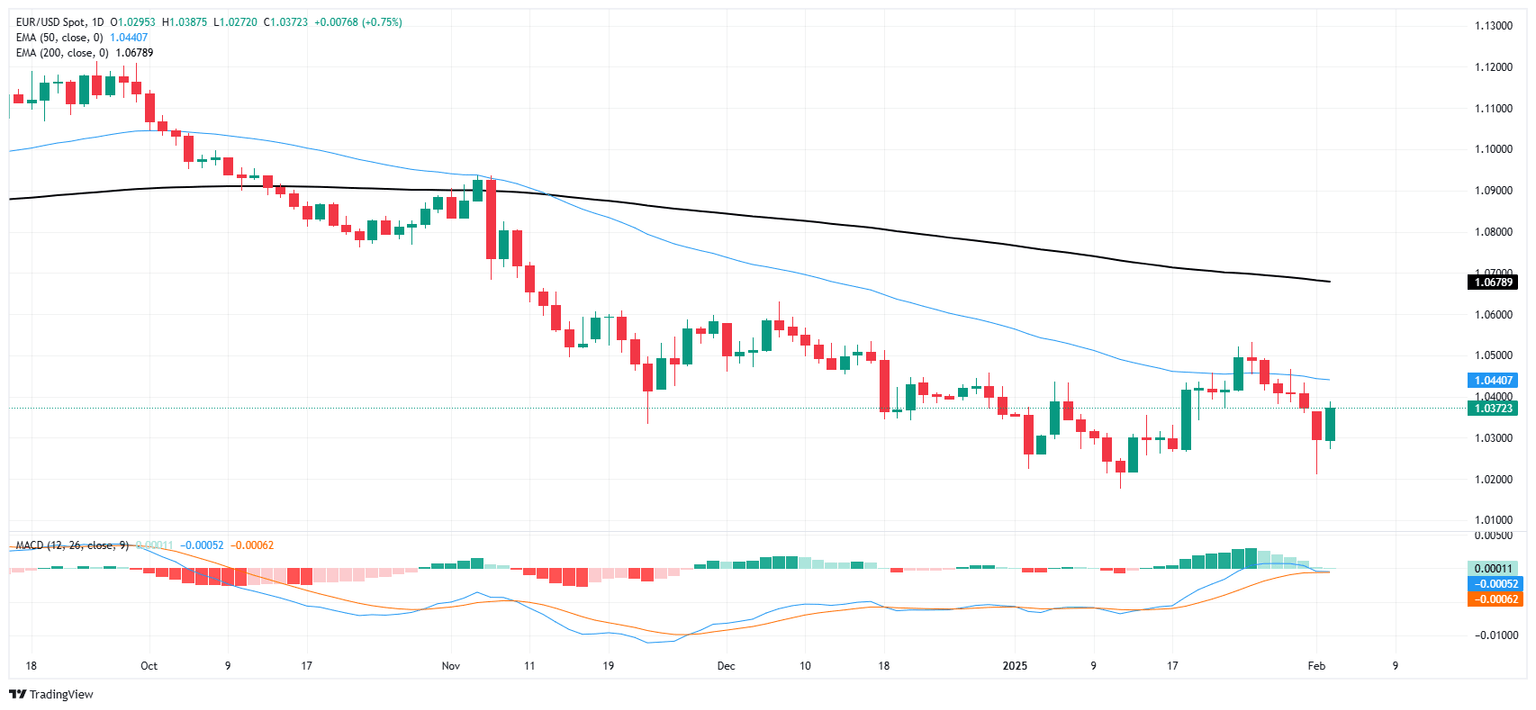

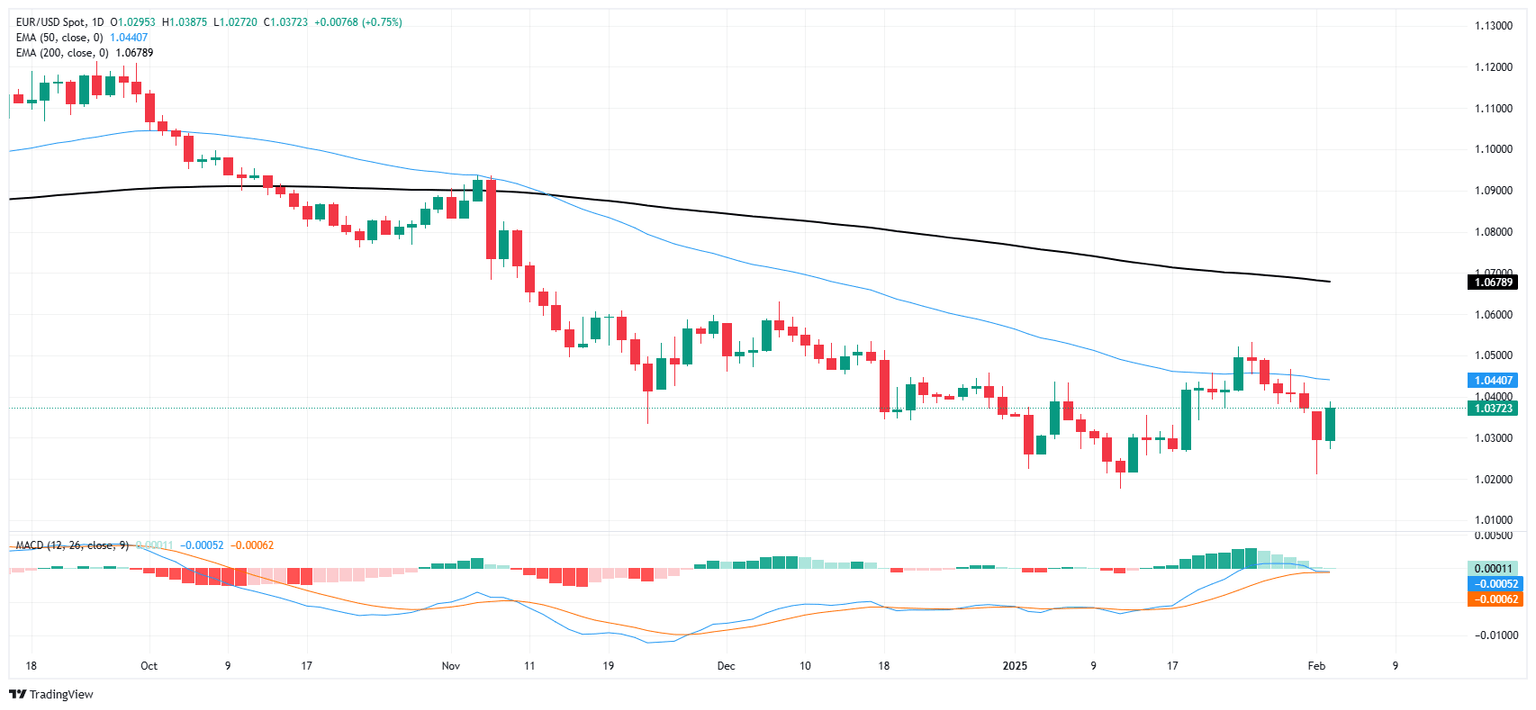

EUR/USD found enough juice to halt a six-day backslide, but the pair still remains on the wrong side of the 1.0400 handle and the 50-day Exponential Moving Average (EMA) at 1.0440. Bullish momentum has waned out of technical oscillators, and Fiber price action is set for a sideways grind between 1.0500 and 1.0300.

EUR/USD daily chart

Euro FAQs

The Euro is the currency for the 19 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day. EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy. The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control. Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency. A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall. Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.