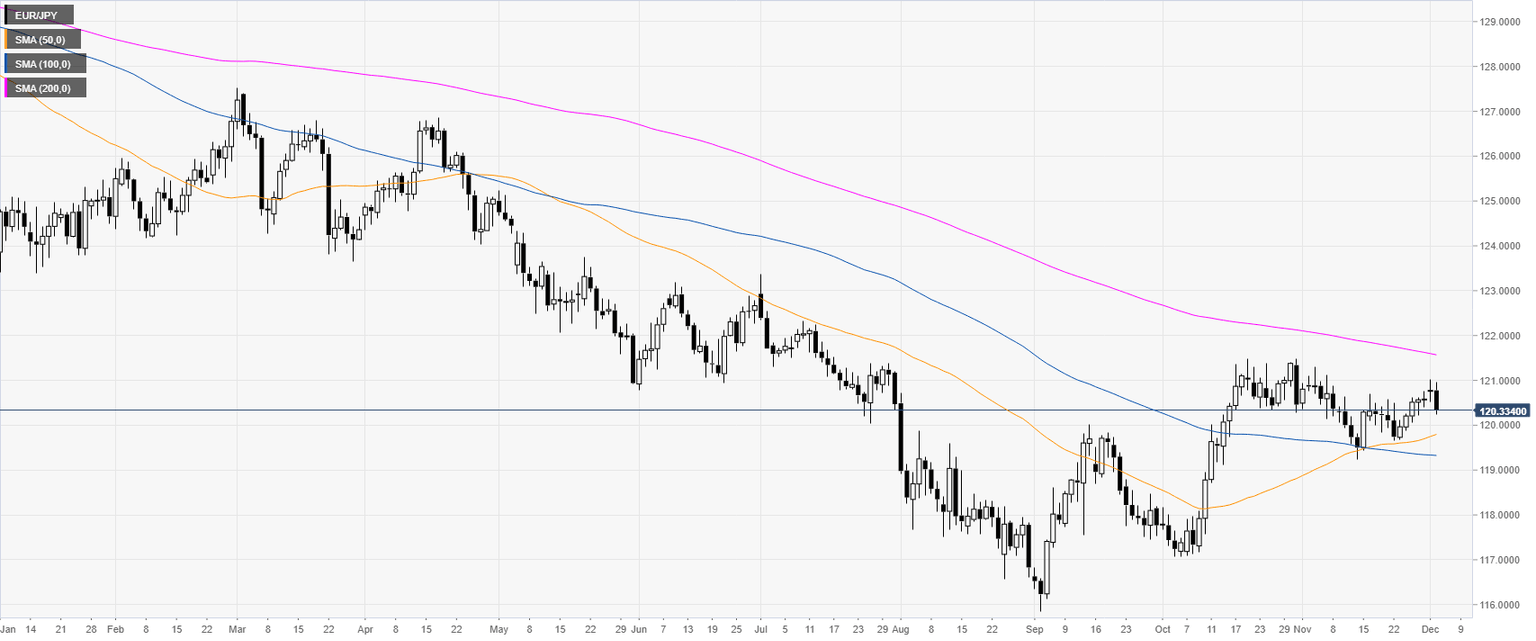

EUR/JPY Technical Analysis: The top is confirmed below the 121.00 handle

- EUR/JPY rejected the 121.00 handle as the yen is gaining strength.

- The level to beat for sellers is the 120.30 support.

EUR/JPY daily chart

EUR/JPY four-hour chart

EUR/JPY 30-minute chart

Additional key levels

Author

Flavio Tosti

Independent Analyst