EUR/JPY Price Prediction: Unspooling a consolidation phase within a bull trend, gap risk

- EUR/JPY is unfurling a consolidation phase within an uptrend. Eventually it is expected to break higher.

- An open gap just below price presents a short-term bearish risk, however, and a deeper pullback might evolve first.

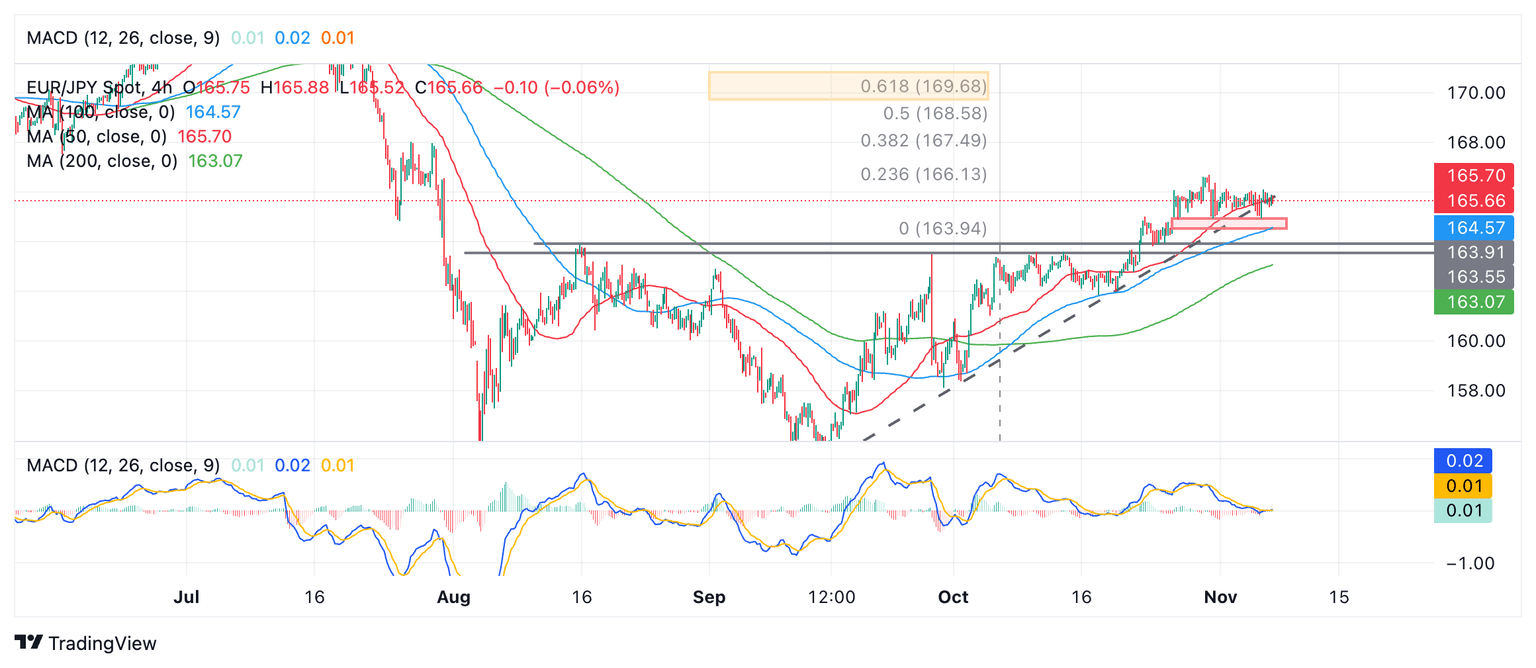

EUR/JPY is still unwinding a consolidation phase within a short and medium-term uptrend. Given the technical analysis maxim that “the trend is your friend”, however, the odds still favor an eventual continuation higher once this phase ends.

EUR/JPY 4-hour Chart

A break above 166.69 (October 31 high) would probably confirm such a continuation higher. Resistance at 167.96 (July 30 swing high) could provide an initial target and act as a barrier to further upside.

The minimum target for the breakout from the range, however, lies higher, at 169.68, the 61.8% Fibonacci extrapolation of the height of the range to the upside.

That said, there is a risk of a deeper pullback first due to the open gap, which lies just below the price between 164.90 and 164.45 (red-shaded rectangle on the chart). Gaps have a tendency to be filled, according to technical analysis theory. If so, EUR/JPY may weaken initially and fall to the bottom of the open gap at 164.45, before perhaps recovering and resuming its dominant uptrend.

The Moving Average Convergence Divergence (MACD) momentum indicator has been falling during the unwinding of the consolidation phase and this decline in momentum without a corresponding fall in price is a sign of underlying weakness. It is another mild indication of the risk of possible near-term weakness materializing.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.