EUR/JPY Price Prediction: Pulls back from range highs as momentum diverges

- EUR/JPY is correcting lower after another test of the top of its ten-week range.

- The pair could begin falling within the range if it passes various confirmation levels.

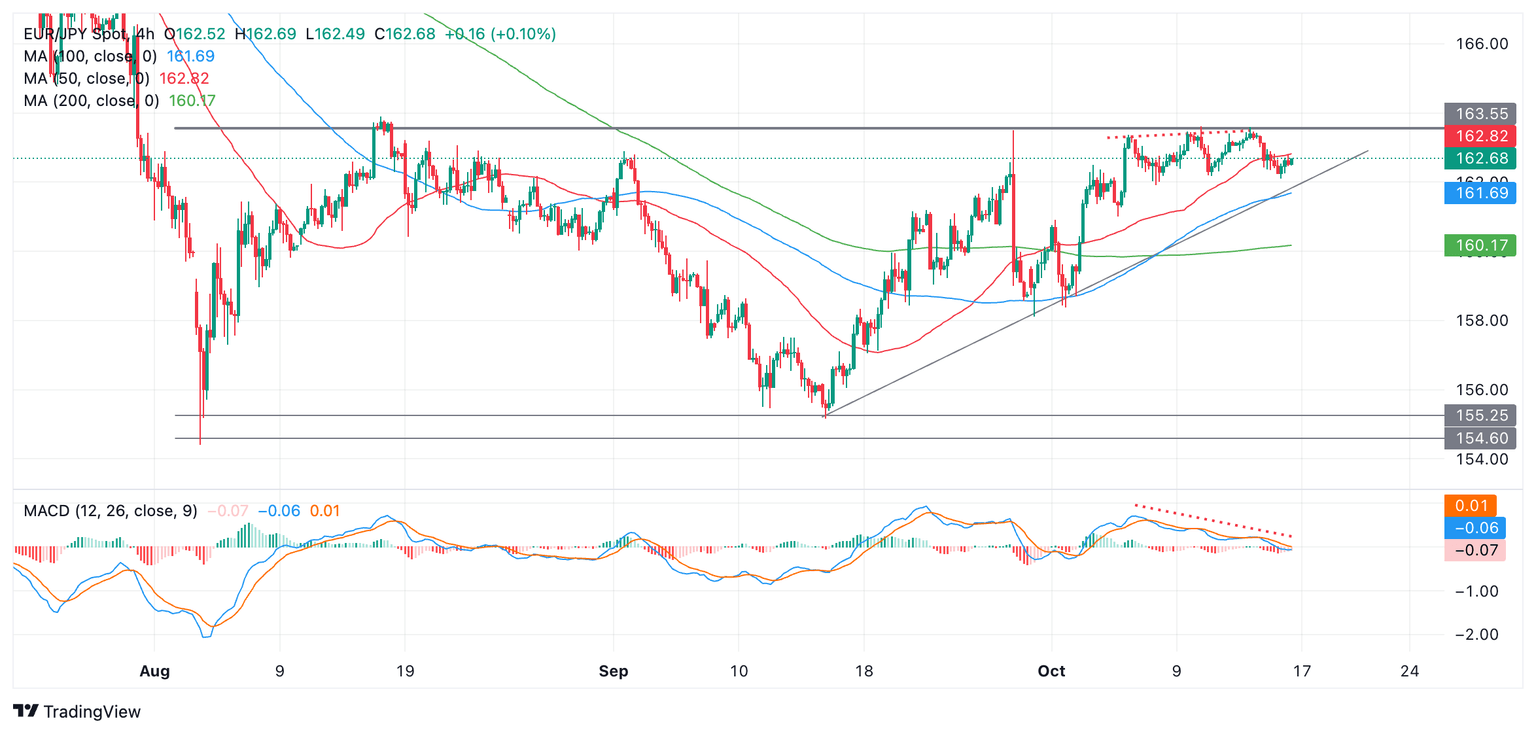

EUR/JPY pulls back after testing the top of its ten-week range. The pair is in a sideways trend with the odds favoring a continuation in line with technical analysis trend theory.

EUR/JPY 4-hour Chart

EUR/JPY’s next move will probably be down, therefore, towards the range floor in the 154s.

A break below 161.91 (October 8 low) would help confirm such a move, and a breach of the trendline for the up leg at around 161.80 (black line on chart) would provide stronger confirmation. The next downside target lies at about 158.32 – the October 1 as well as September 30 lows.

The Moving Average Convergence Divergence (MACD) momentum indicator is diverging bearishly with price (red dotted lines on chart). Whilst price has been making slightly higher highs with each breakout attempt, MACD has been declining. This is a further warning sign of losses to come.

Alternatively, it is possible that EUR/JPY breaks out above the range. Such a break would need to be decisive to inspire confidence. A decisive move would be one characterized by a longer-than-average green candlestick which cleared the range high and closed near its high, or three green candles in a row breaking above the top of the range.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.