EUR/JPY Price Forecast: Euro trades above 170.00 near yearly highs

- EUR/JPY slips slightly but remains above 170.00, near its highest level since July 2024.

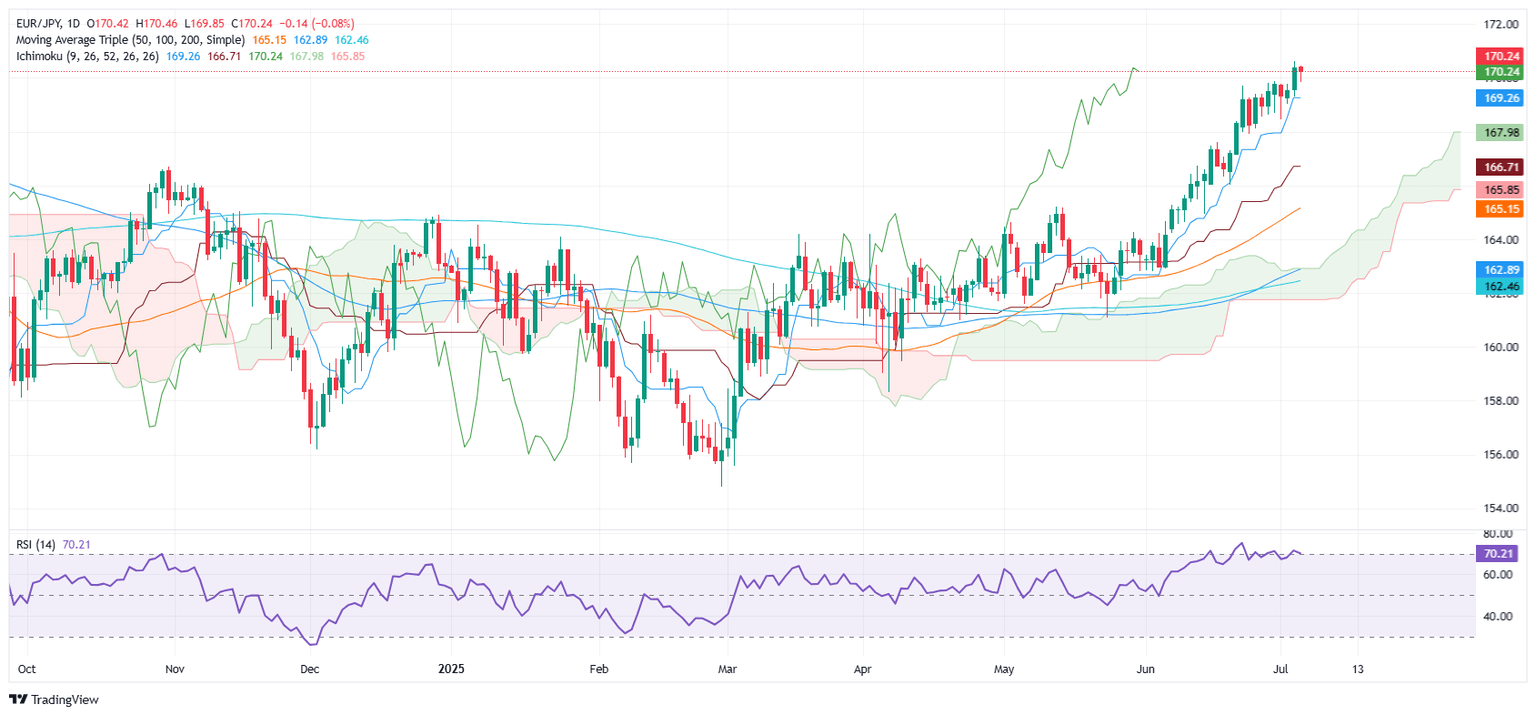

- Bullish trend intact above Ichimoku Cloud, RSI nears overbought zone.

- A break above 171.09 would open the path to the psychological resistance at 172.00.

- A drop below 170.00 could trigger a pullback toward 169.25 or the July swing low at 168.45.

EUR/JPY slips slightly on Friday but remains close to the year-to-date high of 170.61 reached on Thursday. At the time of writing, the cross is trading at 170.19, down 0.11% in the day, amid a risk-off environment as US equity futures tumble amid thin volume trading, with US markets closed for Independence Day.

EUR/JPY Price Forecast: Technical outlook

The upside path is intact, after the Japanese Yen rallied during the first two months of the second half of 2024, sending the EUR/JPY from around 175.42 to 154.39. Since then, the pair enjoyed a recovery, paving the way for higher prices to be tested.

Momentum, although slightly overbought as depicted by the Relative Strength Index (RSI), is bullish. It is worth noting that the EUR/JPY pair has been climbing steadily, after crossing above the Ichimoku Cloud (Kumo) on March 12.

The first key resistance would be the July 23, 2024, daily high at 171.09. A breach of the latter would expose July 19, 2024, high at 171.87, before testing the 172.00 mark. Conversely, if EUR/JPY drops below 170.00, a move towards the Tenkan-sen at 169.25 is likely. Further downside is seen at 168.45, the July 1 swing low.

EUR/JPY Price Chart – Daily

(This story was corrected on July 4 at 16:29 GMT to clarify in the headline, the first bullet point and the first paragraph that the pair didn't reach a year-to-date high on Friday)

Euro PRICE This week

The table below shows the percentage change of Euro (EUR) against listed major currencies this week. Euro was the strongest against the British Pound.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.40% | 0.49% | 0.13% | -0.60% | -0.17% | 0.02% | -0.64% | |

| EUR | 0.40% | 0.86% | 0.53% | -0.21% | 0.20% | 0.43% | -0.25% | |

| GBP | -0.49% | -0.86% | -0.49% | -1.05% | -0.66% | -0.43% | -1.10% | |

| JPY | -0.13% | -0.53% | 0.49% | -0.74% | -0.25% | -0.07% | -0.72% | |

| CAD | 0.60% | 0.21% | 1.05% | 0.74% | 0.38% | 0.63% | -0.04% | |

| AUD | 0.17% | -0.20% | 0.66% | 0.25% | -0.38% | 0.21% | -0.44% | |

| NZD | -0.02% | -0.43% | 0.43% | 0.07% | -0.63% | -0.21% | -0.66% | |

| CHF | 0.64% | 0.25% | 1.10% | 0.72% | 0.04% | 0.44% | 0.66% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.