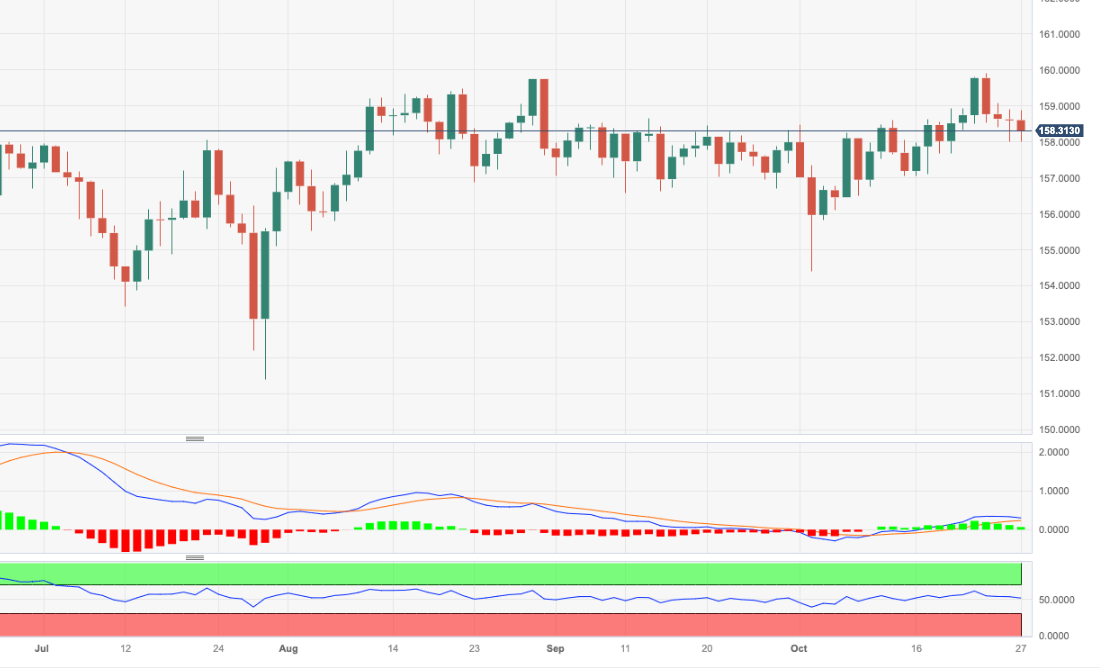

EUR/JPY Price Analysis: The 55-day SMA holds the downside so far

- EUR/JPY resumes the downside and revisits the 158.00 zone.

- So far, the 55-day SMA around 158.00 acts as a decent contention.

EUR/JPY fades Thursday’s small uptick and re-shifts its attention to the downside on Friday.

Following the ongoing price action, the cross could have now entered a consolidative phase. Against that, the breakout of this theme could encourage the index to challenge the 2023 top at 159.91 (October 24) closely followed by the round level at 160.00.

So far, the longer term positive outlook for the cross appears favoured while above the 200-day SMA, today at 151.18.

EUR/JPY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.