EUR/JPY Price Analysis: Technical correction has further legs to go

- EUR/JPY adds to Friday’s pullback around 156.40.

- Further upside could target the weekly top past 163.00.

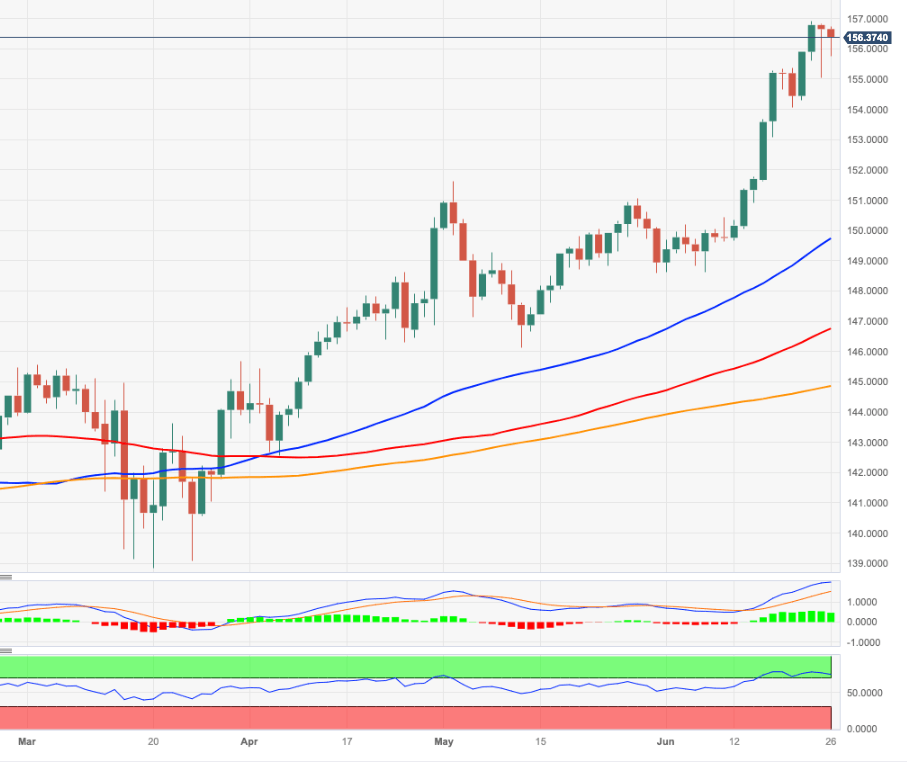

EUR/JPY faces some renewed downside pressure and retreats from recent multi-year peaks in levels just shy of the 157.00 barrier.

In the meantime, further gains appear on the cards, while a clear breakout of the 2023 high at 156.93 (June 22) should meet the next relevant hurdle not before the weekly high of 163.09 (August 22 2008).

The ongoing overbought conditions of the cross, however, are indicative that a deeper knee-jerk should not be ruled out at some point in the short-term horizon.

So far, further upside looks favoured while the cross trades above the 200-day SMA, today at 144.82.

EUR/JPY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.