EUR/JPY Price Analysis: Some consolidation likely near-term

- EUR/JPY extends the rangebound theme following tops near 133.50.

- Immediately to the upside comes in the 2021 highs.

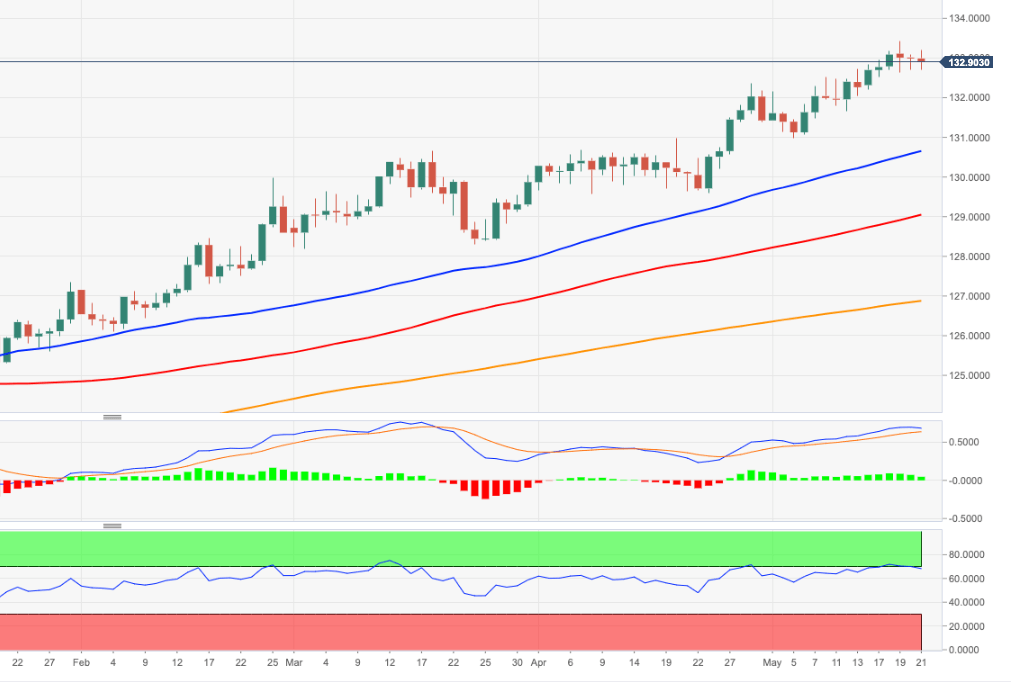

EUR/JPY seems to have moved into a consolidative phase around 133.00 for the time being.

Further consolidation looks likely in the very near-term, with the next up barrier at the YTD peak at 133.43 (May 19) ahead of the 2018 high around 133.50. Further upside should remain in the pipeline as long as the cross remains propped up by the immediate support line (off the March lows) near 130.70. This area is also reinforced by the 50-day SMA, today at 130.72. That said, the next resistance of note is seen at the 134.00 round level.

However, a potential corrective move should not be ruled out in the near-term, as EUR/JPY keeps flirting with the overbought territory, as per the daily RSI (68.56).

In the broader picture, while above the 200-day SMA at 126.84 the broader outlook for the cross should remain constructive.

EUR/JPY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.