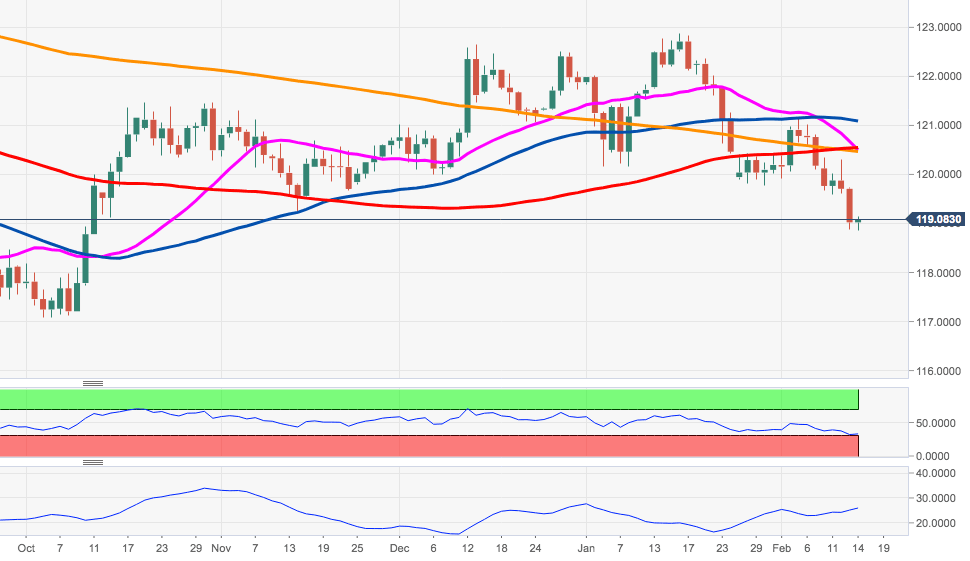

EUR/JPY Price Analysis: Scope for a drop to 117.00

- EUR/JPY dropped further to sub-119.00 levels, fresh 2020 lows.

- The next support emerges at the October 2019 low at 117.07.

The bearish note around EUR/JPY remains unchanged for the time being, encouraging the cross to breach the key support at 119.00 the figure.

While below the key 200-day SMA, today at 120.46, the outlook on the cross is expected to remain negative.

Against this backdrop, the immediate support emerges at the October 2019 low at 117.07.

EUR/JPY dail;y chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.