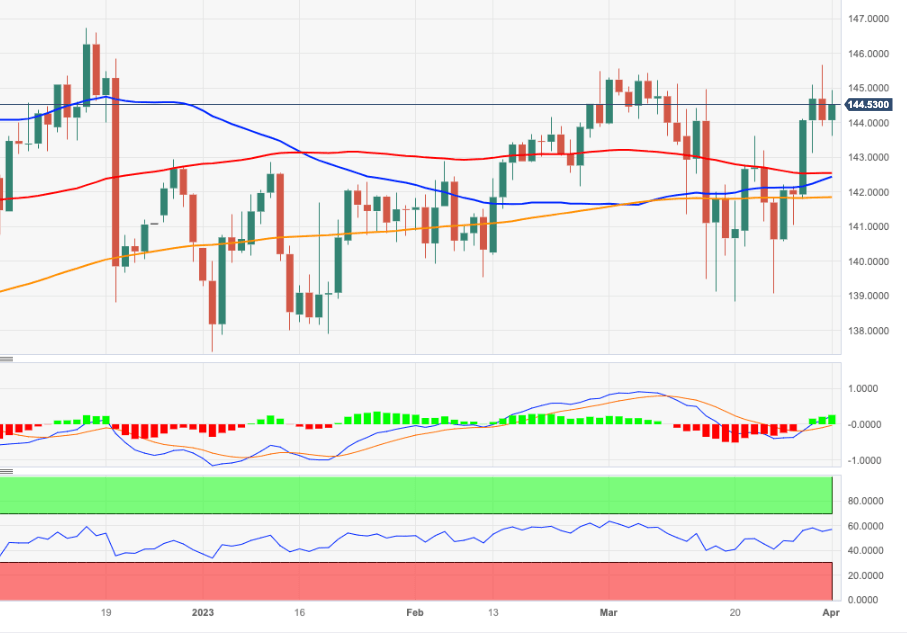

EUR/JPY Price Analysis: Positive outlook remains in place

- EUR/JPY starts the week in a volatile fashion and revisits 145.00.

- The next up barrier of note comes at the December 2022 high.

EUR/JPY regains some composure and advances to the 145.00 region at the beginning of the week.

A daily close above the 2023 top at 145.67 (March 31) should motivate the cross to shift its focus to the December 2022 top around 146.70 (December 15) in the short-term horizon.

In the meantime, extra gains remain on the table while the cross trades above the 200-day SMA, today at 141.82.

EUR/JPY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.